HOW TO TRADE: The Three Drives Pattern - Harmonic Ratios and Explanation

1 October 2014, 06:11

0

3 140

One of the first

references to a Three Drives pattern was outlined in

Robert Prechter's book, "Elliot Wave

Principle." He described the general nature of

price action that possessed either a three-wave or a

five-wave structure.

Adapted from this principle, symmetrical price movements that possess identical Fibonacci projections in a 5- wave price structure constitute a Three Drives pattern. In "The Harmonic Trader," the patterns importance of other larger retracements and projections improved the accuracy of the pattern in real trading situations. The book was one of the first to emphasize the the critical aspect of this pattern that each drive complete precisely at consecutive harmonic ratios - either a 1.13, 1.27 or a 1.618. Also, the price legs should possess clear symmetry with each drive forming over equivalent time periods.

Adapted from this principle, symmetrical price movements that possess identical Fibonacci projections in a 5- wave price structure constitute a Three Drives pattern. In "The Harmonic Trader," the patterns importance of other larger retracements and projections improved the accuracy of the pattern in real trading situations. The book was one of the first to emphasize the the critical aspect of this pattern that each drive complete precisely at consecutive harmonic ratios - either a 1.13, 1.27 or a 1.618. Also, the price legs should possess clear symmetry with each drive forming over equivalent time periods.

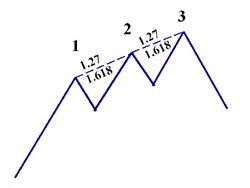

The bearish three drives pattern:

It offers a potential reversal point for a bullish market after forming three consecutive peaks. The pattern could be formed via two connecting bearish AB=CD patterns and also can shows a negative butterfly pattern when it is constructing the third drive.

The pattern defines the symmetry of the move using the projection of Fibonacci retracement.

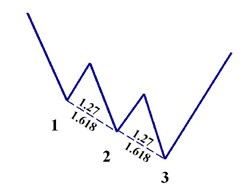

The bullish three drives pattern:

On the opposite side, the bullish three drives pattern offers a

potential reversal point for a bearish market after forming three

consecutive bottoms.