Technical Analysis for USDJPY, GBPUSD and EURUSD - Extreme negative sentiment has accompanied every break to new lows over the past few months

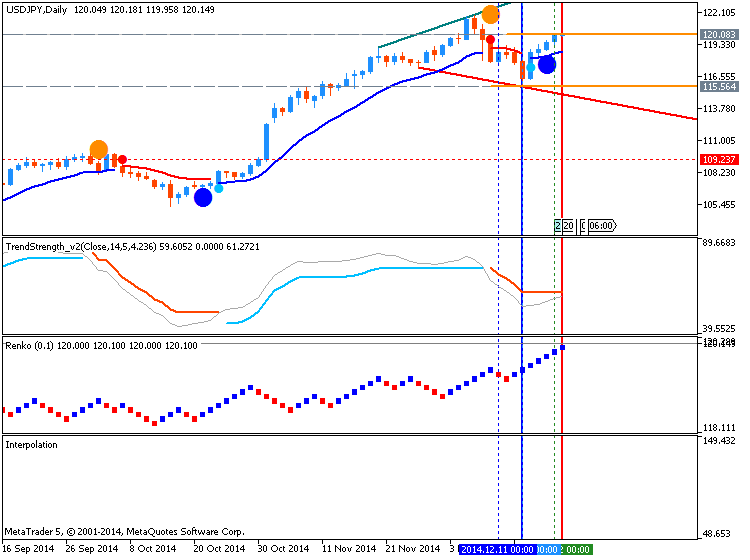

- USD/JPY has moved steadily higher over the past few days since finding support from just above the 38% retracement of the October low

- Our near-term trend bias is higher in USD/JPY while above 117.40

- A confluence of Gann and Fibonacci levels around 120.50 suggests this should be the next important action/reaction area

- A close back under 117.40 would turn us negative on the exchange rate

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | 117.40 | 118.50 | 119.75 | 120.10 | 120.50 |

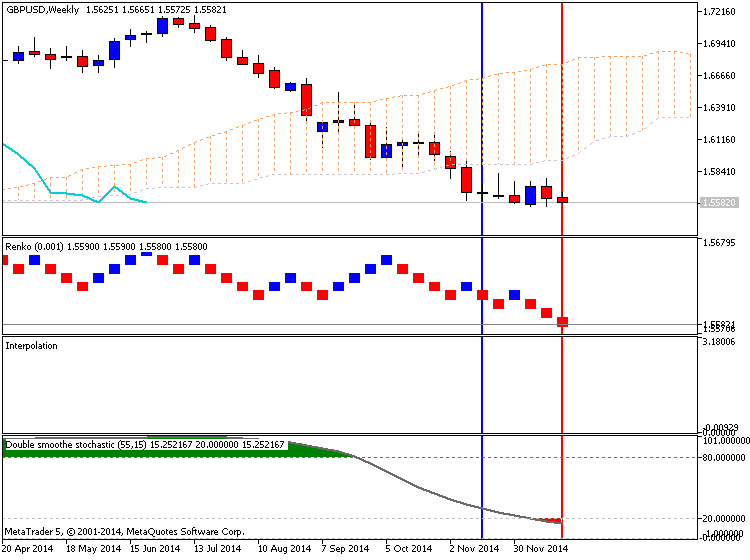

GBPUSD

- GBP/USD registered a new low for the year last week, but has since rallied back into the middle of the month-long range

- Our near-term trend bias is negative while below 1.5790

- A close under 1.5540 is needed to confirm the start of a more important leg lower

- A close over 1.5790 would turn us posiitve on Cable

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| GBP/USD | 1.5370 | 1.5540 | 1.5610 | 1.5675 | 1.5790 |

