The Hidden Cost of Failing Prop Firm Challenges (And How to Eliminate It)

The Hidden Cost of Failing Prop Firm Challenges (And How to Eliminate It)

Let me ask you a question most traders avoid:

How much have you actually spent on prop firm challenge fees?

Not just the last one. All of them. Every attempt. Every restart. Every "one more try."

Most traders don't track this number. And that's exactly why it keeps growing.

The Math Nobody Wants to Do

Let's say you're trading a $50,000 challenge. The fee is around $300.

You fail. You try again. Fail. Try again.

That's the cycle for over 90% of prop firm traders. Industry data shows that only 5-10% of traders ever pass their challenge and receive a payout.

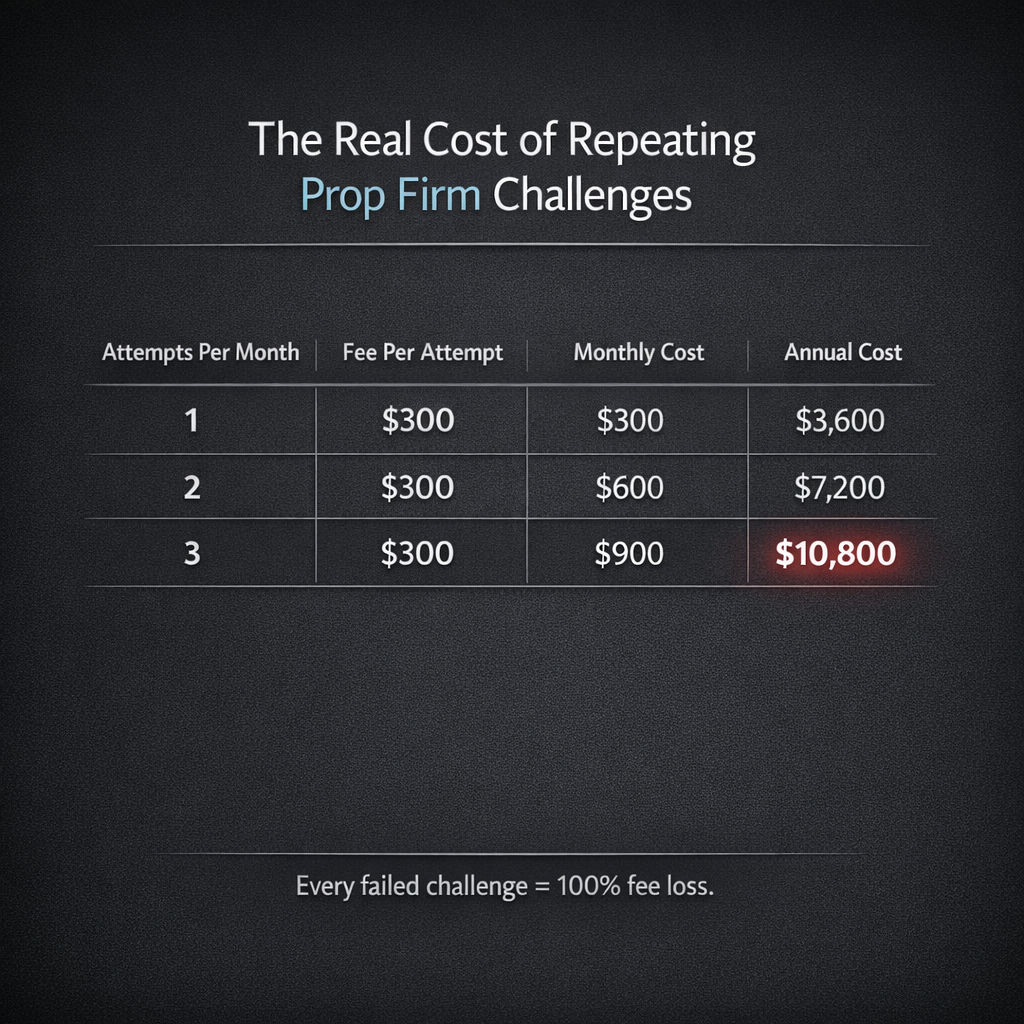

Now let's do the math that nobody wants to do:

| Attempts Per Month | Fee Per Attempt | Monthly Cost | Annual Cost |

|---|---|---|---|

| 1 | $300 | $300 | $3,600 |

| 2 | $300 | $600 | $7,200 |

| 3 | $300 | $900 | $10,800 |

Read that last column again.

