NZDUSD Price Action Analysis - recovery after bullish Morning Star candlestick pattern

28 July 2015, 09:11

0

815

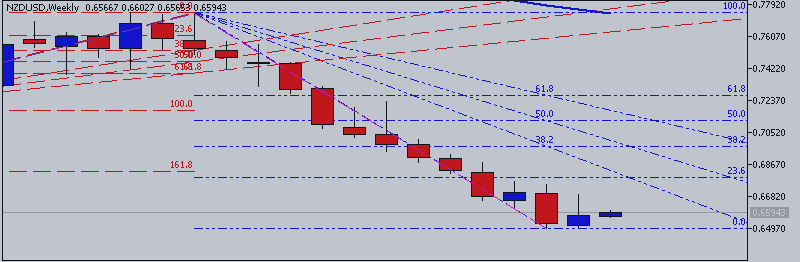

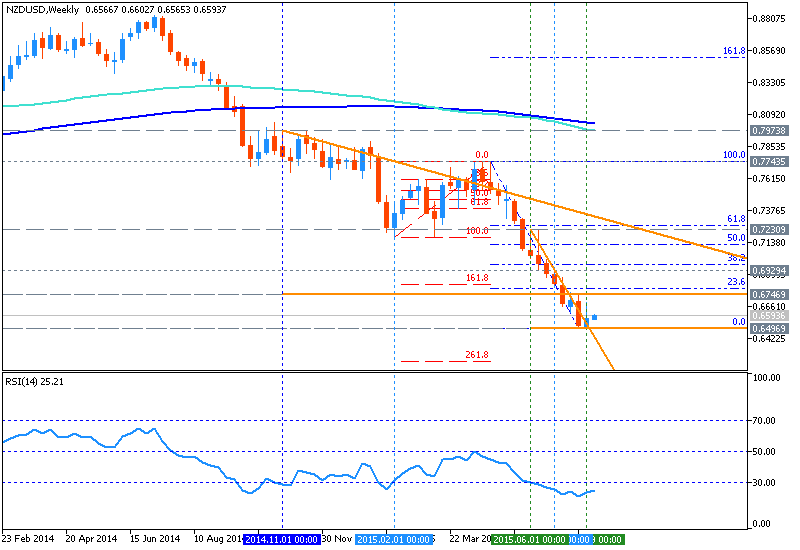

W1 price is located below 200 period SMA and 100 period SMA for the primary bearish market condition:

- The price is on downtrend for trying to break Fibo support level at 0.6496 for the bearish trend to be continuing;

- "The New Zealand Dollar is attempting a cautious recovery against its US namesake after putting in a bullish Morning Star candlestick pattern."

- If weekly price will break 0.6496 support

level so the primary bearish will be continuing, otherwise the price will be ranging within the familiar levels;

- “Near-term resistance is at 0.6679, the 14.6% Fibonacci retracement, with a break above that on a daily closing basis exposing the 23.6% level at 0.6791.”

Levels:

| Resistance | Support |

|---|---|

| 0.6679 | 0.6496 |

| 0.6791 | 0.6400 |