Virtu’s Losing Day Was 1-In-1,238; Odds Say It Shouldn’t Have Happened at All

12:45 pm ET Nov 13, 2014

Virtu’s Losing Day Was 1-In-1,238; Odds Say It Shouldn’t Have Happened at All

- By BRADLEY HOPE

When the high-frequency trading firm Virtu Financial LLC published details about how the firm operated earlier this year, one fact stood out: The firm had only “one losing trading day” over 1,238 days of trading.

Virtu release the information as part of its regulatory filings to offer stock to the public.

Unfortunately for Virtu, the planned IPO also coincided with the publication of “Flash Boys,” Michael Lewis’s vehemently anti-high-frequency trading book. Amid swirling negativity around the industry, Virtu opted to postpone the IPO indefinitely in April.

However, the disclosure remained the subject of fascination to Greg Laughlin, a professor of astrophysics at the University of Santa Cruz.

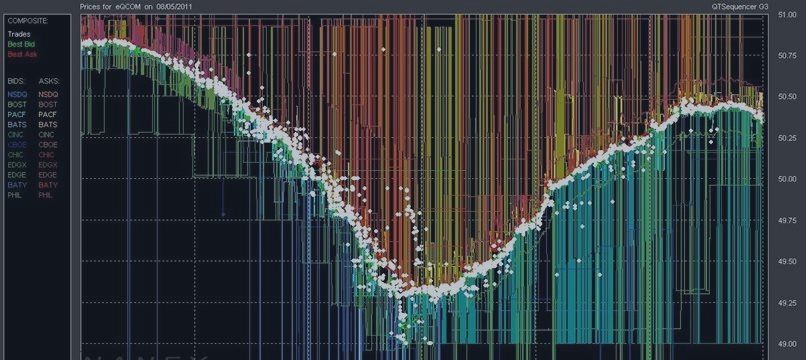

Using Virtu’s disclosure and data from Nasdaq, he recently completed a short academic study of how a firm like Virtu could be so consistently profitable. “The portrait drawn from the newly public data concerning Virtu’s operations is largely at odds with the currently popular viewpoint surrounding HFT,” he wrote. Here is a link to the study.

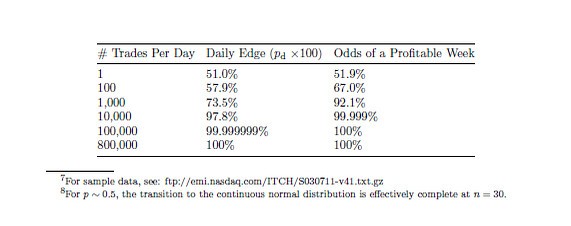

The takeaway: Considering that Virtu trades so often every day that it is nearly impossible for it to not make money so long as it retains its ability to win at least 51% of the trades.

In fact, the chance of not being profitable on a given day is so low that he concluded that Virtu’s one day of losses “resulted from either a technological or human-caused error.”

His explanation of how high-frequency traders are able to consistently earn money despite only being profitable on 51% or more of trades is one of the better ones out there.

Debate around how Virtu is able to retain that “edge” will likely revive next year when the company is expected to restart its IPO plans.