A trader who takes three $50K challenges per month — which is not uncommon — spends $10,800 per year just on fees. With nothing to show for it.

And that's just one account size. Scale it up to $100K or $200K challenges and the numbers get ugly fast.

Where Does That Money Go?

Straight to the prop firm.

This is the part most traders don't think about: prop firms are profitable because you fail. That's the business model. The challenge fee is their revenue. The more you fail and retry, the more they earn.

They don't need you to succeed. They need you to keep trying.

That's not a conspiracy. It's just business. And there's nothing wrong with it — unless you're the one on the losing side of that equation.

The Real Problem Isn't Your Trading

Here's what most traders get wrong:

They think the solution is to become a better trader. Study more. Backtest more. Find the right indicator. Master the perfect strategy.

And yes — improving your trading helps. But it doesn't change the fundamental problem:

Every failed challenge is a 100% loss.

There's no partial credit. No "almost passed." You either hit the target or you lose your entire fee. There's no in-between.

That's what makes prop firm challenges different from regular trading. On a personal account, a losing month is a setback. On a challenge, a losing week can mean $300-$500 gone instantly.

What If Failure Wasn't a Loss?

This is the question that changed everything for me.

I stopped asking "how do I pass every challenge?" and started asking "how do I make sure I never lose money on a challenge — even if I fail?"

