Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD - volatility remains high

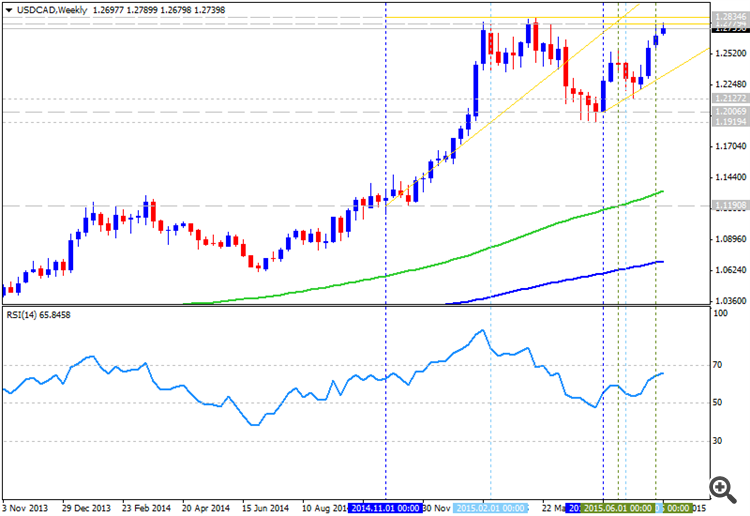

US Dollar - "Chairwoman Janet Yellen reiterated her belief that hikes will begin this year. Fed Fund futures yielded some ground after the comments. Ahead, we have CPI and Yellen testimony that will further decide just hard the dovish market will fight the Fed’s warnings."

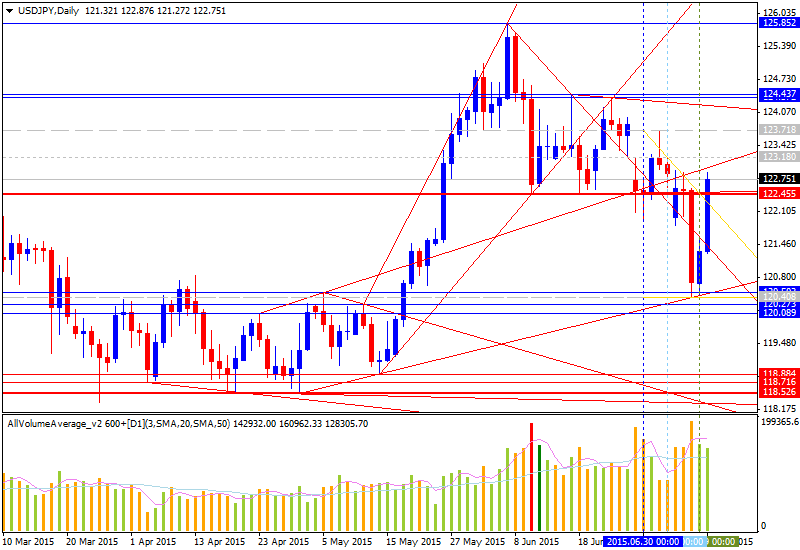

USDJPY - " Keep an eye on China, Greece, and broader financial market risk sentiment to gauge likely direction in the Yen. Volatility prices have picked up from recent lows, and we suspect we have not seen the last of the panic-driven JPY gains."

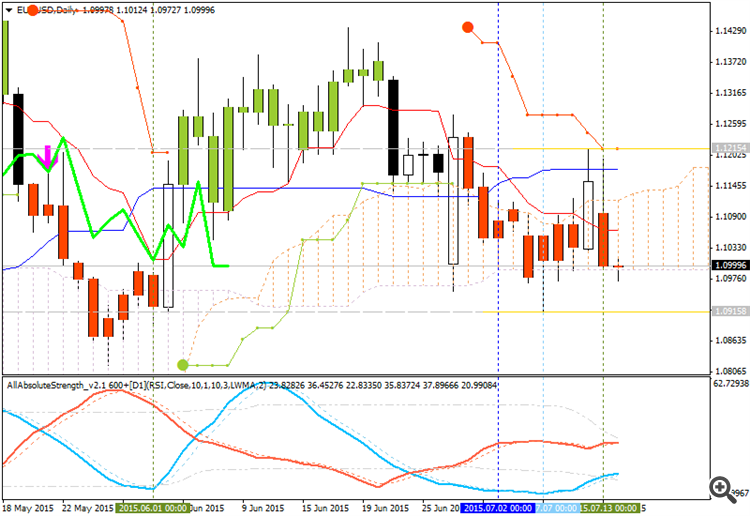

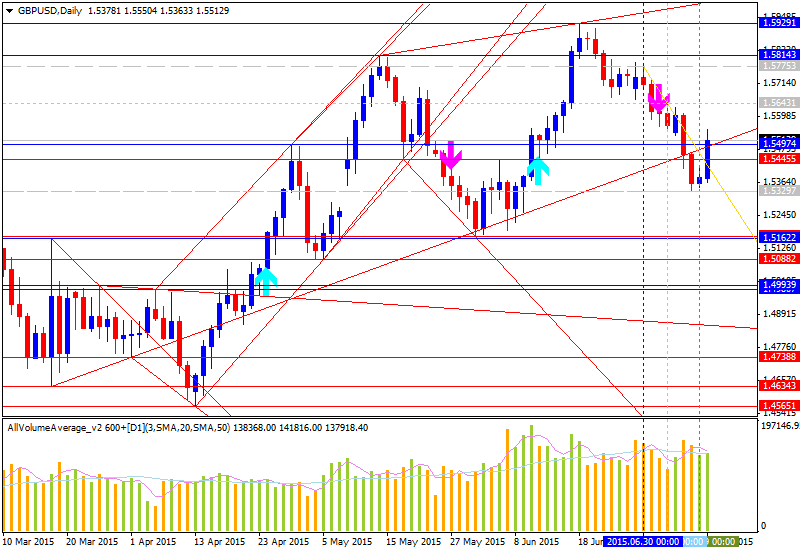

GBPUSD - "With that said, the recent price action in GBP/USD also highlights the risk for a further appreciation in the exchange rate as the pair retains the upward trend carried over from May, and the pound-dollar appears to have carved a near-term low around the 1.5330 region (78.6% Fibonacci retracement) as the Relative Strength Index (RSI) threatens the bearish momentum carried over from the previous month."

