Meta COT Project - New Horizons for CFTC Report Analysis in MetaTrader 4

Introduction

The market prices movement doesn't caused by the subjective Elliott waves, Gann lines and Fibonacci levels or by technical indicators. Nothing of it does contain any new information bits compared to price chart of OHLCV format. The price movement is determined by fundamental law of supply and demand. No matter how trivial it may seems, but demand and supply determine the price.

The price is a result of buyers' and sellers' interaction. Many traders know about it, but just a few use it. The practical application of this comprehensive market law can be extremely useful for anyone who have ever taken a dare to predict future prices. This article is a kind of "conductor" from theoretical postulates of the economy to its application for trading on the futures and commodity markets.

The economic theory states about the possibility of the existence of the "overbought" and "oversold" phases of the market. These phases are critical to the market. A further upward price movement in "overbought" zone is becoming more difficult because of increasing competition of the supply. Further downward price movement in the "oversold" zone is also becoming increasingly difficult, but because of the increasing pressure of demand. In both cases, the market is close to its long-term reversal. These statements may seem simple and so useless, because of the fact that economic theory has not proposed any methods to determine these market phases. However, these methods exist and, as it often happens, were developed a long time ago by successful traders.

This article is a bridge between the theory and practice, it introduces the reader with the methods of the market phase determination, based on simple indicators, described in the book "Trade Stocks and Commodities With the Insiders: Secrets of the COT Report", written by the famous trader Larry Williams. Nevertheless, the book did not become very popular, and the material didn't become widely used. One of the main reasons for this fact is that all the concepts presented in the book, have remained theoretical.

After more than two years since the Russian translation of the book, there hasn't been proposed any universal, useful, and opened software for the conception use in MetaTrader4, the most popular trading platform in Russia. This article fills this gap. Now anyone can test and use the Larry Williams' theory in practice using their own MetaTrader 4 client terminal.

The method of the current market analysis using the Commitments of Traders Report can be considered as a fundamental analysis. The fundamental analysis itself hasn't found a wide application for the traders. It's no secret that most of traders uses technical analysis for the real trading. This is due to the fact that fundamental analysis is often connected with the economic news release, and its impossible to predict the market reaction on the news.

Secondly, this analysis is non-parameterized, and thus it's very subjective.

The third, the fundamental analysis is potentially endless. It means that you

can analyze just a certain part of the economic effects that can

affect the market, and the other part is always not considered by the trader, but it will be considered by the market. The use of the CFTC

reports automatically eliminates all the weaknesses of the fundamental

analysis, and Larry

Williams's method for these reports analysis gives the best features of technical

analysis to the technology. This means that firstly, all the significant economic effects

can be considered indirectly through observing the actions of three groups of

market participants.

Secondly, all these observations can be reduced to the simple technical indicators, with reducing the subjectivity and ambiguity.

It is possible to create an Expert Advisor that uses the simple fundamental analysis rules for trading. One of such developments is presented here. I think that it can be useful for anyone, who will decide to use the CFTC report for a trading.

The first part of the article is about the economic theory of supply and demand. Using simple examples, the market model is described, the possible existence of the different market phases is proved. The second part is about data analysis methods, which are necessary to determine the current market phase. It includes the descriptions of a set of indicators needed to analyze the interaction of buyers and sellers. It's mostly based on Larry Williams's book, in which the practical use of these indicators has been shown in details. The third part is about the technical implementation of the Meta COT Project. It contains detailed information about the Expert Advisor use, the use of indicators and scripts that are included in the project and how to download necessary information. The fourth part is the final. We will examine the Expert Advisor and the effectiveness of the concept presented in the article. The final conclusions are presented, and some constructive suggestions are proposed.

1. The Market as a Balancing Function of Prices

1.1 The law of supply and demand

Market is an institution or mechanism, that brings together buyers

("demand") and sellers ("suppliers") of particular goods, services or resources. [3]

There is no more precise definition

of the market, than that given above. In fact, the main task of any

open market is bringing together sellers and buyers. The relationship between the buyers and sellers are regulated by

the law of supply and demand. This fundamental law makes stock

prices rise or fall, which in turn allows traders to profit or loss

from the price difference between the future and the present prices. Trader should know the mechanism of the balance changing between the supply and demand, so let's consider the following table [3]:

|

Total supply |

Price per bushel (U.S.) |

Total demand per week |

Surplus (+) or shortage (-) |

|---|---|---|---|

12 000 | 5 | 2 000 | +10 000 |

10 000 | 4 | 4 000 | +6 000 |

7 000 | 3 | 7 000 | 0 |

4 000 | 2 | 11 000 | -7 000 |

1 000 | 1 | 16 000 | -15 000 |

Table 1-1. The Market supply and demand of corn (in thousands of bushels)

