Daily Analysis of Major Pairs for April 8, 2016

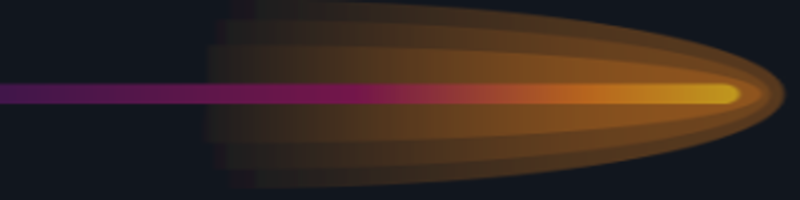

EUR/USD: The bulls have made an attempt to push the price towards the resistance line at 1.1450, but they failed. The resistance line at 1.14500 is still an obstacle in the market; but the bulls are still showing their willingness to push the price to the upside. The bullish bias here remains valid.

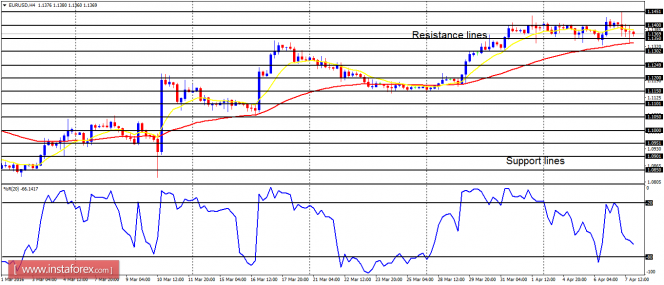

USD/CHF: The USD/CHF has been consolidating to the downside so far this week. The support level at 0.9550 has been tested and it would soon be breached to the downside, despite being a stubborn obstacle to the bears' interests. This is because the outlook on the market is bearish for this week: as long as the EUR/USD continues to show its bullishness, the USD/CHF would remain under bearish pressure.

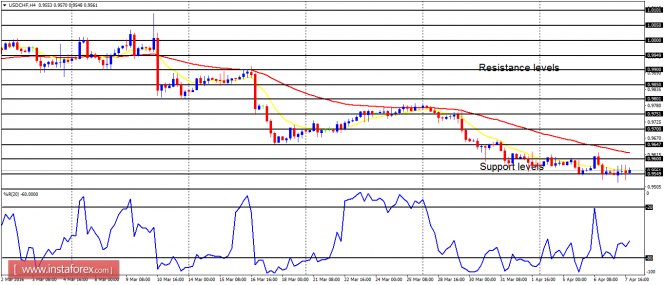

GBP/USD: The Cable went downwards on Thursday. There is a Bearish Confirmation Pattern in the market, and as a result of that, it is assumed that further southwards movement is possible. This is because the EMA 11 is below the EMA 56, while the RSI period 14 is below the level 50. Long trades are not recommended in this kind of market.

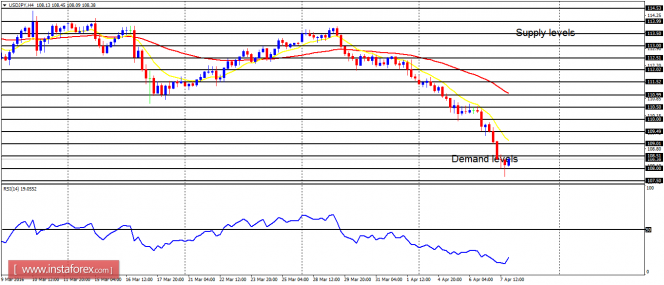

USD/JPY: The USD/JPY went below our target on Thursday, owing to a strong selling pressure on it (and other JPY pairs). The price is now below the supply level at 108.50, going towards the demand level at 108.00. That demand level has been tested and it would be re-tested and later get breached to the downside.

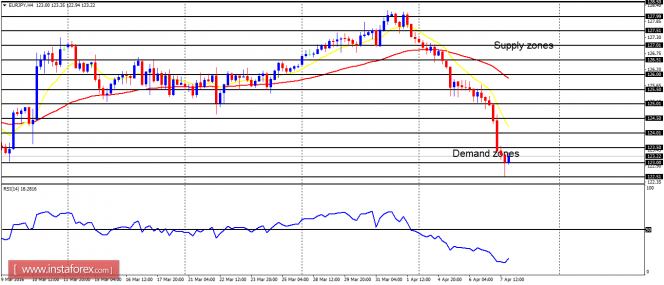

EUR/JPY: There is a major Bearish Confirmation Pattern on the EUR/JPY chart. The price has gone down by 450 pips this week alone. The supply zones at 124.00, 123.50 and 123.00 have been slashed. The next targets for the bears are located at the demand zones of 112.50 and 112.00. The targets would be reached today or next week.

The material has been provided by InstaForex Company - www.instaforex.com