Goldman Sachs: EURUSD Elliot Wave - there is still one last leg lower to complete the 5-wave decline

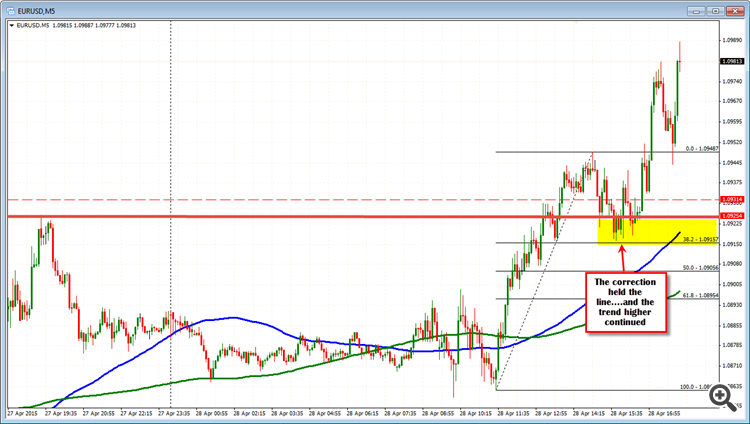

"The market came close to testing 1.0911-1.0914 - 76.4% retrace of the Apr. 6th/13th drop and 76.4% of the swing target from Apr. 13th:

- The break opens topside risks to 1.0988-1.10 which includes the full extension from Apr. 13th and the trend across the highs since Mar. 18th.

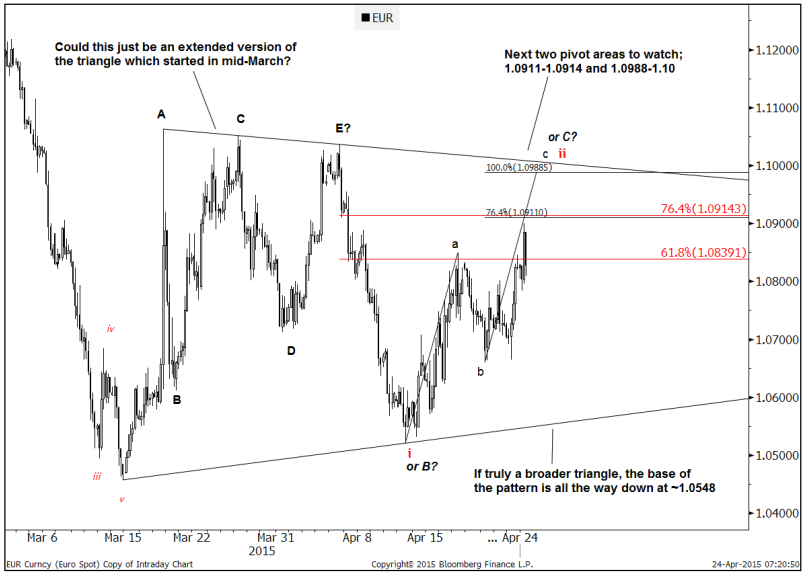

- While it's still possible that this is wave ii of a v wave from the Apr. 6th high, it's also worth considering whether this is a broader, extended version of a triangle that started in mid-March (perhaps we were pre-mature in chasing the break-out?).

- If this is true, would really need a break below the Mar. 15th/Apr. 13th trendline (triangle support) to confirm that the next leg lower is taking place. This comes in all the way down at 1.0548."

"If this is truly a wider/extended triangle,

then it suits the underlying view that there is still one last leg lower

to complete the 5-wave decline

- Taking

a 1.618 extension target from the May '14 high and projecting it off of

current levels implies that wave 5 could go roughly to ~1.01.

- At the same time, this might also mean that there is room to see further sideways/choppy price action.

- It

is however worth highlighting that the 55-dma is now at 1.0947 and

hasn't been broken (on a daily close basis) since May '14 (at the start

of the downtrend).

- The other

thing to note is that daily oscillators are near to the top of their

recent range (implying potential for an imminent turn)."