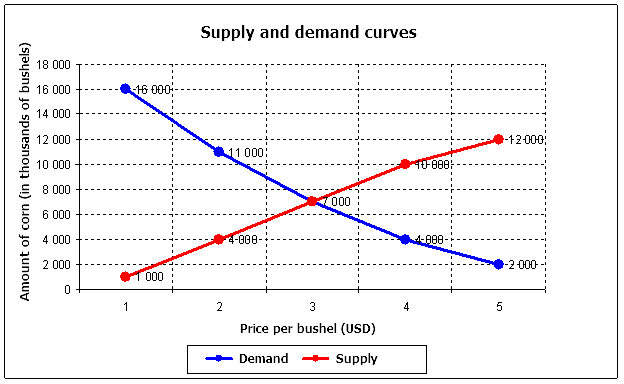

Here is the connection between corn sellers and buyers, expressed in terms of its price and delivery volume. Sellers wish to sell their goods as expensive as possible, and buyers wish to buy it as cheap as possible. In this case, at corn cost of $ 5 per bushel, there are many sellers who would like to sell it. Their total supply will be 12 000 bushels. But the seller's problem is that there aren't so many buyers who are ready to buy it at such a high price. There are buyers who are ready to buy only 2 000 bushels at such a high price. The other 10 000 bushels (12 000 - 2 000 = 10 000) remain unfulfilled, causing goods surplus from sellers, and goods shortage from buyers. This price is unable to stay on the market. Many sellers will cut their prices just to get rid of goods surplus and get even smaller, but live money. They will join other sellers who wish to pre-empt his fellow competitors. The competition among sellers will begin, which will decrease prices [3].

Now let's consider the opposite case. At this time we assume that the corn price is very low - $ 1 per bushel. Such corn price will be very attractive for buyers, there are many buyers who wish to buy it. Their total demand is 16 000 bushels. But there would be much less sellers who want to sell at that price. The total supply (sales) amount is just 1 000 bushels, which again will cause goods shortage among the buyers in the amount of 15 000 bushels, and surpluses from sellers. Again, this price is not able to stay on the market. Some of the buyers will buy the corn at a higher price, to get the goods they need. These buyers will join their colleagues and anticipate further growth of the prices and want to be among the first who bought it relatively cheap. The competition among buyers will begin, which will increase the price [3].

To make it clear let's draw the functions of demand and supply on the graph:

Figure 1-2. Demand and Supply as function of the price

We

have considered only the extreme distribution cases between

the demand and supply. In the first case, the price will fall, in the

second case, the price will rise. Both of these cases will be to the certain equilibrium point in which demand will equal supply. At this point

there will be no shortage of goods among buyers, or its surplus from sellers. In our table such point is located at 3 dollars. At

that price, the total supply, as well as total demand will be 7 000

bushels, at this price there will be the equilibrium exchange between the buyers

and sellers with no unsold goods left or no deficit appeared.

In a real life, the supply and demand are changing under the influence of many factors, ranging from the fundamental reasons to random events. In any case, there will be the only one cross point of supply and demand. This point will be the current market price.

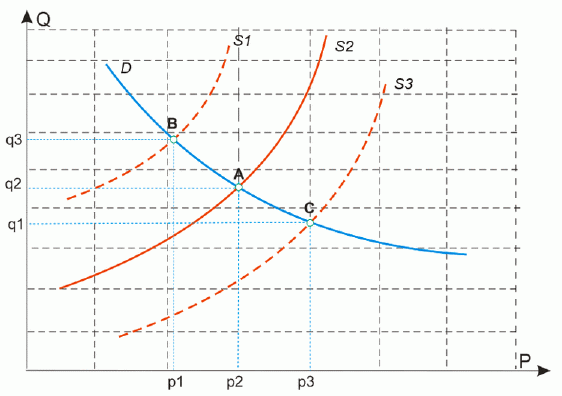

Consider an example when the supply will increase at a constant demand (point A-B on the Figure 1-3, a). In this case the price will fall (p1<p2), since the goods will become cheaper and the competition among the sellers will begin. On the other hand, the amount of buyers who want to buy goods at a better price will be more (q3>q2).