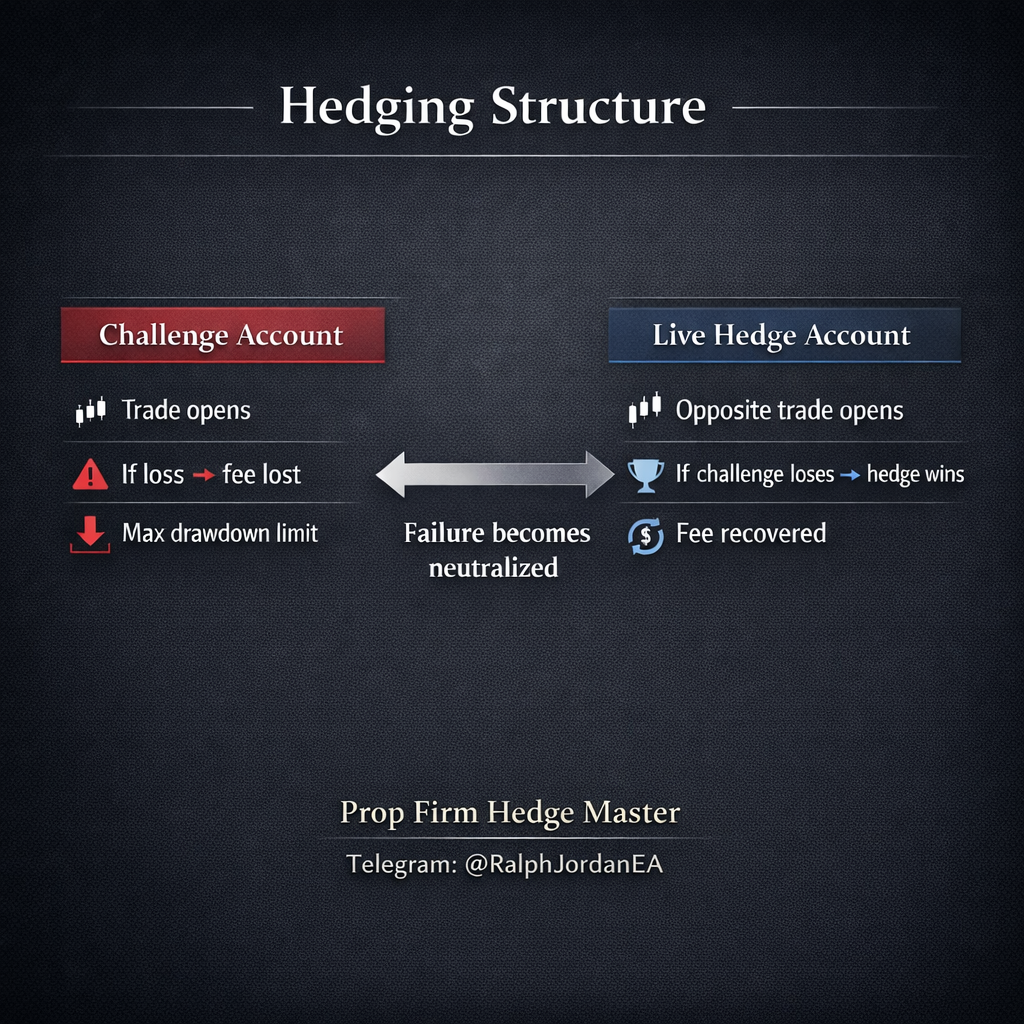

The answer turned out to be simple: hedging.

For every trade on my challenge account, an opposite trade opens on my personal live account.

- If the challenge trade wins → I'm passing the challenge. The live account takes a small loss (that's the cost of insurance).

- If the challenge trade loses → the live account wins. The profit covers my challenge fee.

Both outcomes are accounted for. There's no scenario where I walk away with nothing.

A Real Example

Let's say I'm running a $50,000 challenge:

- Challenge fee: $300

- Max drawdown: 6% = $3,000

- My hedge multiplier: set to recover the $300 fee

If I pass the challenge:

- I get a funded $50,000 account

- My live account takes a small hedge loss (cost of doing business)

- Net result: funded account

If I fail the challenge:

- Challenge account is done — fee was $300

- Live account hedge profit: +$300 (or more, depending on settings)

- Net result: break even. Fee recovered.

If I fail with higher recovery settings:

- Live account hedge profit: +$450 (fee + 50% extra)

