How to Build and Trade Strategies: Trading with CCI and Camarilla Pivots

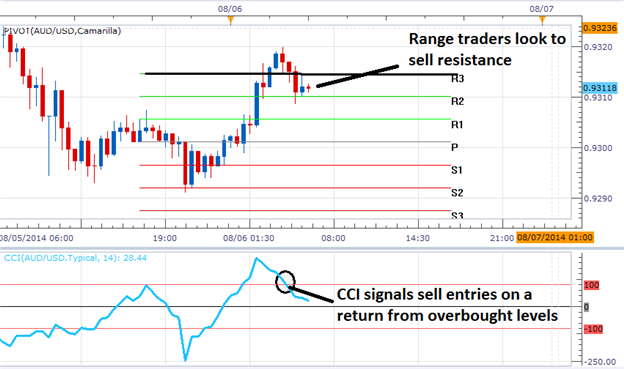

The key to using CCI with camarilla pivots is to line an entry signal near support and resistance, along with an overbought or oversold reading of CCI.

Timing entries is an important step to consider when developing a

trading strategy. This is especially true for scalpers and day traders

looking to take advantage of intraday market price swings and reversals.

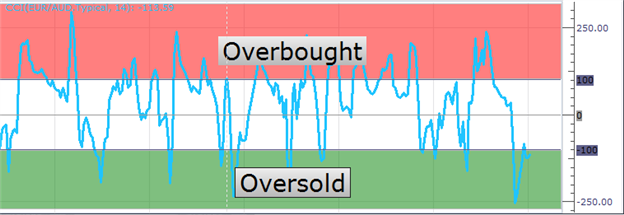

Normally, technical oscillators such as CCI (Commodity Channel Index)

can be used in tandem with support and resistance to identify potential

areas to enter the market.

The use of support and resistance lines, such as camarilla pivots, can

also be used in conjuncture with oscillators like CCI. The benefit of

this, is that camarilla pivots outlines an area for traders to plan for a

market reversal. Intraday resistance is typically found at the R3

resistance pivot, while support for the day’s range is found at the S3

pivot point.