Now consider the case when the supply decreases (point A to C at Figure 1-3a). This will cause the higher prices, because there will be less goods and the competition among buyers will begin (p3>p2). Certainly the buyers who want to buy at the higher prices will become less.

Figure 1-3a. Supply change at a constant demand

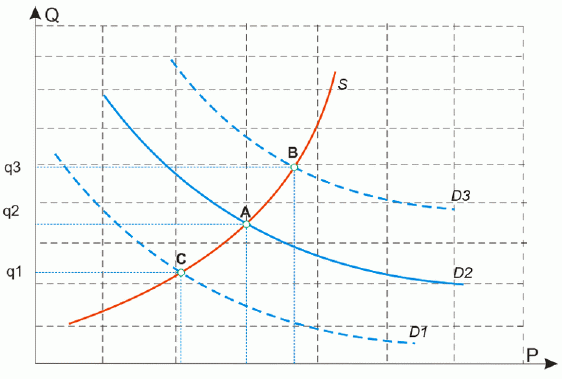

The same is true for the demand - when it increases (points A and B at Figure 1-3b), the price starts to rise, and it will be many who want to sell at a higher price, which would result into increased total supply (q3>q2). In the opposite case, when demand begins to fall, the price will fall, sellers wonting to sell at a low price will be less, and thus, the cumulative number of supply will decrease (q1<q2).

Figure 1-3b. Demand change at a constant supply

Now

let's consider the case where the demand and supply are changing

simultaneously. Is clear that there are only four such cases [3]:

1. The demand decreases, the supply increases. Each of these factors separately leads to the lower prices and, consequently, the total price decline will be even greater than that caused by each of the factors separately.

2. The demand increases, the supply increases. These factors are mutually compensating, since the demand growth leads to the price increase, and the supply growth leads to the price decrease. Generally, the price movement will depend on the stronger factor.

3. The demand decreases, the supply decreases. Just as in the previous case, the result is uncertain. With the demand decrease the price will decline, while the supply decrease leads to the price increase. Generally, the price movement will depend on the stronger factor.

4. The demand increases, the supply decreases. The demand increase leads to the price increase, exactly as the supply decrease leads to the price increase. As a result, the total price increase will be even greater than that caused by each of the factors separately.

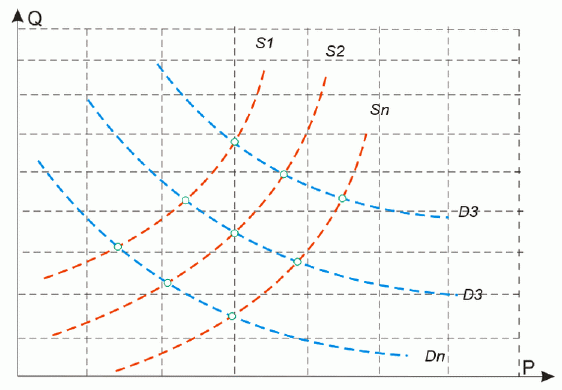

On the real market the supply and demand are changing every second, and all these four cases are reflected in the actual market price of the value. Thus, the cross point of supply and demand "walks" on the chart of prices and volume, at different time periods, being in different locations (see Figure 1-4):

Figure 1-4. The dynamics of demand and supply

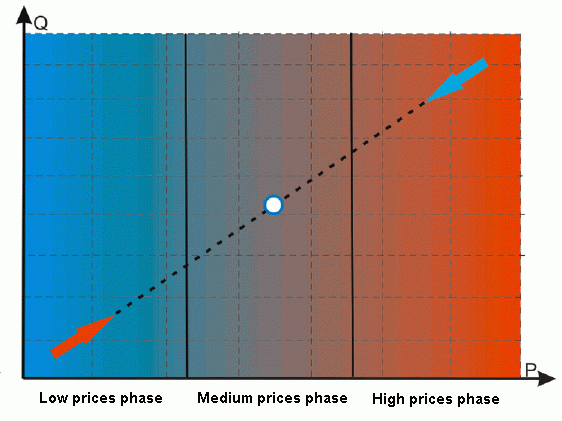

Figure 1-5. The Market Phases

As it has been stated above, the suppliers will refuse to provide a large volume at low prices (to sell a lot and cheap), and the buyers will refuse to provide a high demand at high prices (to buy a lot and expensive). Therefore, it is possible to construct a model of any market. The Figure 1.5 shows a model. The dotted line shows the average cross of the supply and demand. The full market cycle can be divided into three periods or phases:

1. The Low Prices Phase. It is characterized by low volumes at low

price. The real, but unrealized market demand from buyers will be

high, while the market supply will be limited. There is a

goods shortage among the buyers and unrealized goods surplus from

the sellers. It will cause the buyers competition, which will lead ultimately to the price increase.

