The

Butterfly Pattern

The general extension structure of the

Butterfly pattern was discovered by Bryce Gilmore. However, the

exact alignment of ratios was defined in Scott Carney's 1998 book, "The

Harmonic Trader." This has become the industry

standard for the structure. Scott's ideal Butterfly Pattern requires

specific Fibonacci ratios to validate the structure. These

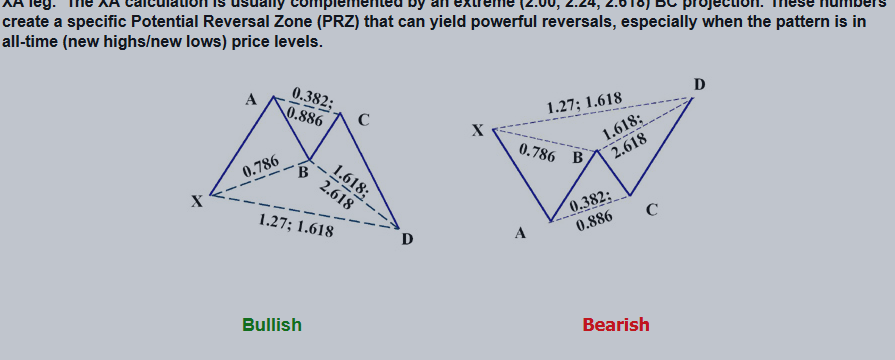

measurements include a mandatory 0.786 retracement of the XA leg at

the B point, which defines a more precise Potential Reversal Zone (PRZ)

and more significant trading opportunities. Also, the

Butterfly pattern must include an AB=CD pattern to be a valid

signal. Frequently, the AB=CD pattern will possess an extended CD

leg that is 1.27 or 1.618 of the AB leg. Although this is an

important requirement for a valid trade signal, the most critical

number in the pattern is the 1.27 XA leg. The XA calculation

is usually complemented by an extreme (2.00, 2.24, 2.618) BC

projection. These numbers create a specific Potential Reversal Zone

(PRZ) that can yield powerful reversals, especially when the pattern

is in all-time (new highs/new lows) price levels.

Raymond Chien:

i am going to call you my MASTER! lol

I am new to these price pattern trading strategy, would really like to learn. is it possible that you can show a few pictures of this butterfly pattern in the current markets??

Hi,

https://www.mql5.com/en/charts/3958646/audusdf-h1-fort-financial-services-au-emerging-butterfly