- Net result: I actually profited from failing

The Difference Over a Year

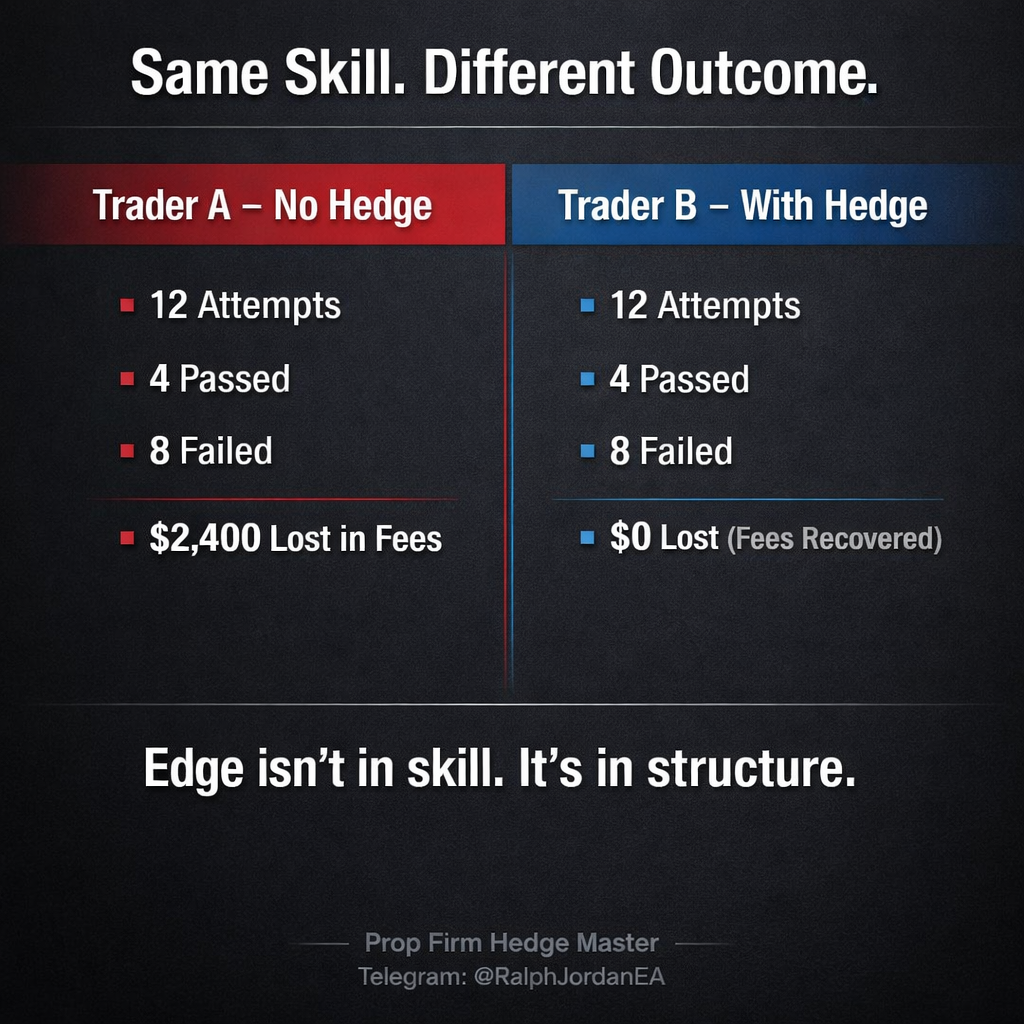

Let's compare two traders. Same skill level. Same challenge. Same 70% failure rate (which is actually better than average).

Trader A: No hedge

| Passes (30%) | Fails (70%) | |

|---|---|---|

| 12 attempts/year | 4 funded accounts | 8 failed = $2,400 lost in fees |

Trader A needs those 4 funded accounts to earn enough to cover the $2,400 in lost fees — before making any actual profit.

Trader B: With hedge

| Passes (30%) | Fails (70%) | |

|---|---|---|

| 12 attempts/year | 4 funded accounts | 8 failed = $0 lost (hedged) |

Trader B has the same 4 funded accounts. But the 8 failures cost nothing. Every fee was recovered through the hedge.

Same skill. Same results. Completely different outcome.

Why Most Traders Don't Hedge

If hedging is so effective, why doesn't everyone do it?

Three reasons:

1. They don't know about it.

Most traders think the only way to make money from prop firms is to pass the challenge. The concept of profiting from failure isn't something that's widely discussed.

2. They tried manually and gave up.

Manual hedging — opening opposite trades by hand on two accounts — is exhausting. You have to match every trade, calculate lot sizes, watch both accounts simultaneously. One mistake and the whole thing falls apart.

3. They're worried about detection.

Prop firms are getting smarter. If your trades look identical across accounts, or if multiple users show the same patterns, you risk getting flagged.

These are all legitimate concerns. And they're exactly the problems I spent years solving before automating the entire process.

The Bottom Line

The hidden cost of prop firm challenges isn't just the fees you've already paid. It's the fees you'll keep paying — month after month, year after year — as long as failure means a total loss.

The traders who are winning this game aren't necessarily better traders. They're the ones who figured out how to remove the downside.

Stop thinking about how to win every challenge. Start thinking about how to make sure you never lose on one.

I've personally passed 300+ challenges and collected over $500K in verified payouts using a hedging system I built and automated. I recently released it on MQL5 Market as two EAs — Prop Firm Hedge Master and Prop Firm Hedge Live — so other traders can run the same system.

If you want to see it in action, check my product page or send me a message.