US DOLLAR TECHNICAL ANALYSIS

Prices are extending to a new four-year high. Daily close

above the 38.2% Fibonacci expansion at 11130 exposes the 50% level at

11200. Alternatively, a reversal back below the 23.6% Fib at 11043

clears the way for a test of rising trend line support at 11016.

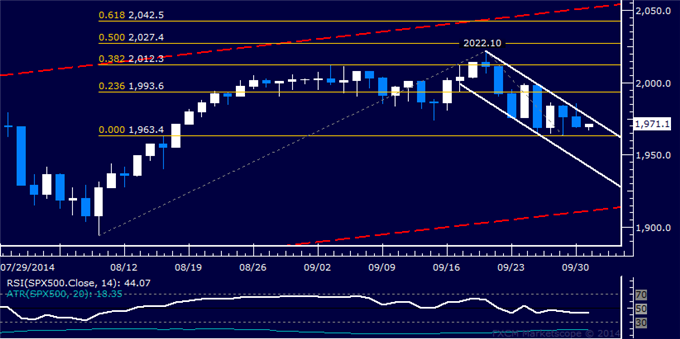

S&P 500 TECHNICAL ANALYSIS

Prices continue to edge lower. Near-term support is 1963.40, the September 29

swing low, with a break below that on a daily closing basis exposing the

channel floor at 1941.60. Alternatively, a move above the channel top

at 1976.60 targets the 23.6% Fibonacci expansion at 1994.60.

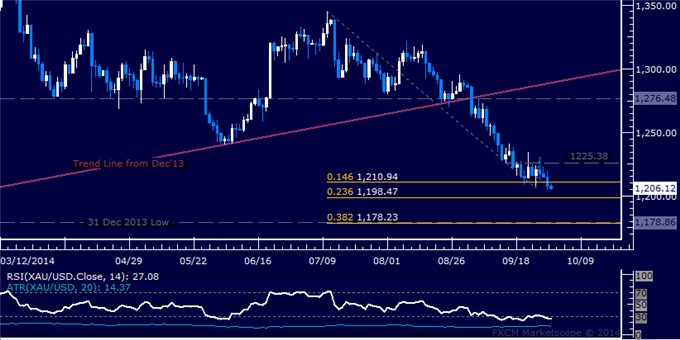

GOLD TECHNICAL ANALYSIS

Prices resumed its down trend after consolidative period, with sellers now aiming to test the 23.6%

Fibonacci expansion at 1198.47. A break below that on a daily closing

basis exposes the 1178.23-86 area marked by the 38.2% level and the

December 31 2013 low. Alternatively, a turn back above the 14.6% Fib at

1210.94 aims for range top resistance at 1225.38.

CRUDE OIL TECHNICAL ANALYSIS

Prices edged past support at

95.11, the 23.6% Fibonacci expansion. A break below that exposes the 38.2% level at 92.34.

Alternatively, a turn back above the 95.11 eyes the 96.73-82 area,

marked by the April 18 2013 low and the 14.6% Fib.