EUR/USD Weekly Overview | Technical Analysis | SGT Markets

This week Yellen testifies and USA. Inflation information is free (along with sales data) thus investors are able to place a lot of precise guesses on once Fed can rise Interest Rates once more this year. Federal Reserve System members same that the recent lag in inflation didn’t deter the Federal Reserve System from its stance of raising rates bit by bit, as most members expect that inflation can rise to central bank’s target of twenty-two in 2019.

Draghi same that the ECB should be “prudent” in however it unwinds the information. Bloomberg according to that ECB sources the same market misinterpreted Draghi’s remarks: the speech “was supposed to strike a balance between recognizing the currency bloc’s economic strength and warning that financial support continues to be needed” Bloomberg same.

Italian municipal elections marks a change with right-wing (no-euro) parties placing more mayors than expected.

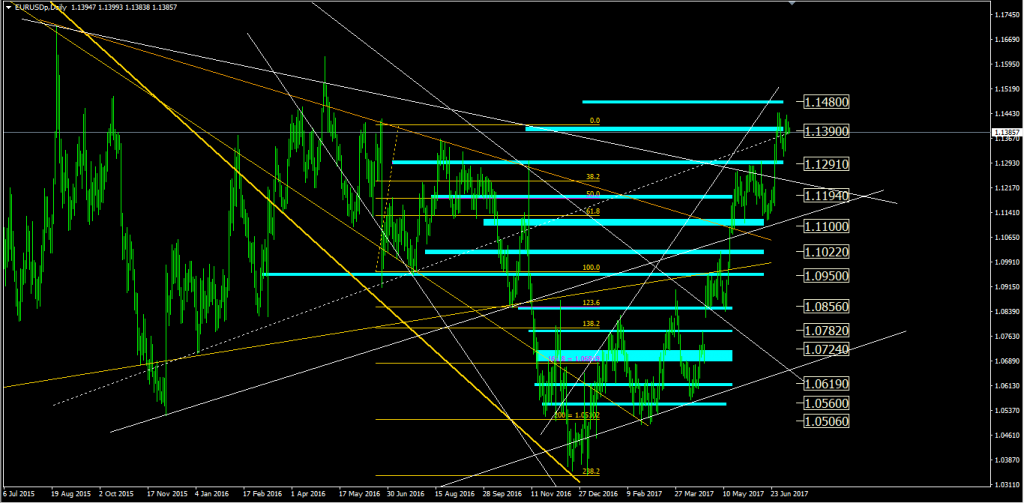

Here 1.1390 area is again under test. Breakout looks failing again, so we will probably see a test down to 1.129 area, first, and eventually a continuation to 1.1194 Support area.

Fibo Retracement is confirming that the following S/R levels against the Monthly and Weekly Trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Bearish

1st Resistance: 1.1390

2nd Resistance: 1.1480

1st Support: 1.1291

2nd Support: 1.1194

EUR

Recent Facts:

9th of March, ECB Interest Rate decision + ECB Press Conference

Interest Rates Unchanged, ECB President Dovish (can be cut again in the future if necessary)

14th of March, German CPI + German ZEW Economic Sentiment

German CPI as Expected, German ZEW Worse than Expected

24th of March, German Manufacturing PMI

Significantly Better than Expected

30th of March, German CPI

Lower than Expected

31st of March, German Unemployment Change + Eurozone CPI

German Unemployment Change better than Expected (for the sixth time in a row), Eurozone CPI Worse than Expected

3rd of April, German Manufacturing PMI

As Expected

11th of April, German ZEW Economic Sentiment

Better than Expected

21st of April, French Manufacturing PMI + German Manufacturing PMI

Better than Expected

23rd of April, French Elections (first round)

Centrist Emmanuel Macron, a pro-EU ex-banker and former economy minister, emerged as the leader of the first round of voting and qualified for a May 7 runoff alongside the second-place finisher, far-right leader Marine Le Pen

24th of April, German Ifo Business Climate

Better than Expected

27th of April, ECB Interest Rate decision + ECB Press Conference

Unchanged, eyes on next Inflation data

28th of April, CPI (Preliminary)

