Long-term forecasts for USD/JPY by National Bank of Canada: total ranging within the bullish

10 December 2015, 12:11

0

5 260

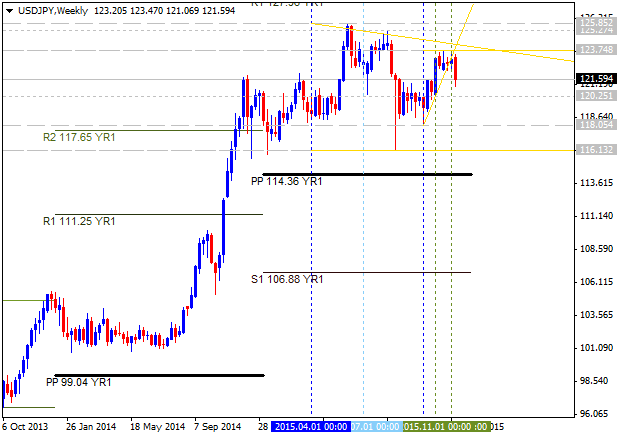

The latest forecast for USD/JPY made by National Bank of Canada is indicating for USD/JPY to be in ranging market condition within Central Pivot at 114.36 and the first pivot resistance level R1 Pivot at 127.96. This is the total ranging market condition without any breakout or breakdown up to Q1 2017.

| Instrument | Q1'16 | Q2'16 | Q3'16 | Q4'16 | Q1'17 |

|---|---|---|---|---|---|

| USD/JPY | 124.0 | 125.0 | 123.0 | 125.0 | 126.0 |

As we see from the chart above - the price is on bullish market condition with the ranging within Central Pivot at 114.36 and R1 Pivot at 127.96. Intermediate support/resistance levels for the pairs are 125.85 and 116.13, and the symmetric triangle pattern is formed by the price to be crossed by direction.