Euro trims losses but remains vulnerable after mixed economic reports

The euro bounced off seven-month lows hit earlier after a string of economic reports showed a mixed picture of the euro zone economy.

EUR/USD was last seen at 1.0620, down 0.24%. The euro hit $1.0636 after the release of the German numbers.

EUR/GBP was unchanged at 0.7010, while EUR/CHF declined 0.02% to trade at 1.0841.

Overnight, the shared currency dropped to a seven-month low against the greenback, as expectations of further easing continued to weigh.

German private sector activity grew at the fastest pace in three months in November, increasing optimism over the health of the euro zone’s largest economy. Markit's seasonally adjusted Flash Germany Composite Output Index, which measures the combined output of both the manufacturing and service sectors, rose from 54.2 in October to 54.9 in November, beating forecasts for a reading of 54.0.

The preliminary German manufacturing purchasing managers’ index rose to a seasonally adjusted 52.6 this month from a final reading of 52.1 in October. Analysts had expected the index to inch down to 52.0 in November.

The preliminary services purchasing managers’ gauge rose to a seasonally adjusted 55.6 in November from 54.5 in the prior month. Analysts had expected the index to fall to 54.3.

French private sector activity rose at the slowest pace in three months in November, highlighting worries over the economic outlook of the euro zone’s second largest economy, preliminary data showed earlier Monday. Markit said that its seasonally adjusted Flash France Composite Output Index, which measures the combined output of both the manufacturing and service sectors declined from 52.6 in October to 51.3 in November, the weakest in three months and missing forecasts for 52.5.

The preliminary services purchasing managers’ index fell to a seasonally adjusted 51.3 this month, also a three-month low. The reading came in below expectations for 52.6 and down from 52.7 in October.

Some service providers said that the terrorist attacks in Paris had negatively influenced the activity.

The French manufacturing purchasing managers’ index meanwhile edged higher to a seasonally adjusted 50.8 this month, matching expectations and up from a final reading of 50.6 in May. Manufacturers’ new export orders fell for the first time in three months, and at the fastest pace since April. A reading above 50.0 on the index indicates industry expansion, anything below 50 indicates contraction.

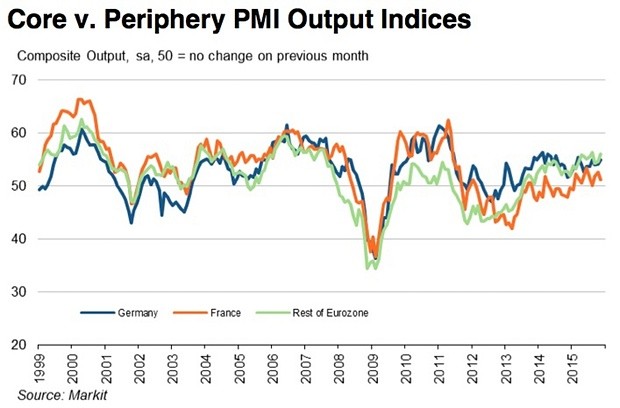

The gap between France and other eurozone neighbors has widened:

Growth across the eurozone private sector has touched its highest level since May 2011, despite weakness logged in France.

Markit’s monthly healthcheck of the sector, the eurozone PMI, rose from 53.9 in October to 54.4 this month.

The strongest growth was seen in the eurozone periphery, rather than its largest two economies.

Markit explains:

"The recovery continued to be led by the service sector, where business activity and new business rose at the fastest rates since May 2011 and employment showed the biggest monthly gain for five years. Manufacturing output growth meanwhile also gathered pace, reaching a three-month high amid the largest monthly improvement in order books since April of last year."

Data released Friday showed that consumer confidence within the euro zone fell less-than-expected last month. The European Commission reported last week that Euro zone consumer confidence fell to an annual rate of -6.0, from -7.6 in the preceding month whose figure was revised up from -7.7. Analysts had expected confidence to fall -7.5 last month.