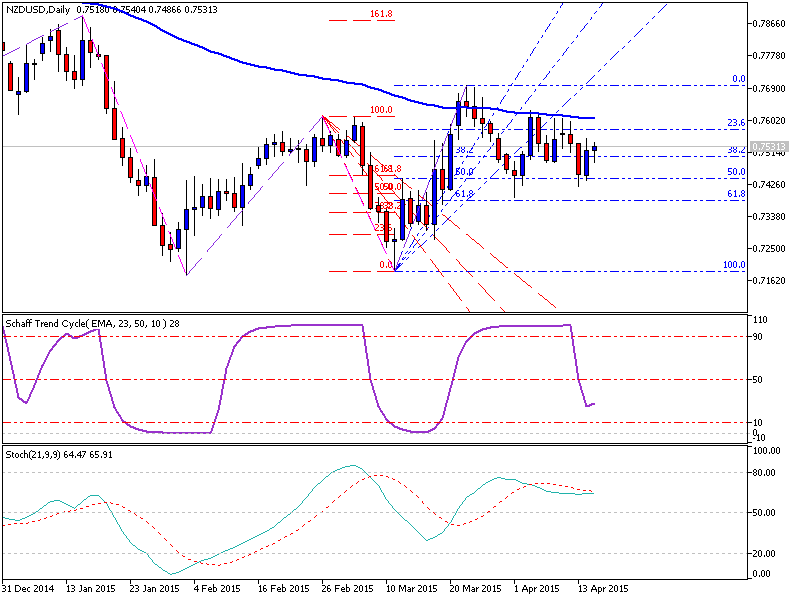

Technical Analysis: NZDUSD for daily close above the 0.7503 area with 38.2% Fibonacci expansion

15 April 2015, 21:11

0

719

New Zealand Dollar corrected higher against US namesake after

seemingly overturning the up move from the March swing low yesterday. A

daily close above the 0.7503 area (horizontal pivot, 38.2% Fibonacci

expansion) exposes the 50% level.

Alternatively, a reversal above trend line support-turned-resistance at 0.7547 clears the way for a challenge of 0.7608 (December 9 low, falling trend line).

The corrective rebound has improved risk/reward parameters and we will now enter short, initially targeting 0.7418. A stop-loss will be activated on a daily close above 0.7608. We will book profit on half of the position and move the stop-loss to breakeven (0.7513) once the first objective is reached.

Alternatively, a reversal above trend line support-turned-resistance at 0.7547 clears the way for a challenge of 0.7608 (December 9 low, falling trend line).

| Resistance | Support |

|---|---|

| 0.7547 | 0.7406 |

| 0.7608 | 0.7332 |

The corrective rebound has improved risk/reward parameters and we will now enter short, initially targeting 0.7418. A stop-loss will be activated on a daily close above 0.7608. We will book profit on half of the position and move the stop-loss to breakeven (0.7513) once the first objective is reached.