Technical Price Pattern Analysis for US Dollar, S&P 500, Gold and Crude Oil

US DOLLAR TECHNICAL ANALYSIS

Prices may be readying to correct

lower as negative RSI divergence warns of fading bullish momentum.

Near-term resistance is at 12221, the 50% Fibonacci expansion, with a

break above that on a daily closing basis exposing the 61.8% level at

12335.

S&P 500 TECHNICAL ANALYSIS

Prices broke upward, with buyers

now targeting the 38.2% Fibonacci retracement at 2093.50. A break above

that on a daily closing basis exposes the 50% level at 2110.00.

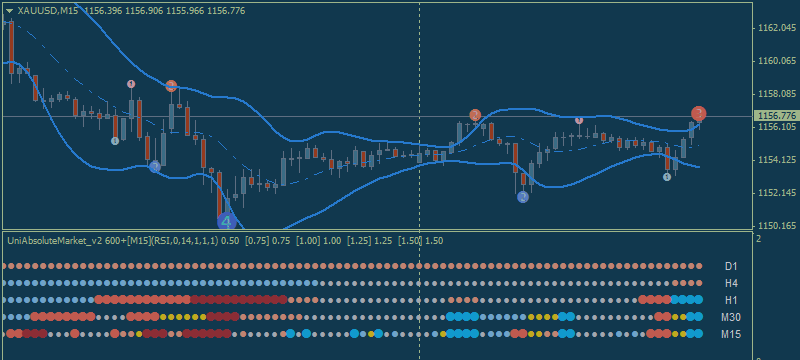

GOLD TECHNICAL ANALYSIS

Prices are digesting losses after

dropping to a three-month low. A break above the 50% Fibonacci expansion

at 1163.43 on a daily closing basis exposes the 38.2% level at 1177.51.

Alternatively, a push below the 61.8% Fib at 1149.35 targets the 76.4%

expansion at 1131.92.

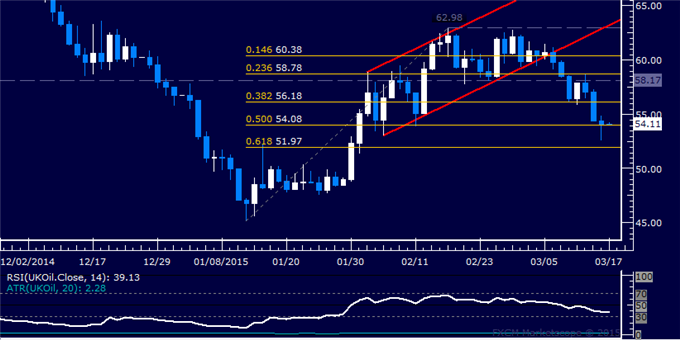

CRUDE OIL TECHNICAL ANALYSIS

Prices resumed pushing lower,

sliding to the lowest level in six weeks. A daily close below the 50%

Fibonacci retracement at 54.08 exposes the 61.8% level at 51.97.

Alternatively, a reversal above the 38.2% Fib at 56.18 targets the

58.17-78 area marked by the 23.6% retracement and the February 6 close.