GBP / USD: the interest rate and GDP data in the US. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

After yesterday, the Fed left the interest rate unchanged in the range of 0.00% - 0.25%, but signaled the possibility of a rate hike at the next meeting, which will take place on 15-16 December, the euro / US dollar has lost more than 160 points, having fallen to a mark of 1.0900, the lowest level since August 11. As well as the euro fell and cross-pair EUR / GBP (almost 80 points), the pound fell against the dollar less significant, supported by its purchases in the cross-pairs, including in the pair EUR / GBP.

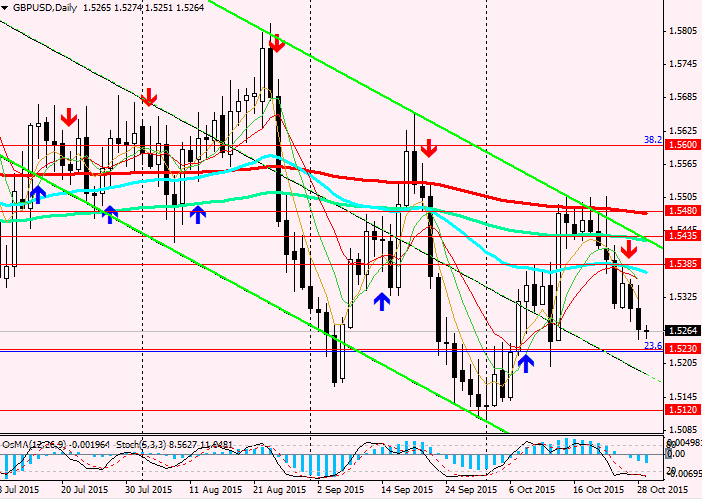

GBP / USD pair on a statement yesterday, the Fed has lost slightly more than 70 points.

In the accompanying statement, the Fed noted that the US Fed keeps track of global economic and financial developments and would like to see "a further improvement in the labor market" to raise interest rates. Despite the fact that inflation remains below the target level of 2.0%, economic activity is growing at a moderate pace, and the situation in the housing market continued to improve. The pace of job creation slowed, though, the unemployment rate stable.

It is worth noting that the Fed President Lacker of Richmond for the second time in a row is not agreed with the other leaders of the Fed and again voted in favor of raising the key rate by 25 basis points. The Fed decision on rates was adopted by 9 votes to 1.

On the whole, the US dollar rose yesterday on the market on the decision and the Fed's statement. The GBP / USD pair with the opening of the European session, there is some correction. However, steam is pressurized. At 12:30 (GMT + 3) is scheduled to yield data on consumer credit and the number of approved applications for mortgages in September. Both figures are expected to increase in the forecast of the previous month, which should support the pound. Then at 15:30 it published a number of important indicators of the US economy, which will give market participants suggests further Fed action. Among the published figures: the annual GDP data for the 3rd quarter (growth of 1.6% forecast), domestic prices and indices of consumer spending in Q3 (up by 1.5% and 3.2% respectively, according to the forecast). If the data are confirmed or come out better than expected, the US dollar will continue to strengthen in the market, including the pair GBP / USD.

It should also be recalled that in the week came the GDP data in the UK for the 3rd quarter, which turned out at 0.5% (below the forecast of 0.6%). Recent data indicate the growth of labor productivity and retail sales in the UK, as well as GDP growth, albeit somewhat lower than forecast, suggest ongoing commitment to the Bank of England's monetary policy, and most economists suggest a rate hike in the UK in 2016.

Despite the exposure to GBP / USD pair continued to decline, the pound will be supported in his purchases in a cross-pairs, primarily the euro, as well as the release of economic data from the US, if they are worse than forecast.

See also review and trading recommendations for the pair USD/CHF!