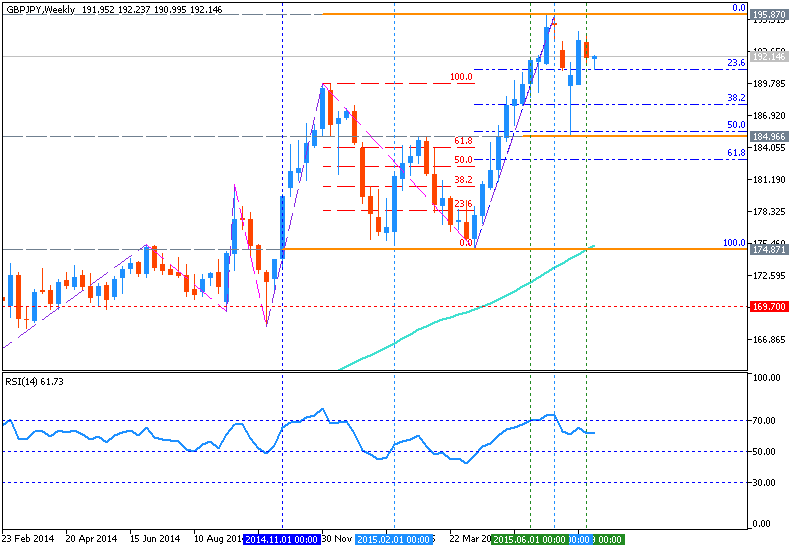

GBPJPY Price Action Analysis - 50.0% Fibo support level to cross for correction

W1 price is located above 200 period SMA

(200-SMA) and 100 period SMA (100-SMA) for the primary bullish with secondary ranging

between Fibo resistance level at 195.87 and 50.0% Fibo support level at 185.41. The value of 200-SMA is located far below the market price which makes impossible the reversal of the price movement to the primary bearish in this year for example. The value of 100-SMA is located in exact Fibo support level at 174.87 so it may be total ranging market condition just in case the price crosses this level from above to below.

- the price is ranging between Fibo resistance level at 195.87 and 50.0% Fibo support level at 185.41;

- the price is breaking 23.6% Fibo support at 190.96 for now, and if the price will break 50.0% Fibo support level at 185.41 - the secondary correction to be started;

- "the British Pound is aiming below the 191.00 figure against the Japanese Yen after narrowly edging below chart support. Near-term support is at 190.20, the 38.2% Fibonacci expansion, with a break below that on a daily closing basis exposing the 50% level at 188.92."

If the price will break 50.0% Fibo support level at 185.41 so we may see the secondary correctional trend to be started within the primary bullish condition.

If the price will break Fibo resistance level at 195.87 from below to above so the primary bullish trend will be continuing with good possible breakout of the price movement.

If not so the price will be ranging between support level at 185.41 and resistance level at 195.87.

Trend: