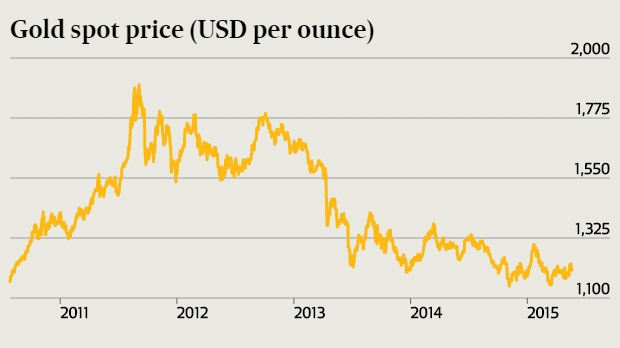

Deutsche Bank - 'Gold would need to fall towards $US750 per ounce to bring prices in real terms'

"Gold would need to fall towards $US750 per ounce to bring prices in

real terms back towards long-run historical averages," said Deutsche Bank.

Deutsche Bank ran gold price several models to determine 'fair value' of it, and this 'gold price model' calculated fair

value at $US785 per ounce. But long-run average price in real

terms using the Consumer Price Index - was $US770, and using Producer Price Index - was $US725:

"In

real terms gold prices would have to fall to as low as $US750,

suggesting that even at current levels gold can still not be considered

cheap."

And this correction will happen shortly."We believe financial forces imply fresh lows in the gold price in the months ahead," said the bank. "We believe the adjustment in US long term real yields and the US dollar is still incomplete and interest rate and dollar markets will continue to move higher heading into next year and beyond."

Deutsche Bank is the most bearish on gold but is not the only bank predicting sharp losses ahead - the other banks are Goldman Sachs (bearish on gold since 2012) and Credit Agricole (a low point of $880).