With market focus largely on the European Central Bank so far in 2015, the Fed has found itself playing second fiddle. And it is highly unlikely that we will hear anything from the Fed tomorrow to steal the spotlight back from Frankfurt.

The language of forward guidance will be the key element in tomorrow’s announcement, after the Fed’s emphasis on “considerable time” between the final tapering of its third round of quantitative easing and the first rate hike was substituted with an emphasis on “patience”, something unlikely to change in tomorrow’s statement.

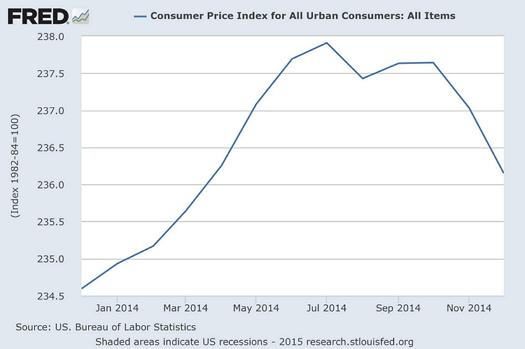

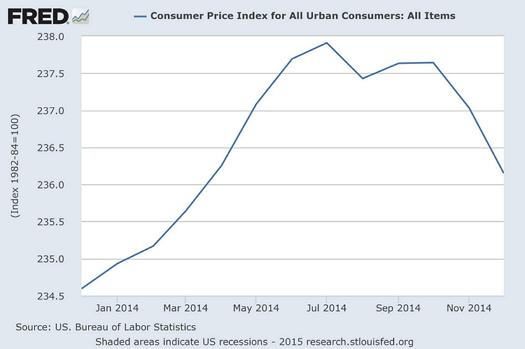

In line with the global decline in fuel prices, US CPI inflation declined to 0.8 percent in December, down from 1.3 percent in November. With lower oil prices unlikely to rebound significantly in the short-medium term, there is anticipation that inflation could fall below 0.5 percent as lower fuel prices feed into core prices.

In addition, the dollar rally forecasted through 2015 will decrease the price of US imports, further feeding into lower inflation numbers.

While the European Central Bank acted last week to unleash EUR60bn of asset purchases beginning in March, the initial effects are market rather than wider economy-based and unlikely to spur European demand for US goods and services in the short-medium term. As Mario Draghi stressed at his announcement of the ECB’s QE programme, there needs to be reform from member state governments for a return to sustained economic growth to take place.

All in all, there is unlikely to be anything in the FOMC’s statement to shake the long dollar-short euro consensus, with the Fed’s March meeting more likely to have greater market impact.

The language of forward guidance will be the key element in tomorrow’s announcement, after the Fed’s emphasis on “considerable time” between the final tapering of its third round of quantitative easing and the first rate hike was substituted with an emphasis on “patience”, something unlikely to change in tomorrow’s statement.

In line with the global decline in fuel prices, US CPI inflation declined to 0.8 percent in December, down from 1.3 percent in November. With lower oil prices unlikely to rebound significantly in the short-medium term, there is anticipation that inflation could fall below 0.5 percent as lower fuel prices feed into core prices.

In addition, the dollar rally forecasted through 2015 will decrease the price of US imports, further feeding into lower inflation numbers.

While the European Central Bank acted last week to unleash EUR60bn of asset purchases beginning in March, the initial effects are market rather than wider economy-based and unlikely to spur European demand for US goods and services in the short-medium term. As Mario Draghi stressed at his announcement of the ECB’s QE programme, there needs to be reform from member state governments for a return to sustained economic growth to take place.

All in all, there is unlikely to be anything in the FOMC’s statement to shake the long dollar-short euro consensus, with the Fed’s March meeting more likely to have greater market impact.