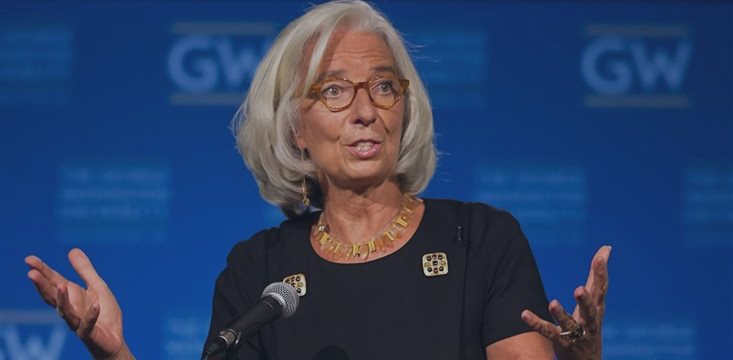

IMF: Emerging markets will face instability when US rates rise later this year

Christine Lagarde, the chief of the International Monetary Fund cautioned

on Tuesday that emerging markets are likely to face a renewed period of

economic instability when US interest rates rise later this year,

She predicted a repeat of 2013’s damaging “taper tantrum” episode of capital flight and rapid currency depreciation, says The Financial Times.

Her comments, given during a

speech in India, come one day before Federal Reserve chairwoman Janet

Yellen is expected to signal

an end to the Fed’s policy of low-rates guidance on Wednesday, with

global investors bracing for an initial hike in US rates as early as

June.

Lagarde said she was afraid that negative “spillover” effects from these

increases would lead to a re-run of the crisis that hit developing

economies such as India and Turkey

nearly two years ago, following hints from then Fed chair Ben Bernanke

about an early end to institution’s bond purchasing programme known as

quantitative easing.

Developing economies received about $4.5tn of gross capital inflows between 2009 and 2012 according to IMF data, or half of all global capital flows during that period.

The second risk which emerging economies face is the recent strength of the US currency, with indebted companies that took advantage of low rates to borrow in dollars facing sudden and steep hikes in debt servicing costs, according to Lagarde.

India’s corporate sector, which is already dealing with fears over

corporate indebtedness and weak bank capitalisation, was “not immune to

this vulnerability”, she said, noting that dollar denominated corporate

debt had risen “very rapidly, nearly doubling in the last five years”

to $120bn.

Facing these two dangers, Ms Lagarde prompted emerging market authorities to enact economic reforms to spur growth, improve their current account positions and gradually liberalise financial markets. Emerging market central bank governors were called on to prepare emergency measures to support under-pressure currencies and companies struggling with debt repayments.