2. The Average Prices Phase. In this phase there are acceptable prices at sufficiently high volumes. There is no shortage of buyers for both and there is no surplus from the sellers. Here is the equilibrium point for the price and volume [3]. In Figure 1.5 it is presented by dot.

3. The High Prices Phase. It is characterized by high prices (P) with high volumes (Q). The actual supply from the producers of goods will be high, while the buyers demand will be limited. The buyers' reluctance to buy expensive goods and producers' desire to sell expensive goods will cause the producers' competition, which will lead ultimately to the price decrease.

In other words, the law of supply and demand determines the return-and-trending market movement. In the medium term (its time scale is about 1-1,5 years approximately) the market will go from the low prices phase to the high prices phase, or vice versa, so there will be a trend. In the long term (from one year or more) the market will go to the high or low prices phase, meeting with buyers' or sellers' resistance, and under their action will turn backwards, so it will be the flat. The market movement can be compared with the breathing. After a full exhalation it is very difficult to find even just a little air in the lungs, to continue exhalation.

Contrary, the pressure between the diaphragm and lungs is becoming less than atmospheric, and air come to the lungs easy. After the full breath the volume of lungs is completely used and there is no possibility to inhale it still at least a little. At this time the pressure between a diaphragm and lungs becomes more than atmospheric, superfluous pressure tries to push out air from the lungs. This process repeats again and again. The similar processes occurs in the market. The arising buyers' competition (the negative pressure) forces the market to increase prices (to inhale air) while the sellers' competition (the positive pressure) forces the market to decrease prices (to exhale air).

As we have seen above, the goods shortage and oversupply situations are possible at the market. But it is also true that the equal quantity is bought and sold every time on the market. Therefore, the conclusions of some technical analysts that the market is dominated by the bulls, when they see an uptrend or bear when they see a downward trend, are incorrect. The market always has an equal number of bulls (buyers) and bears (sellers) contracts. But, at low prices, there is a limited quantity of goods for sale on the market. The majority of goods owners wait out such periods.

In the other words, if it is wheat, it stays in the storehouse and stays in the bank if it is a currency. Thus, buyers are unable to buy goods in the

quantities they want. Using the standard

terminology this situation can be called as "overbought". The opposite case, where

the prices are high and all of the goods surplus from the sellers are on the

market, may be called as "oversold". Further we will mean it for the overbought and oversold cases.

1.2 The price is the first variable for the demand and supply equation

To illustrate the examples of low and high prices, let's consider the weekly sugar bars:

Figure 1-6. Sugar, weekly bars

We know that at relatively low prices there will be little who want to sell, and thus the goods volume presented on the market is also relatively small. Contrary, at the high market prices the goods volume will be more. The price itself can tell us about the possibility of the oversupply or shortage of goods. However, this assumption is often rude and estimated. Although the goods price and volume are correlated between themselves, there is no direct linear relationship between them.

At relatively high prices there can be a relatively small volume of goods, while at the same time at relatively high volumes there may be relatively cheap prices. This is due to the fact that the functions of supply and demand are rarely linear, almost always they are subject to both price elasticity of demand and price elasticity of supply [5]. The second problem determining the volumes of the market using the prices is the "relativity" of such an approach. How can we determine, what prices are high, and what prices are low?

We know that the market is not counter-trended in the long term, so why not to create an indicator of overbought and oversold states of the market, and using it start to open short positions first, when the market reaches the high prices and to open long positions, when prices are low? The profit must be obtained with a simultaneous use of all of the market properties - when it is trended and when it is counter-trended.

Many technical indicators have been developed during last fifty years, that attempt to determine overbought and

oversold market states. But all of them have one serious problem - the are based on only one variable of the demand and supply, and this variable is price. The change of the price is the

last thing that happens on the market after the change of supply and demand balance.

