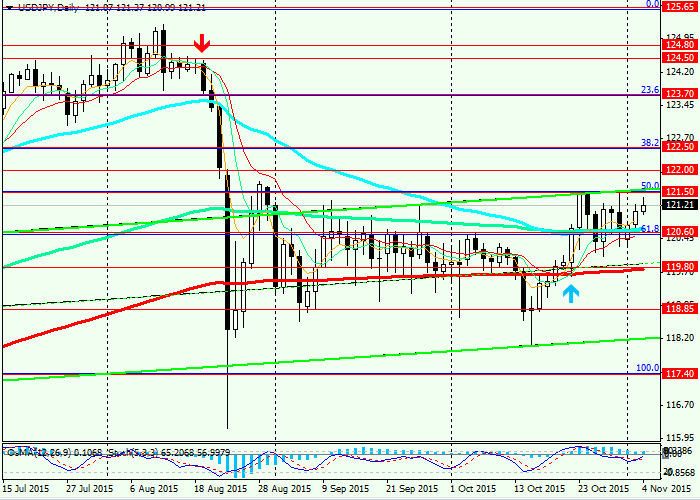

USD/JPY: the US dollar is growing.Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

In Asia, the pair USD / JPY is mostly in a narrow range with a slight upward trend. The trading week began to increase in dollar pairs. Expectations of tighter monetary policy in December, the Fed pushed down the price of gold and to an increase in the yield on 10-year US bonds. Last Tuesday, their yield rose to nearly 7-week high.

Despite the decision of the Bank of Japan at the end of October to leave the asset purchase program - the main tool to combat deflation - unchanged at 80 trillion yen, the head of the Bank of Japan Kuroda said the central bank "without hesitation go for further easing, if needed" and "restrictions on the disposal of monetary instruments" does not.

The Bank of Japan for the third time in a row has lowered the forecast of inflation for the next year - up 1.4% from the previous value of 1.9%. Forecast economic growth has also become more cautious. It is expected that in this fiscal year GDP will grow by 1.2%. The previous forecast was 1.7%. Next year GDP growth forecast of 1.4% instead of 1.5%.

However, today the main Chinese stock index closed higher. So, Shenzhen Composite at the end of trading in Asia rose by 5,1%, ChiNext - on 6,4%, Shanghai Composite - by 4.3%.

Unveiled today Purchasing Managers Index (PMI) for the services according to the Caixin China in October rose to 52.0 against 50.5 in September. It seems that the stimulus measures taken by the Government of China, are beginning to show positive results.

Japanese index Nikkei Stock Average in the background grew consumer confidence index in Japan October (41.5 vs. 40.6 in September) on trades was also up by 1.3%.

Against the backdrop of easing concerns about the risks of slower growth of the Chinese and world economies, market participants seem to have strengthened the view that the Fed will still raise interest rates in December. This will attract investors to the dollar and enhance its position in the financial markets.

Now the attention of market participants focused on the employment data is USDA (NFP) in October, which will be released on Friday at 13:30 (GMT ). From them will largely depend on the Fed's decision on interest rates.

See also review and trading recommendations for the pair GBP/USD!