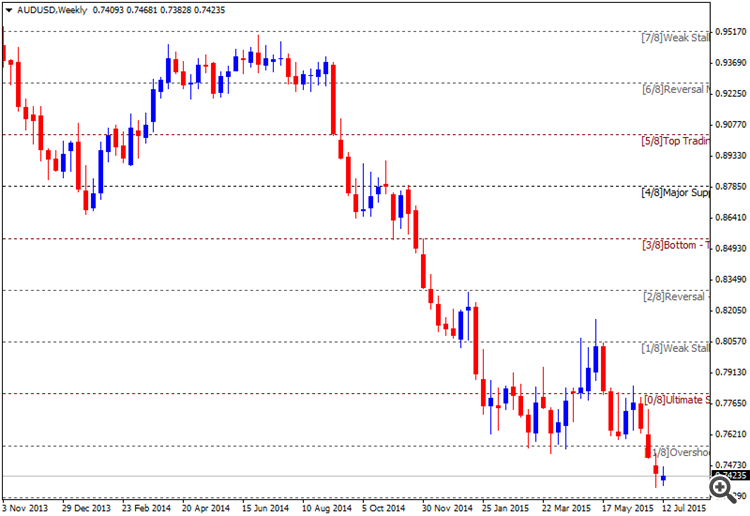

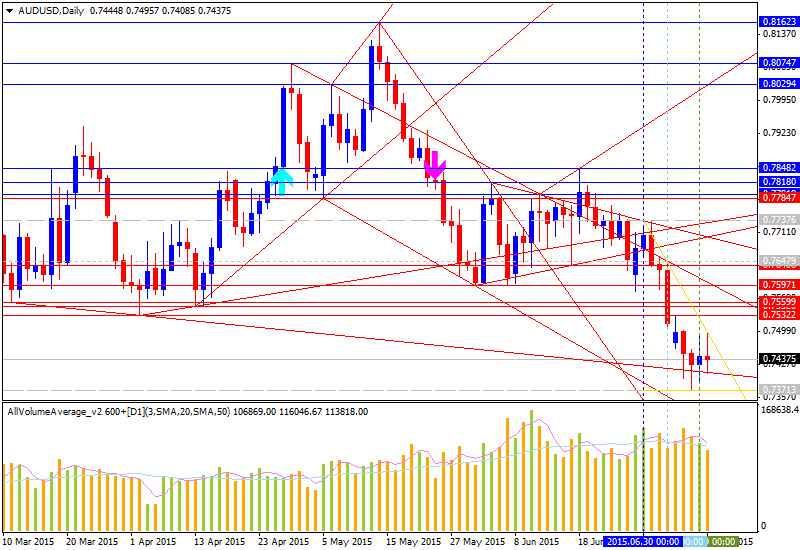

AUDUSD - "This ought to be particularly pronounced the Fed Chair downplays likely knock-on effects from external headwinds (including the Greek crisis and recent Chinese financial market volatility). Furthermore, US economic data has increasingly outperformed relative to expectations in recent weeks, hinting data flow may reinforce commentary perceived as leaning hawkish. Needless to say, such a scenario bodes ill for the Aussie."

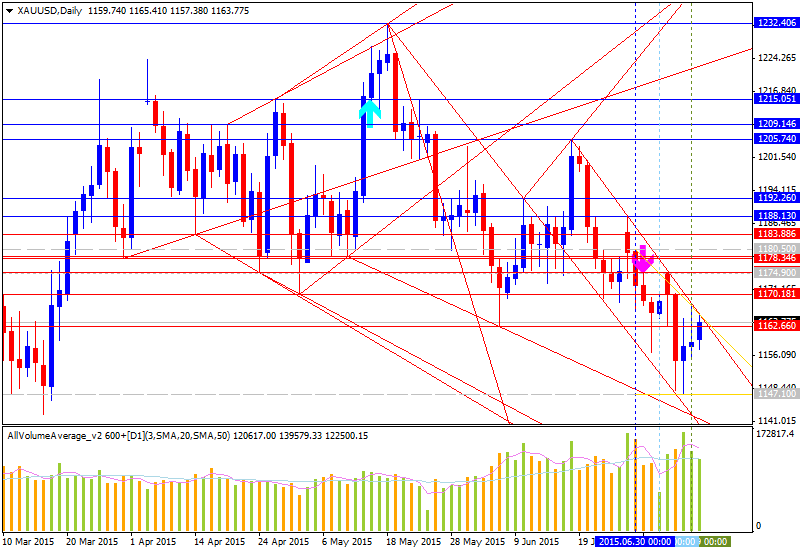

GOLD - "That said, the short-side remains vulnerable above key support near-term with initial resistance eyed at 1171. A breach above the yearly open at 1182 would be needed to suggest a more significant low has been put in with such a scenario eyeing objectives back into the 1200 mark. A break of support risks sharp losses for bullion with no significant support seen until 1105/10 backed by the 2010 low at 1044. Bottom line: the downtrend is at major support near-term and the immediate focus is on a break of the June opening range."