0

1 250

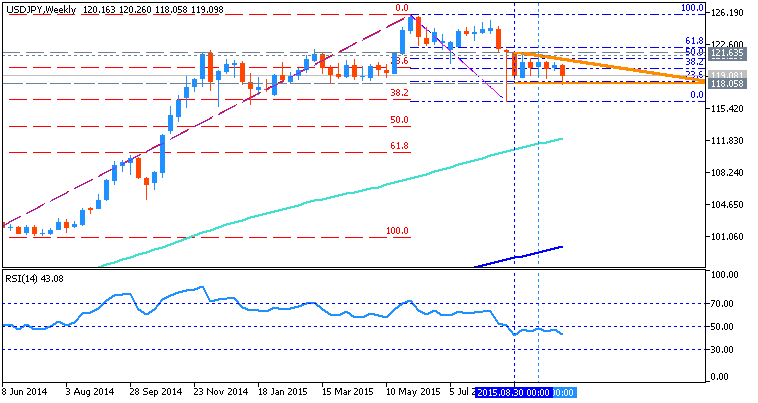

W1 price is located to be above 200 period SMA and above 100 period SMA for the primary bullish market condition with the secondary ranging between the following key support/resistance levels:

- 116.09 key support level, and

- 125.85 key resistance level.

Descending triangle pattern was formed for the price to be broken for the secondary correction to be started.

- "June’s trade produced a monthly key reversal in USD/JPY."

- RSI indicator is estimating the correction to be started in the near future.

- "This key reversal didn’t form just anywhere…it formed at the line that connects the 1995 and 2005 lows. That line was support in 2007 and resistance before the 2008 collapse. The time element is interesting of course too (MAJOR turn every 10 years in USDJPY). Bottom line, the key reversal may have signaled a multi-year top in USD/JPY."

If the price will break 116.09 key support level so the secondary correction will be started within the primary bullish market condition.

If the price will break 125.85 key resistance level from below to above so the primary bullish trend will be continuing with good possible breakout of the price movement.

If not so the price will be ranging within the levels.

Trend:

- W1 - possible correction to be started