The Coming Greater Depression

By Vern Gowdie, Editor, Gowdie Family Wealth

Hockey can’t do it. Obama couldn’t do it. Abe thinks he can do it. Merkel is going to find out she can’t do it. Hollande knew he couldn’t do it, but said otherwise.

What they can’t do is raise sufficient tax revenues to fund government promises (primarily health and welfare).

What apparently also can’t be done is convince society that cuts to spending programs are essential to long term financial stability.

Old fashioned ‘living within your means’ has somehow been re-labelled as ‘austerity’. This is an indication of how far we have drifted away from common sense.

Politicians lack the ‘male equipment’ to make the really tough calls on spending cuts. Society has become so pampered it doesn’t recognise the party is over and refuses to countenance any cut backs. Politicians therefore look for creative ways to dig deeper into our pockets to extract more tax dollars —aimed invariably at ‘the rich’. Who are ‘the rich’? Anyone with more money than the person asking the question. ‘Everyone else must pay except me’ is the unspoken creed.

The problem with higher taxes is they never raise the revenues the treasury boffins predict. People become creative and reorganise their affairs to minimise or even skirt the new tax regime.

The budget dilemma we are seeing in Australia is being played out across the developed world — too many promises and not enough money.

Budget deficits are locked in for years to come.

The problem is Western countries all have different levels of existing public debt (as a percentage of GDP) — Japan around 240%, US 100%, France 95%, Australia 30%.

To finance deficits, these economies have been printing money and buying government bonds, or making money available to investment banks to then channel back into the bond market.

There simply aren’t enough dollars, yen, euros, or renminbi to fund these deficits without printing more. This is madness, yet no one seems to notice. If they do, they don’t seem to care.

Perhaps this is because the system has not yet succumbed to economic gravity. So we keep up the illusion.

The US was looking like it might’ve been working its budget back into the black thanks to the shale oil boom. However, the collapse in the oil price has thrown these forward projections into doubt...similar to the collapse in iron ore impacting our government revenues.

Shale oil development has created 40% of all new jobs in the US. Companies have invested billions into developing these mines. The falling oil price brings into question the viability of these projects — bankruptcies and lay-offs are threatening to turn the decade long boom into a bust of monumental proportions.

Which brings us to another interesting link in this fragile financial chain.

On December 11, 2014, the US House of Representatives succumbed to the might and power of Wall Street. A bill was passed that repealed a section of Dodd-Frank Act that protected depositors and US taxpayers from being exposed to massive derivative losses.

From American Banker:

‘"Wall Street's determined lobbying on Section 716 provides compelling evidence that Wall Street's business model depends on the ability of large financial conglomerates to keep exploiting the cheap funding provided by their 'too big to fail' subsidies," said Arthur Wilmarth, a professor of law at George Washington University. "Shame on Congress if it allows megabanks to continue to pursue the same business strategy that brought us the financial crisis.”

‘Making matters potentially worse, news reports quickly surfaced that Jamie Dimon, JPMorgan Chase's CEO, also personally lobbied lawmakers on the bill.’

The provisions allow Wall Street’s big banks to trade derivatives through subsidiaries that are insured (by the taxpayer) under the Federal Deposit Insurance Corporation (FDIC).

In a nutshell, the profits from these derivatives are Wall Street’s and the losses are the taxpayers. Little wonder that no less than Jamie Dimon himself hit the phones to pressure politicians to vote in favour of passing this bill.

What does Wall Street know that we don’t?

We know from annual data provided by the US Office of Comptroller of the Currency (OCC) that derivatives exposure amongst the US banks is $230 trillion dollars (to put this mind-blowing figure into perspective, the US economy is $17 trillion).

Wall Street has become one giant casino with bets on all sorts of contracts — interest rates, commodities, currencies.

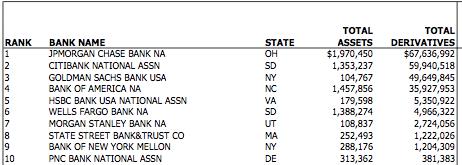

The following is a snapshot of the table in the latest OCC report showing the top ten US banks total derivate exposures:

What a surprise — Jamie Dimon’s firm JP Morgan heads the list at $67.6 trillion.

The top four Wall Street banks account for 93% ($213 trillion) of total US bank derivate exposure.

There’s a whisper going around that the dramatic plunge in the oil price might be causing the big banks some financial pain. Apparently, some of the forward thinking shale oil companies locked in prices for 2015 and 2016 when oil was trading at US$100 per barrel. No one, least of all the banks on the losing end of the trade, expected prices to fall 40%.

I don’t think this is the real reason behind the intense lobbying efforts.

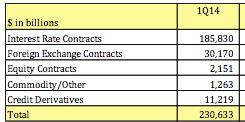

This chart from the latest OCC report might give us a clue:

Commodity contracts are ONLY $1.2 trillion. The really big exposure is to interest rate contracts — a whopping $185 trillion.

Yields on junk bond debt are rising as investors become increasingly risk averse. A credit scare could see a spike in interest rates that is as equally unexpected as the dramatic fall in the oil price.

Albert Edwards from Societe Generale pondered this thought in his latest weekly Global Strategy report:

‘My own view is that the Eurozone cannot withstand another full scale recession and will ultimately fracture despite the best efforts of the ECB. I believe that Beppe Grillo of Italy’s Five Star Movement is right.

He says, "Eventually will come a time when a politician will hold up a copy of the EMU treaty, declare it null and void, and the debt null and void right along with it. That politician will be elected."’

As Western governments find it harder and harder to make ends meet and their citizens begin protesting, all it’ll take is one populist politician to say ‘up yours’ to the bond market.

When that happens, bullets are going to fly everywhere. No one has the slightest clue where the ricochets are going to eventually land.

With $185 trillion dollars’ worth of exposure to interest rate contracts, it is no wonder the Big Four Wall Street banks want US tax payers to pick up the tab.

These blood sucking parasites are positioning themselves for survival.

The longer we defy economic gravity, the harder the fall to earth will be.

The Greater Depression is coming. The Wall Street banks are provisioning for it. So should you.

Vern Gowdie

For The Daily Reckoning Australia