3

4 894

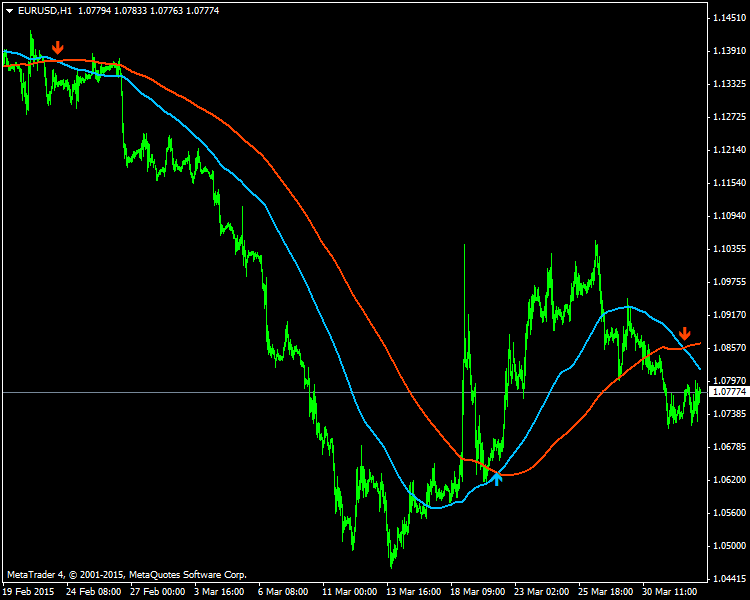

The 20 pips strategy is used for H1 and M15 timeframes. We use 100

SMA and 200 SMA indicators to determine the direction of the trend.

H1 timeframe chart checks long term direction of the trend. Trades are opened only when the price is within 20 pips range of the 200 simple MA.

Condition for buy:

H1 timeframe chart checks long term direction of the trend. Trades are opened only when the price is within 20 pips range of the 200 simple MA.

Condition for buy:

- On the 1 hour Forex chart time-frame the price of the currency pair should be above both the 100 and 200 simple moving average. We then move to a lower chart time-frame, the 15 minute chart time-frame to generate a trade signal.

- On 15 minute chart time-frame, when price reaches the 20 pips range above the 200 SMA, we open a buy trade and place a stop loss 30 pips below the 200 SMA. Stop loss can be adjusted to the amount of Pips that are suitable for your risk but to avoid being stopped out by normal Forex volatility its best to use 30 pips stop loss.

Condition for sell:

- On the 1 hour chart time-frame, the price should be below both the 100 and 200 simple moving average. We then move to the 15 minute chart time-frame to generate a Trading Signal.

- When price reaches the 20 pips range below the 200 SMA, we open a sell trade and place a stop loss 30 pips above the 200 simple moving average.