Higher than Expected

2nd of May, German Manufacturing PMI

As Expected

3rd of May, German Unemployment Change + Eurozone GDP (Preliminary)

German Unemployment Change Better than Expected (for the 5th time in a row)

Eurozone GDP (Preliminary) As Expected

7th of May, French Elections

Centrist pro-EU Macron Won French Elections

12th of May, German GDP (Preliminary release)

As Expected

16th of May, Eurozone GDP (Preliminary release) + Trade Balance + ZEW Economic Sentiment

Better than Expected

17th of May, Eurozone CPI

As Expected

23rd of May, German Manufacturing PMI

Better than Expected

30th of May, German CPI (Preliminary release)

Worse than Expected

31st of May, German Unemployment Change + Eurozone CPI (Preliminary)

German Unemployment Change better than Expected (for the 8th time in a row), Eurozone CPI Worse than Expected

1st of June, German Manufacturing PMI

Slightly Better than Expected

8th of June, GDP, Interest Rate Decision + ECB Press Conference

GDP Better than Expected, ECB moving closer to an exit from its stimulus program

13th of June, French Non-Farm Payrolls

Better than Expected

13th of June, German Zew Economic Sentiment

Worse than Expected

23rd of June,

German Manufacturing PMI Better than Expected

German Services PMI Worse than Expected

Eurozone Manufacturing PMI Better than Expected

Eurozone Services PMI Worse than Expected

26th of June, German Ifo Business Climate

Better than Expected

29th of June, German CPI

Better than Expected

30th of June, German Unemployment Change + Eurozone CPI

German Unemployment Change Better than Expected, Eurozone CPI higher than Expected

3rd of July, German Manufacturing PMI

Better than Expected

5th of July, French Services PMI + German Services PMI + Eurozone Retail Sales

Better than Expected

USD

Recent Facts:

5th of May, Nonfarm Payrolls + Unemployment Rate

Better than Expected

11th of May, U.S. Producer Price Index (PPI)

Higher than Expected

12th of May, U.S. Retail Sales + Core CPI (Inflation data)

Worse than Expected

18th of May, Initial Jobless Claims + Philadelphia Fed Manufacturing Index

Better than Expected

23rd of May, Manufacturing PMI + New Home Sales

Worse than Expected

24th of May, FOMC Meeting Minutes

U.S. central bank kept its benchmark rate unchanged, highlighting a slowdown in economic activity (more proof that weakness in the first-quarter was temporary is needed for future rate hikes).

26th of May, Core Durable Good Orders + U.S. GDP (Preliminary release)

Core Durable Goods Orders Worse than Expected, GDP (Preliminary) Better than Expected

31st of May, Chicago PMI + Pending Home Sales

Worse than Expected

1st of June, ADP Nonfarm Employment Change + ISM Manufacturing PMI

Better than Expected

2nd of June, Nonfarm Payrolls + Unemployment Rate

Nonfarm Payrolls Worse than Expected, Unemployment Rate Better than Expected

13th of June, Producer Price Index

Core PPI (ex food and energy) Better than Expected

14th of June, CPI + Retail Sales

Worse than Expected

14th of June, FOMC Interest Rates Decision + Statement

Interest Rate hike as Expected (to 1.25%)

23rd of June, Manufacturing PMI

Worse than Expected

26th of June, Durable Goods Orders

Worse than Expected

28th of June, Pending Home Sales

Worse than Expected

29th of June, U.S. GDP + U.S. Job Market

GDP Better than Expected, Job claims slightly worse than expected

3rd of July, ISM Manufacturing PMI

Better than Expected

5th of July, FOMC Minute Meeting

U.S. Federal Reserve members insisted that expectations are that inflation will rise to 2% target in 2019

6th of July, ADP Nonfarm Employment Change + ISM Non-Manufacturing PMI

ADP Nonfarm Worse than Expected, ISM Non-Manufacturing Better than Expected

7th of July, Nonfarm Payrolls + Unemployment Change

Nonfarm Payrolls Better than Expected, Unemployment Change Worse than Expected