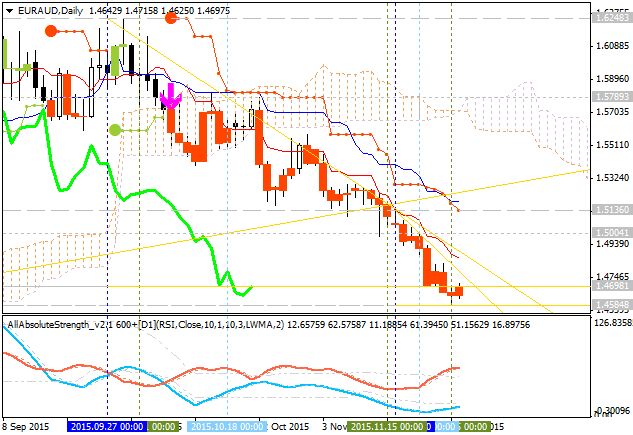

The most interesting pair you can make money with - EUR/AUD

EUR/AUD: correction to the bearish reversal. Weekly price for the pair is located to be above Ichimoku cloud with the primary bullish area of the chart. 'Reversal' Sinkou Span line ((as the border between the primary bullish and the primary bearish on the chart) is located near and below the price which makes the bearish reversal to be very likely in the coming weeks. The price is on secondary correction for breaking 1.4698 support level on open weekly bar for now with 1.4202 as the next bearish reversal target. There are the following key reversal support/resistance levels:

- 1.6248 resistance level located above Ichimoku cloud in the bullish area of the chart, and

- 1.4202 support level located on the bearish area of the chart and near the border between the

primary bearish and the primary bullish trend.

Chinkou Span line is above the price for possible crossing it to below in the near future indicating the good bearish breakdown.

There are 4

simple scenarios for the price movement for the coming weeks:

- bullish trend will be resumes in case the price breaks 1.6248 resistance on close bar with 1.6590 as the nearest target in this case,

- bearish

reversal may be started with the secondary ranging in case the close daily price breaks 1.4584

support from above to below with 1.4202 as the next bearish reversal target,

- bearish breakdown in case the price breaks 1.4202 support with 1.3671 level as the long-term target,

- or the ranging within the levels.

The strategy: watch D1 price to break 1.4584 support level for possible sell trade

| Resistance | Support |

|---|---|

| 1.6248 | 1.4584 |

| 1.6590 | 1.4202 |

| N/A | 1.3671 |