USDCAD Pivot Points Analysis - the secondary correction to be started

22 October 2015, 09:11

0

1 128

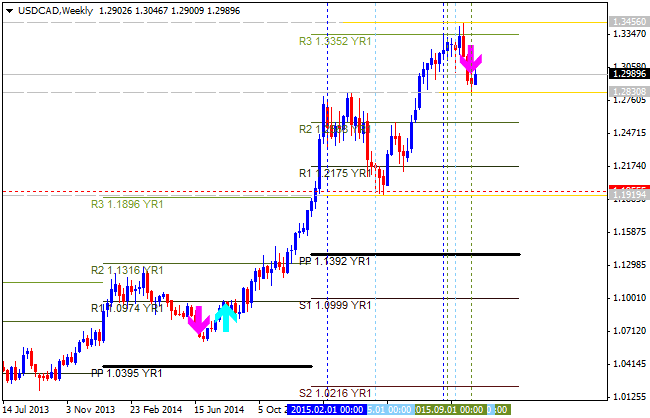

W1 price is on bullish market condition located between R3 Pivot at 1.3352 and R2 Pivot at 1.2568:

- The price is on bullish ranging between 1.3456 resistance and 1.1919 support level.

- The price is crossing 1.2830 from above to below for the secondary correction to be started.

- "The Canadian Dollar broke out of its 4-month rising impulsive channel rather aggressively. This drop brought about a 600 pip decline from the late September high of 1.3457 to a current corrective low of 1.2833."

- "This is the lowest level since the Bank of Canada surprised markets with a rate cut and USDCAD went from ~1.21 to 1.3450 in short order. Since then, Oil has regained some footing and if you remove the 8-most volatile components of Canadian CPI, we’re over 2%. Additionally, we’ll have the Bank of Canada and PM elections that will likely spark volatility in the Loonie."

- "While we are moving higher off the recent 1.2832 low, resistance is near. Short-Term resistance is setting up around the 38.2% Fibonacci Resistance around 1.31 from the decline that started at 1.3457. Because price broke below 1.2950, the confidence of the longer-term uptrend is quickly waning. Price action around resistance will be imperative to grabbing the feel for this pair during this data heavy week. Two complementary markets to USD/CAD is the WTI / US Oil and the US Dollar."

| Instrument | Yearly PP | R1 Pivot | R2 Pivot | R3 Pivot |

|---|---|---|---|---|

| USD/CAD | 1.1392 |

1.2175 |

1.2568 | 1.3352 |

Trend:

- W1 - possible correction to be started