Video manual: How to Trade - Vertical Horizontal Filter indicator, and Free to Downloads

18 May 2015, 09:11

0

654

- Developed by Adam White and published in August 1991 in Futures Magazine

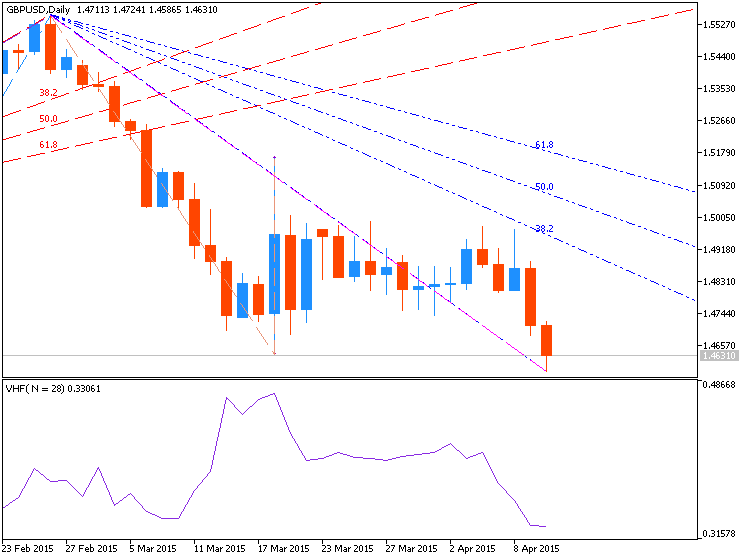

- Used for determining whether a market is trending or congested, or about to change from one to the other

- Useful within a technical trading system to determine which indicators are best-calibrated to the current market. In other words, VHF can help you determine whether you should use rangebound or trend-following trading indicators.

The VHF value implies whether prices are trending.

- Higher VHF = a higher degree of trend; in such scenarios, the implication is to use trend-following indicators.

- Lower VHF = lower degree of trend (use trading-range-friendly indicators like RSI or Stochastics)

- Rising VHF = developing trend

- Falling VHF = congesting market

Signals of market shift: congestion often follows high VHF values (as price peaks), trending prices often occur following low VHF (as price bottoms out)

FREE TO DOWNLOADS