Consequently, at best, a trader using any indicator, based on the

price or the price itself, will be the last to keep up with the

changing price, but will never be able to preempt it. The simple computer

tests shows the inconsistency of this approach.

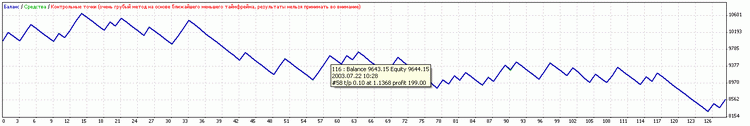

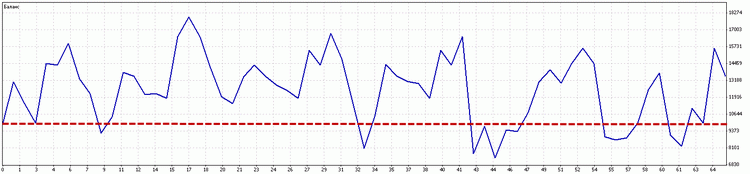

Here is a profit chart of the elementary system based on the RSI indicator:

Figure 1-7. The profit dynamics of the Expert Advisor, based on RSI indicator. EURUSD, daily bars, from 2000 to 2009.

The system is elementary. If 7-period RSI reaches 80 percents, it opens a sell deal. If the RSI reaches 20%, then it opens the buy deal.The custom period has chosen to open more deals. The stop is 100 points, and the exist from the trade condition is the profit of 200 points. Testing performed on EURUSD, from 2000 to 2009, the daily bars has used. The trading lot for all of the deals was constant and equal to 0.1.

The conclusions are unambiguous: using the price data only it is not enough to

determine the phase of the market. We need a second variable of the

equation of supply and demand - the market volume.

1.3 The Open Interest is the second variable of the demand and supply equation

It is surprising that for many markets, there is an opportunity to know their volume up to one contract, analyzing the open interest values.

The Open Interest is the number of contracts of the futures and/or options market and uncompensated by deals, delivery, etc. The Open Interest is the sum of all long or short positions [1]. For example, if the sum of all long positions in the market is equal to 1000 contracts, it means that the sum of all short positions in the same market, too, is equal to 1000 contracts and open interest of 1,000 contracts are the same. The formula for the open interest is presented below:

![]()

The buyer and the seller of one futures contract for the wheat will add one unit to the Open Interest value.

It is important to understand the difference between the Open Interest and the market volume. For example during a day 1 000 000 contracts can be traded, but it does not mean that there are goods for 1 000 000 contracts. It may be much smaller, just during the day they passed from hand to hand, increasing the daily volume. At the end of the day, not all of the positions are closed, many of them are rollovered to the next day. The number of open contracts is the Open Interest Indicator. The producers of goods are looking to hedge their risks by buying long futures, thus they give a commitment of the actual delivery of goods. It is reflected in the Open Interest values. Thus, in some sense, the Open Interest could be a measure of the volume of goods on the market.

The Open Interest is calculated daily at the end of each session in all futures markets. This information is open and it is usually available on the official websites of the futures exchanges. The same data on Open Interest can be obtained by subscribing to the paid signals like e-Signal. For the MetaTrader users, the Open Interest data for more than 40 markets can be obtained using the indicator «Meta COT: Net Position», which is part of Meta COT. project presented here. For more information on its using see the third part of the article.

Unfortunately, the information on Open Interest (as well as for all other types of data described in this article) is not available on the spot and stock markets, because of their structure and properties. However, due to the strong correlation between the spot and the futures markets, it becomes possible to trade on the spot, guided by the dynamics of supply and demand on the same futures market. For example, you can analyze the Open Interest dynamics for the EURO futures, but trading on the spot EURUSD. However, for a more accurate representation we will use the futures chart only.

