Goldman Sachs for EUR/USD: 1.04 at year-end? EUR/USD will fall 'a lot further'

Some banks are trying to predict the values for EUR/USD and for other

pairs at year-end providing their technical analysis using

support/resistance and 200 SMA indicator.

For example, Barclays estimated the EUR/USD to be 1.04, but Goldman Sachs evaluated that EUR/USD will fall 'a lot further':

- "We see our results as consistent with our view that low inflation in the Euro zone is partly structural, which supports our view that ECB QE will last at least through September next year, which in turn supports our EUR/$ downside view."

- "GS sees EUR/USD trading at 1.02, 1.00, and 0.95 in 3, 6, and 12-month respectively."

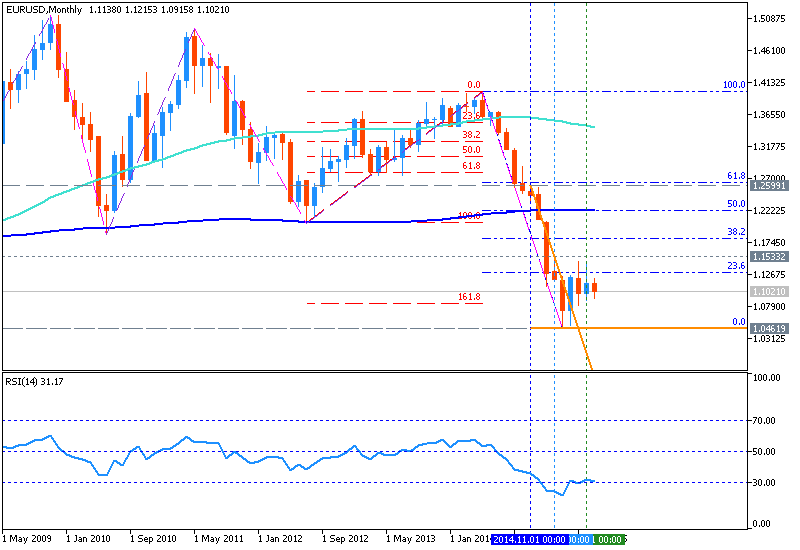

Thus, the bearish trend will be continuing: it may be without secondary ranging, or it may be with ranging, but it will be the primary bearish market condition anyway because of the following:

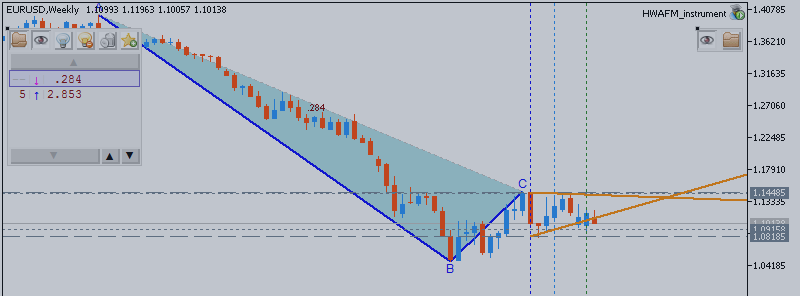

- weekly and monthly prices are below 100-period SMA and below 200-period SMA;

- price (both weekly price and monthly price) are on ranging between the levels but it is bearish ranging: they are ranging between resistance level and support level which is 1.04 for now;

- I can expect the support level to be 1.00 or 0.95 for example so the forecast provided by Goldman Sachs may be the valid one if we are talking about support levels for this price moving with primary bearish market condition for all the timeframes started with H4 for example.