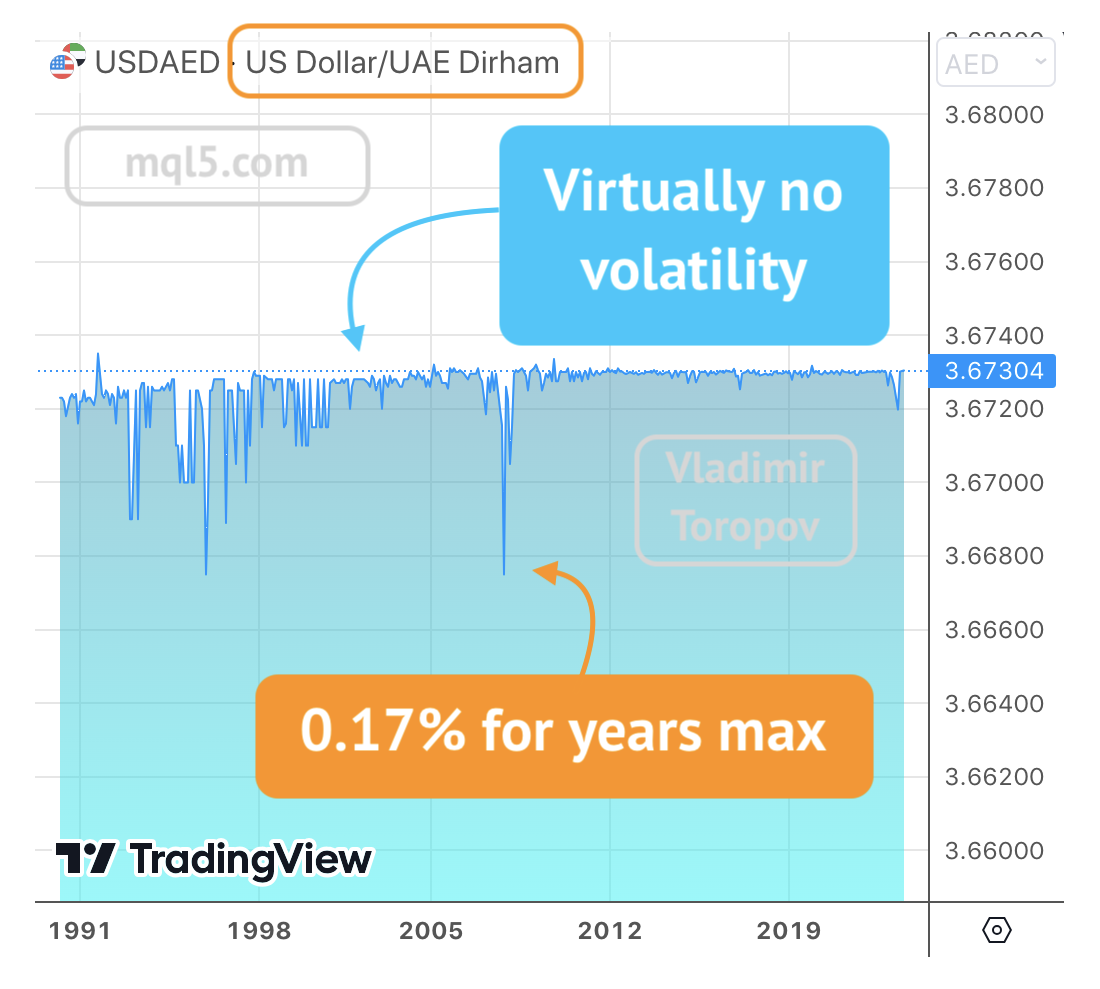

Dirham is approximately equal to 0.27 USD. Contrary to the currencies actively traded on Forex, the UAE dirham always maintains a constant exchange rate against the US dollar. You may know this fact about the Dirham. However, did you know that, in addition to the UAE, dozens of other countries do the same? Let’s figure it out.

Which countries’ currencies are pegged to the US Dollar?

Most Caribbean islands, such as Aruba, the Bahamas, Barbados, and Bermuda, peg their currencies to the U.S. dollar because tourism is their main source of income.

In Africa, many countries peg to the euro. Djibouti and Eritrea are the only exceptions, which peg their own currencies to the dollar.

Several Middle Eastern nations, including Jordan, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, peg to the U.S. dollar for stability – the oil-rich nations need the United States as a major trading partner.

In Asia, Macau and Hong Kong fix to the U.S. dollar.

My solutions on MQL5 Market: Vladimir Toropov’s products for traders

What are the reasons?

Countries choose to peg their currencies to the United States dollar (USD) for various reasons. Here are some common motivations behind currency pegging:

Stability and confidence

Pegging a currency to a stable and widely accepted currency like the USD can provide stability and confidence to investors, businesses, and consumers. It helps in reducing exchange rate volatility and mitigating the risks associated with fluctuating currency values.

Trade facilitation

Pegging to a major trading currency like the USD can simplify international trade transactions. It provides a consistent exchange rate and eliminates the need for constant recalculations, making it easier for businesses to plan and execute cross-border trade.

Inflation control

Some countries with high inflation may choose to peg their currency to a more stable currency like the USD to help control inflationary pressures. By adopting the monetary policies of the currency to which they are pegged, they can potentially benefit from lower inflation rates.

Attracting foreign investment

A stable currency can be attractive to foreign investors, as it reduces the risk of currency depreciation. Pegging to a widely used currency like the USD can encourage foreign investment by providing a familiar and predictable exchange rate environment.

Methods

The methods used to peg currencies to the USD can vary. Here are a few common approaches:

Fixed exchange rate

In this approach, the central bank of the country sets a specific exchange rate between its currency and the USD and commits to maintaining that rate. The central bank intervenes in the foreign exchange market as necessary to buy or sell its currency to maintain the desired exchange rate.

Currency board arrangement

Under a currency board arrangement, the country’s central bank fully backs its currency with foreign reserves, typically denominated in the pegged currency (USD). The central bank holds sufficient reserves to exchange the local currency for the pegged currency at the fixed exchange rate.

Crawling peg

This system involves regularly adjusting the exchange rate within a predefined range. The exchange rate is adjusted gradually based on economic factors such as inflation differentials, balance of payments, or other predetermined criteria.

Managed float with intervention

Some countries adopt a managed floating exchange rate regime, where the exchange rate is allowed to fluctuate within a certain range or based on market forces. However, the central bank occasionally intervenes in the foreign exchange market to stabilize the exchange rate and prevent significant deviations from the desired level.

Risks

It’s important to note that while pegging a currency to the USD can offer benefits, it also comes with challenges. Pegged currencies may face difficulties in responding to domestic economic conditions, limiting the ability of the central bank to conduct independent monetary policy. Additionally, maintaining the peg requires careful management of foreign reserves and may expose the country to risks if the peg becomes unsustainable due to changing economic circumstances.

My solutions on MQL5 Market: Vladimir Toropov’s products for traders