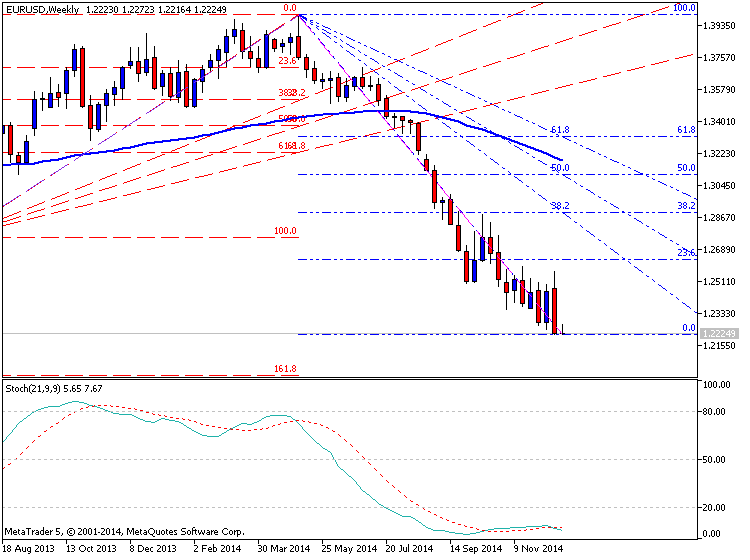

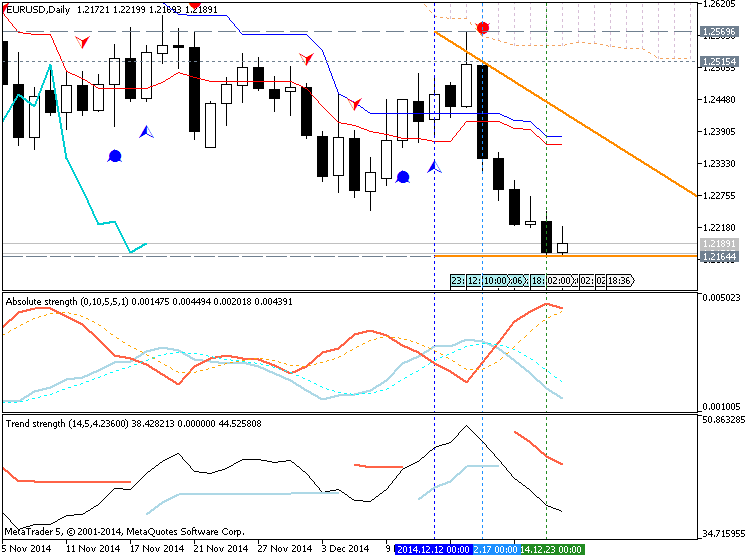

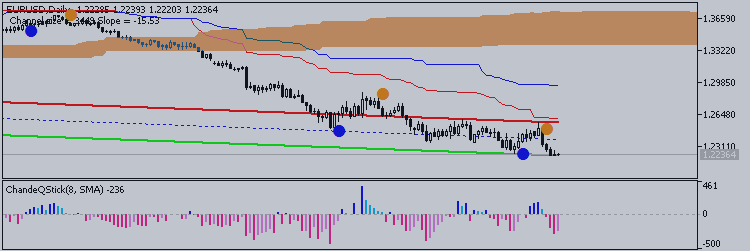

EURUSD

EUR/USD has managed to buck the historically positive seasonality of late December with aggressive weakness over the past few days taking the exchange rate to new lows for the year. The resumption of the broader trend has come earlier than we were expecting and has caught us a bit by surprise. We are now open to the possibility of a cyclical inversion early next year. Attention now turns to the next major downside pivot around 1.2135 as this marks the 50% retracement of the all-time low and the all-time high in the euro. Traction under this level in the weeks ahead would signal the start of a more important run lower in the exchange rate. A potential positive for the euro is the sentiment picture which saw the DSI fall to just 6% bulls on Friday. Extreme negative sentiment has accompanied every break to new lows over the past few months and warns too many traders are looking for the same thing. However, the next cyclical turn window of significance is not seen until closer to year-end.