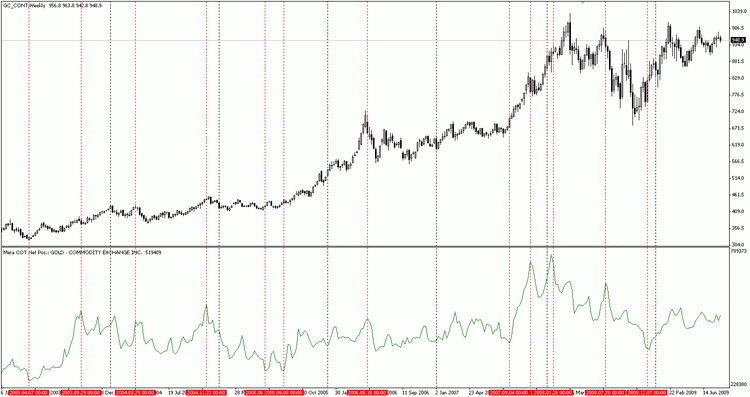

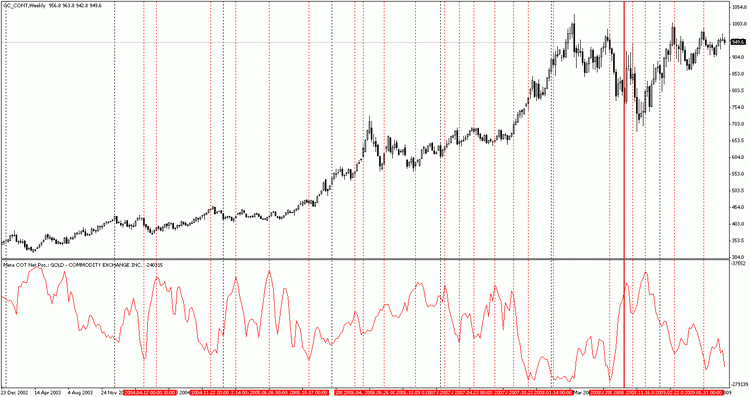

Now let's look at the of Open Interest dynamics for Gold over a long time period:

Figure 1-8. Gold, weekly chart

In Figure 1-8 we see the Price chart (upper) and the Open Interest (lower) chart for the futures of Gold from 2003 to 2009. One can see that when the Open Interest values were relatively high as compared with its previous values, the market started to go downward. At the same time, when the Open Interest values were low, the market started to go upward. It isn't seen well on a weekly chart because of the long time period, including a recent high volatility.

What is true for the gold, it is true for any other commodity, the law of supply and demand works on any market:

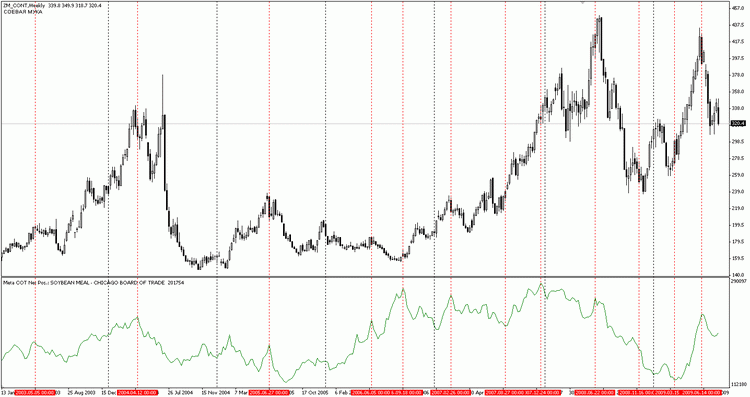

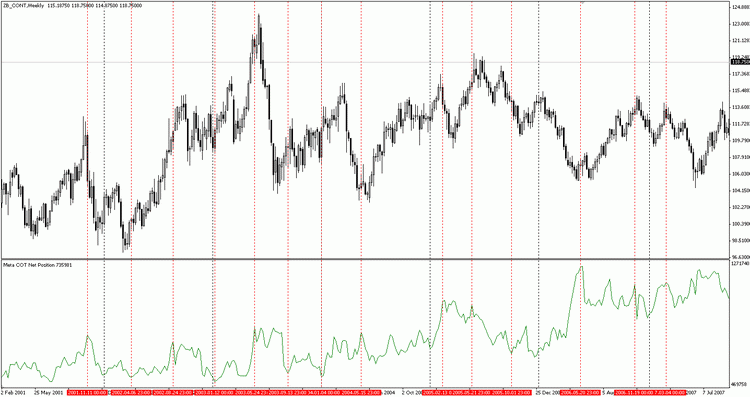

Figure 1-9. Soybean, weekly chart

Figure 1-10. US Treasury bonds, weekly chart

As you can see, relatively low values of the Open Interest indicate the potential for the market growth, while relatively high Open Interest values indicate the potential for the prices decline. The market does not always reverse when Open Interest has minimal or maximal values, and the extremal values of Open Interest don't point to an immediate market reversal. The Open Interest is not a magic market "switcher", but it allows to measure the second dimension - the market volume, and estimate the current phase of the market.

