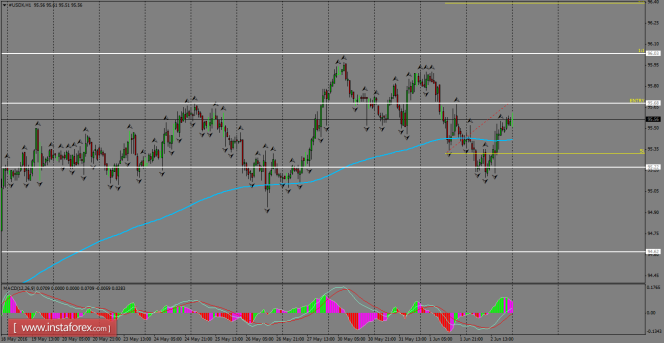

Daily Analysis of USDX for June 03, 2016

The index recovered from Wednesday's losses and is now looking to do a consolidation back above the 200 SMA. It could break the resistance zone of 95.68. If a breakout happens above it, then we can expect another rally to possibly reach the 96.03 level, and the index could ride a bullish bias in coming days, but be aware of today's US NFP release.

H1 chart's resistance levels: 95.68 / 96.03

H1 chart's support levels: 95.22 / 94.62

Trading recommendations for today:

Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bullish candlestick; the resistance level is at 95.68, take profit is at 96.03, and stop loss is at 95.32.