Risk is an important part to asses in all investing, know your risk before opening any position that way you can deal with any losses that may occur in this business.

I recently got asked the question, how much should one risk per trade in forex? This is a good question, my recommended answer is to keep your risk under 2%, that way even if you get a losing streak of three trades in a row you only draw down your account by 6%. For even safer trading or for learners of the Forex Market I recommend even keeping the risk level under 1%.

"The 1% Rule

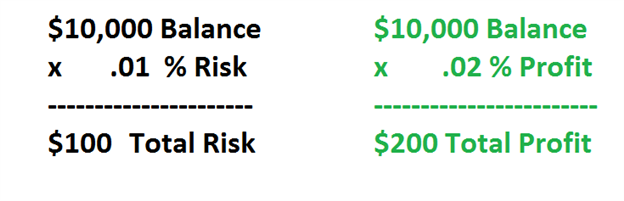

While no one wants to experience a loss on their account, it is an inevitable part of scalping. Because of this, it is always important to have a plan of action to manage risk before entering into a trade. While placing a stop is important, traders should also consider the 1% rule. This means that traders should never risk more than 1% of their account balance on any one trading idea. That means using the math above, if you are trading a $10,000 account you should never risk more than $100 on any one positions.

The 1% rule can also be coupled with a favorable risk reward ratio. Using a 1:2 setting, this means if we risk 1% in the event of a loss, at minimum we should look to close our trades out for a 2% profit. This would translate into a $200 profit on a $10,000 account balance. Now that you are familiar with the 1% rule, let’s look at our next risk management tip."

Walker England, Trading Instructor, The Definitive Guide to Scalping, Part8: Risk Management

===============