AUDUSD Intra-Day Fundamentals - 32 pips price movement by National Australia Bank Business Confidence

- past data is 5

- forecast data is n/a

- actual data is 4 according to the latest press release

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry.

It's a leading indicator of economic health - businesses react quickly

to market conditions, and changes in their sentiment can be an early

signal of future economic activity such as spending, hiring, and

investment

==========

Clearly the most surprising feature of the Survey was the sharp jump in business conditions in October (the largest monthly increase in the history of the survey). The improvement driven by sales and profits was relatively broad based –unlike the (short-lived) jump in July. While welcome we remain cautious re the sustainability of the improvement. For example it does not sit well with further falls in business confidence and only marginal improvement in capacity utilisation. While the falling AUD may have helped many sectors, it is probably also behind the large falls in the wholesale and transport/utilities sectors. The jump in conditions also saw employment improve somewhat – consistent with other labour market partials.

GDP forecasts up slightly: 2014/15 2.9% (was 2.8%) and 2015/16 3.2% (unchanged). Unemployment still to peak at around 6½% and no change in cash rate expected until tightening begins near the end of 2015.

In contrast, business confidence lost more ground in the month, reaching its lowest level since the pre election jump in mid 2013. The index dropped 1 points (to +4), with outcomes varying significantly across industries. Transport/utilities, mining and wholesale each report a negative confidence index (-13, -9 and -6 points respectively). Confidence fell the most in transport/utilities (down 18 points, despite recent weakness in oil prices), followed by manufacturing and wholesale (both down 3) – suggesting manufacturers are yet to see any offsetting lift in competitiveness as the AUD declines. All other industries improved in the month (surprisingly, mining rose the most). Looking through the monthly volatility, trend confidence was down 1 point (to +6), with construction highest (+11) and mining lowest (-15).

==========

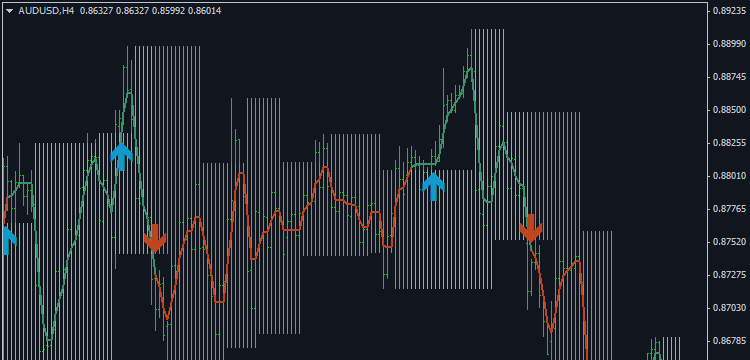

AUDUSD M5: 32 pips price movement by AUD - NAB Business Confidence news event

M5 chart