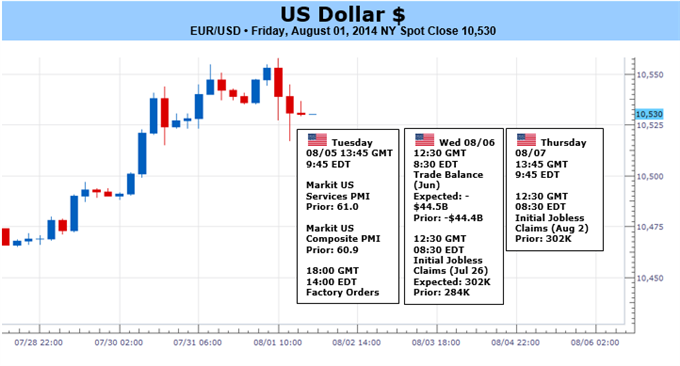

-

NFPs may have dampened momentum behind rate forecasts just before a true trend was set

- Risk trends may single-handedly carry the dollar’s next move – whether full blown trend or begrudging correction

The most capable backup for the dollar’s run also happens to be the most difficult to ignite. If there was a bigger theme this past week than the dollar’s it was the surge in volatility.

The activity barometers maintain their distinct relationship to

speculative appetites, and the VIX Index’s advance to 17 translated into

the biggest drop from the S&P 500 in two years. The amplitude of

the move is a persuasive indication of ‘risk aversion’ on the scale

that would activate the dollar’s liquidity / safe haven status.

However, we have seen many similar jumps before over the past years

only to have them evaporate as the market buys the pullback and revert

quickly back to complacency. What would separate this instance from

previous false starts? Consistency. There are early signs that the underlying trend in these volatility measures is turning higher

but we are still short of a virtuous cycle. If the selling and

deleveraging pressures persist next week, the dollar will likely mount

serious gains versus its counterparts. But don’t expect the market to

fold so easily.