Catalan vote cautions Spain that turmoil in financial markets likely

Spanish financial markets jumped on Monday before slipping into the red after regional elections in Catalonia, welcoming a result that although secessionists won a parliamentary majority, there appeared not to have advanced a broader case for independence from Spain.

Stock and bond investors have been worried that a breakaway movement gathering pace in the region could cause political and financial instability in the euro zone's fourth largest economy.

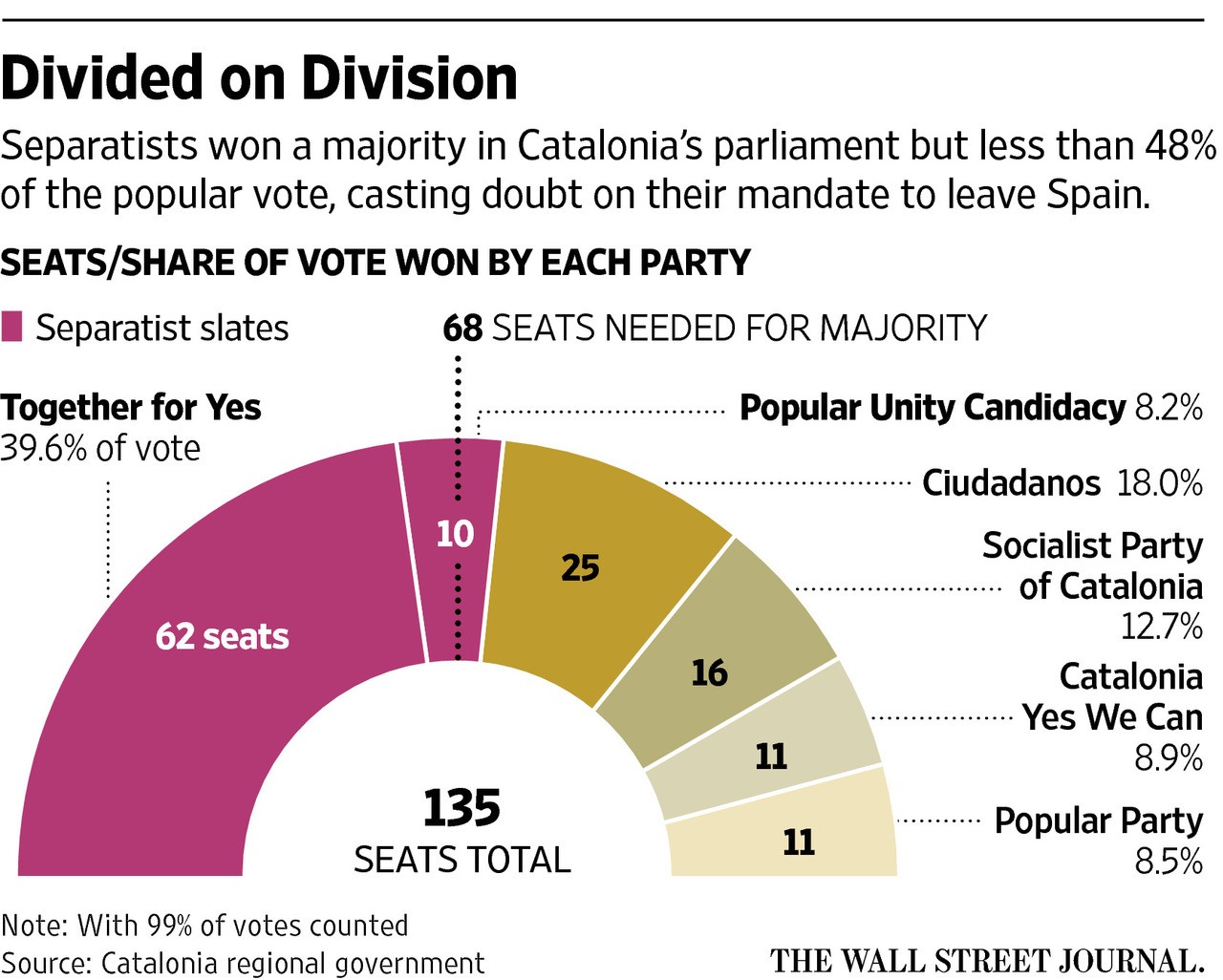

On Sunday secessionist parties won 72 of the 135 seats in the legislature of Spain's wealthiest region, prompting the acting head of the regional government, Artur Mas, to claim the result as a "yes" for independence. Separatist leaders vowed to advance plans to create a new state.

The same parties won only 47.8 percent of the vote, and analysts claimed that statistic had removed any immediate risk of a breakaway which, in view of constitutional obstacles and opposition from central government in Madrid, remains purely theoretical.

However, as analysts think, the result was likely to strengthen the position of the regional government in negotiations with Madrid over devolutionary concessions.

The separatists “have enough of a majority to govern, but to make a unilateral proclamation of independence with less than 50% of the popular vote would have no credibility, here or internationally,” said Emilio Sáenz-Francés, a professor of history and international relations at Comillas Pontifical University in Madrid.

"What came out from the local elections is that there is a majority for independence parties, but at the same time they did not reach an absolute majority," BNP Paribas rate strategist Patrick Jacq said. "If there is a referendum for independence, it's not clear that "yes" would win. There is no signal that Catalonia wants to be independent."

“The vote, with a very high turnout, has made it very clear that a majority of Catalans don’t want to break with Spain,” said Xavier García Albiol, regional leader of the conservative Popular Party, which governs nationally.

Market

Spain's

banks, including some based in the Catalan capital Barcelona, have signaled secession could cause financial turmoil and the Spanish central

bank has said the region was under risk of leaving the euro.

Shares in Catalan banks Caixabank and Banco Sabadell were last down 0.71% and 0.56% respectively.

Overall, Spain's IBEX was last down 1.04% and other European shares

fell due to global growth concerns, with Germany's main DAX index down 1.71% pushed lower by fresh details on the VW scandal.

While Catalan 10-year bond yields rose more than 15 basis points at 4.16 percent, they retreated from the highs of about 4.25 percent hit at the open. Equivalent Spanish yields fell 8 bps to 1.95 percent, outperforming most other euro zone government debt.

Independence

Catalonia, Spain's richest region, has been moving towars a break with Spain for five years. There have been large pro-independence meetings, a resolution in Catalonia’s parliament on the right to self-determination and a symbolic referendum with 2.3 million participants last November.

In recent years, Mariano Rajoy and his governing conservative People’s party (PP) have refused to address underlying grievances over Catalonia’s language and identity, as well as concerns that the region pays more in taxes than it receives in investments and transfers from Madrid. Instead, his party repeatedly turned to the country’s constitutional court to shut down the process, backed by the Spanish constitution, which does not allow regions to unilaterally decide on sovereignty.

Rather than giving the separatists a strong mandate, Sunday’s election simply signaled that Spain has a problem, said Sáenz-Francés. “While the headline is not ‘Catalonia votes in favour of independence and Spain breaks apart’, it’s rather ‘Spain has to face the problem of Catalonia’s integration’.”