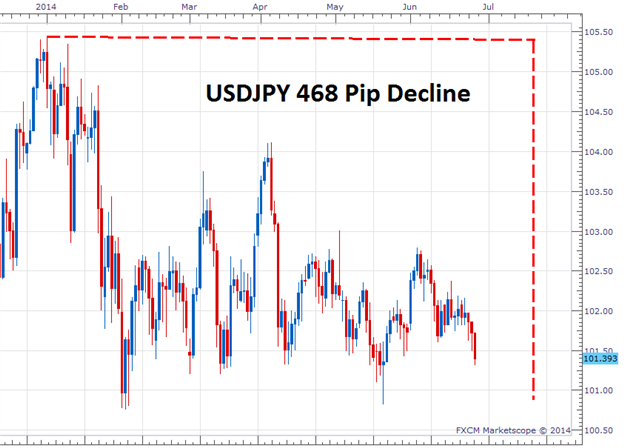

- The USDJPY has declined as much as 468 pips for 2014

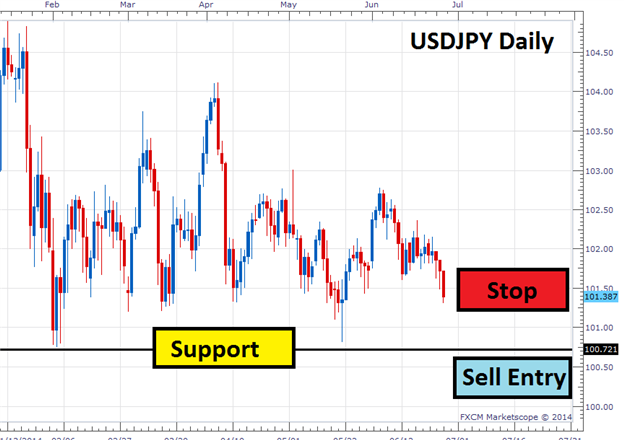

- In a Downtrend, breakout traders will sell as price moves under support

- Entry orders can be used for breakout entries

Today we will answer that question and more by looking for breakout trading opportunities with the trend. Let’s get started!

Trading Breakouts

After finding the current line of support in a downtrend, implementing a

breakout strategy takes just a few basic steps. Below, we can again see

the USDJPY daily chart, with the current line of support identified at

100.75. This point on the graph is currently acting like a pricing

floor. Breakout traders will wait for price to move through this area of

support, and create a new low before entering into the market. The idea

behind this strategy is to enter into the market on the creation of a

lower low, with the expectation of price continuing in the direction of

the primary trend.

One of the most prevalent ways of preparing for a price breakout is through the use of an entry order. An entry order can be set through the FXCM Trading station and allows you to trigger an order once the market has reached a designated price. In the event that price reaches the selected value, your order will be executed and your trade triggered into the market! This method of trading is very popular with traders, primarily because you don’t have to constantly monitor charts. Regardless if you are in front of your trading screen or not, your trade is scheduled to execute as soon as a breakout occurs!

Stops and Limits

While designing a breakout trade, traders should consider how to manage

their risk. This can be done through the placement of a pending stop

order in tandem with the previously discussed line of support. In the

event that price moves back above support, traders should consider the

possibility that a false breakout has occurred. Using this logic, stop

values can be placed above support to exit positions in anticipation of

the market turning.

Once a stop is set, traders can then manage their profit targets by using a positive risk: reward ratio of their choosing.