Fundamental Weekly Forecasts for US Dollar, GBPUSD, USDJPY, AUDUSD and GOLD

US Dollar - "The housing data, national activity figure from the Chicago Fed and manufacturing survey are far from top tier event risk. As for the round of Fed speeches, we have seen confusion and skepticism rise from the conflicting views from the various voters and non-voters. Far more capable should be some of the international events. Chinese 3Q GDP will be a great risk spark as one of the primary concerns for global investors. The ECB rate decision will also establish the opposing extreme of the monetary policy scale. Any whiff of a QE upgrade from Draghi, and EURUSD will leverage a broad Dollar move."

GBPUSD - "The continued uncertainty around rate trajectory, combined with the mixed bag of data that was seen this week, continues to obscure the near-term picture in the British Pound. For now, the forecast remains neutral. But should inflation begin to show more prominently in the coming months, that forecast can quickly change to bullish, as the Bank of England remains one of the few Central Banks in the free world actually looking at tightening monetary policy. The expectation still remains for a 2017 rate hike, but should inflationary pressures begin showing, that expectation could certainly be moved up, and the British Pound will likely move along with it."

USDJPY - "Positive data prints out of Japan coupled with dovish remarks from Fed officials may spur a further decline in USD/JPY as the pair fails to retain the range-bound price action carried over from September. With that said, the August low (116.07) sits on the radar, and the dollar-yen may continue to congest over the remainder of the year especially as the Relative Strength Index (RSI) largely preserves the bearish formation from June."

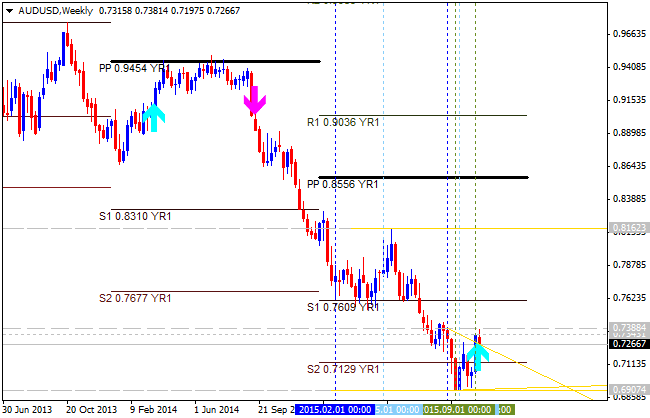

AUDUSD - "The Australian Dollar may turn lower after hitting a two-month high as soft Chinese data amplifies swelling RBA interest rate cut speculation."

GOLD - "From a technical standpoint gold broke above a key threshold of resistance at 1151/55 with both daily & weekly momentum stretching to their highest levels since January. This marked change in behavior continues to suggest further upside potential remains with interim resistance at the 50% retracement at 1189 backed by a key Fibonacci confluence at 1194/98 & the May high-day close at 1207. Prices are vulnerable for move lower heading into next week but the medium-term outlook remains constructive while above the October 2nd low/reversal-day close at 1138. Bottom line: looking for a pullback before stretching into new highs."