Daily Analysis of USDX for July 04, 2016

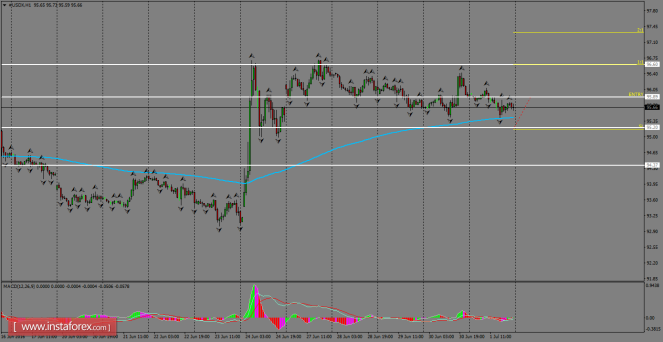

A short-term picture for USDX is still calling for more upsides as the index remains supported by the 200 SMA on H1 chart, which is also offering dynamic support. Next strong resistance is located around the 96.60, where a breakout should open the doors to test the 97.52 price zone. MACD indicator is entering neutral territory, adding uncertainty to the current outlook for the USD index.

H1 chart's resistance levels: 95.89 / 96.60

H1 chart's support levels: 95.20 / 94.37

Trading recommendations for today:

Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bullish candlestick; the resistance level is at 95.89, take profit is at 96.60, and stop loss is at 95.17.