0

684

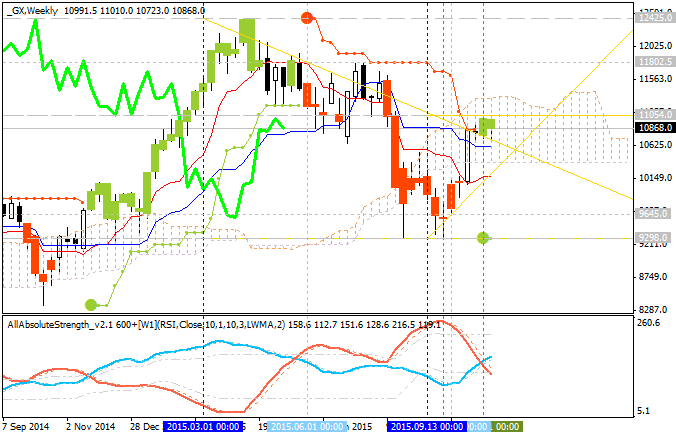

Weekly price is on ranging market condition located inside Ichimoku cloud between the following key reversal support/resistance levels:

- 12425.0 resistance level located far above Ichimoku cloud in the bullish area of the chart; if the price breaks this level so we may see good bullish breakout; and

- 9298.0 support level located far below Ichimoku

cloud in the bearish area of the chart; if the price breaks this level

so the bearish breakdown may be started.

There are intermediate support/resistance levels which the price should cross on the way to the reversal levels:

- 11054.0 resistance level located on the border between the primary bearish and the primary bullish on the chart; if the price breaks this level from below to above so the bullish reversal will be started with the secondary ranging condition; and

- 9645.0 support level located

near and below Ichimoku cloud in the primary bearish area of the chart;

if the price breaks this level from above to below so we may see the

bearish market condition to be started with the secondary ranging.

Chinkou Span line is located to be below and near the price indicating the ranging condition by direction. Absolute Strength indicator is estimating the secondary ranging to be continuing.

- watch close price to break 11054.0 resistance level for possible buy trade with the target to be below 12425.0;

- watch price to break 9645.0 support level for possible sell trade with 9300.0 as the target.