Technical Analysis for Gold, Grude Oil, US Dollar and S&P 500 - Gold Prices Try to Mount Recovery, Eyeing $1200/oz Level

US DOLLAR TECHNICAL ANALYSIS

Prices flat-lined after hitting a

five-year high, with negative RSI divergence warning a downturn may be

ahead. Near-term resistance is at 11577, the 38.2% Fibonacci expansion,

with a break above that on a daily closing basis exposing the 50% level

at 11648. Alternatively, a turn below the 11489-522 area marked by the

December 8 top and the 23.6% Fib clears the way for a test of the 14.6%

expansion at 11434.

S&P 500 TECHNICAL ANALYSIS

Prices edged above the December 5

high at 2079.60, exposing the 50% Fibonacci expansion at 2098.60. A

daily close above this barrier exposes the 61.8% level at 2129.40.

Negative RSI divergence warns of ebbing upside momentum and hints a turn

lower may be looming. A turn back below 2079.60 sees initially support

at 2067.90, the 38.2% Fib.

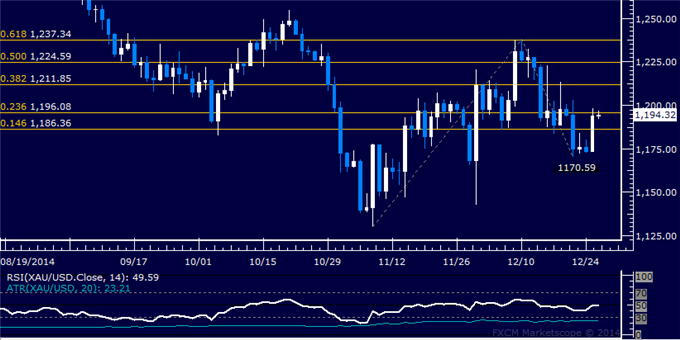

GOLD TECHNICAL ANALYSIS

Prices recoiled upward to test

resistance at 1196.08, the 23.6% Fibonacci expansion, with a break above

that on a daily closing basis exposing the 38.2% level at 1211.85.

Alternatively, a move below the 14.6% Fib at 1186.36 targets the

December 22 low at 1170.59.

CRUDE OIL TECHNICAL ANALYSIS

Prices are in consolidation mode

above the $58.00/barrel figure. A break below the 23.6% Fibonacci

expansion at 58.20 exposes the 38.2% level at 54.83. Alternatively, a

bounce above the 23.6% Fib retracement at 63.94 targets the 38.2%

threshold at 67.31.