Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - S&P 500 Coiling Up for a Breakout Below 2100 Figure, Crude Oil at 5-Week High

US DOLLAR TECHNICAL ANALYSIS

Prices may be readying to turn

lower after producing a bearish Evening Star candlestick pattern.

Negative RSI divergence reinforces the case for a downside scenario. A

daily close below the intersection of the 14.6% Fibonacci retracement

and a rising trend line at 11734 exposes the 23.6% level at 11648.

S&P 500 TECHNICAL ANALYSIS

Prices declined as expected

after putting in a bearish Evening Star candlestick pattern. A daily

close below the 23.6% Fibonacci retracement at 2028.00 exposes the

1980.60-88.00 area marked by the 38.2% level and a Triangle pattern

floor.

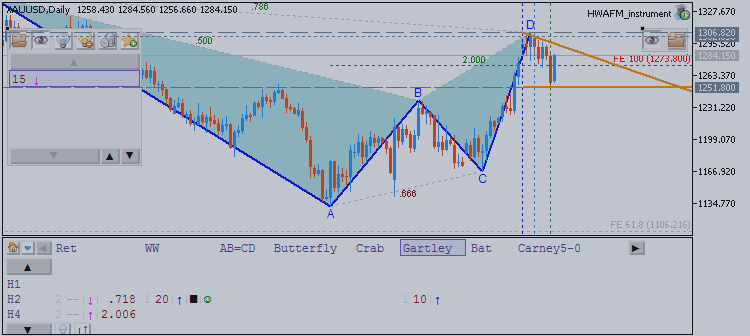

GOLD TECHNICAL ANALYSIS

Prices are consolidating above

resistance-turned-support at October’s swing highs. A daily close above

the 23.6% Fibonacci expansion at 1285.20 exposes the 38.2% level at

1305.73. Alternatively, a reversal below the 38.2% Fib retracement at

1253.77 targets the 50% threshold at 1237.18.

CRUDE OIL TECHNICAL ANALYSIS

Prices pushed higher following a

prolonged period of consolidation after bottoming as expected above the

$45.00/barrel figure. A daily close above the 38.2% Fibonacci

retracement at 59.08 exposes the 50% level at 63.38. Alternatively, a

reversal below the 23.6% Fib at 53.77 targets the 14.6% retracement at

50.49.