Here is the first rule, that can be formulated from the law of supply and demand:

When Open Interest has extremely high levels, try to open short positions.

When Open Interest has extremely low levels, try to open long positions.

2. The Market Structure

We have found that the market - is an institution or mechanism, that brings together buyers and sellers of certain goods and services. Now it is time to consider these groups in details.

2.1 Hedgers and speculators are parts of the market structure.

So, the market always finds the cross point of supply and demand. This point is the consensus price of the goods, i.e., the price at which sellers are ready to sell a certain volume of goods and buyers are ready to buy this volume of goods. Every time the demand and supply is changing under the influence of the fundamental, political, random, and other factors. Based on the law of supply and demand, the price of goods is also changing. Consequently, there is some probability that the future price will be either more or less than the current one. Once the price may change over the time, the price has uncertainty in the future. Such price uncertainty about the price in the future is called a risk [6].

Thus, any owner of goods holds the risk of the adverse price changes in the future. However, the price change may be upward and downward. If the price changes downward it would mean the losses from the sale at a lower price in the future compared to the current market price. Contrary the increase in commodity prices should give the owner an additional profit. Typically the principal owners of goods are their producers.

If the product is wheat, its owner may be the General Mills company, and if it is gold

- its owner can be Barrick Gold Corp, etc. While the high risk of the price changes is high, and the main income of these companies is obtained from the

difference between the cost of their products and the price of its sale, they are interested in reducing the risk that arises in

consequence of the goods owning. To do this, the manufacturers use

hedging operations in commodity and financial markets. In fact,

manufacturers sell their risk to others who want to buy it. As addition to the risk, its buyers have an opportunity to get an additional profit (risk premium) in case of the favorable price changes.

Thus, the exchange is not only a centralized market place. Exchange is also a centralized place for buying and selling risk and premiums for it.

The buyers of goods and the risks attendant to them are called speculators. The main objective of a speculator is to get a profit from the difference between the current and future prices. Speculators are like a "glue" between the manufacturer of the product and its end consumer. They provide a high market liquidity, with a smooth change of the price [4].

The hedging operations are not so much the reduction of risk to zero, it is a way to find the reasonable balance between risk and profit. As you can see further, competent hedging allows the use of an opportunity for speculation. By monitoring hedged positions dynamics it is possible to join the investment group of large manufacturing companies, who know almost everything about the market they work in.

In fact, this viewpoint is not devoid of meaning. These companies are direct goods suppliers, which are traded on the exchange. Who, if not the manufacturer, must know everything that happens in this field of the business? These guys have information hidden from the party eyes and ears, they know that nobody else knows. Or how to explain the fact that for a many decades, they remain successful players on the exchange, performing many millions of dollars daily transactions!

The monitoring

of speculators is also not devoid of meaning. The speculators' buying levels indicates the moments when the market is "overheated", i.e.

it has the third phase, or vice versa, the moments when is it cold (first phase) (see Part

1). In the end, the speculators usually are the main buyers of

the goods, which means that when they built up their long positions to

the maximum, and they no longer have the possibility to buy, the market reverses to downward direction.

2.2 Commodity Futures Trading Commission Reports analysis

Anyone has an opportunity to observe the positions of hedgers and speculators, thanks to the American Government Organization called "Commodity Futures Trading Commission"- CFTC. The fact is that any private or legal person shall submit a report on their committed deals in commodity exchanges, if the volume of these transactions amounts to or exceeds the level specified by the Commission. Once a week the commission reports on the combined positions of traders.

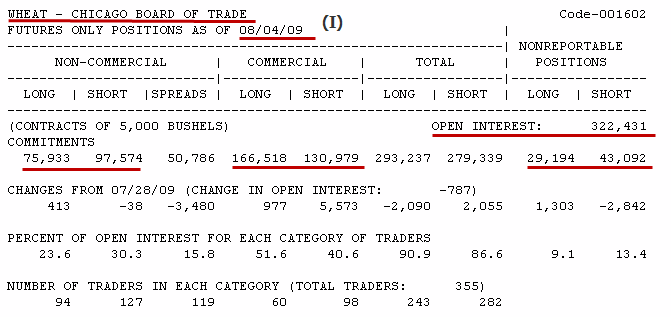

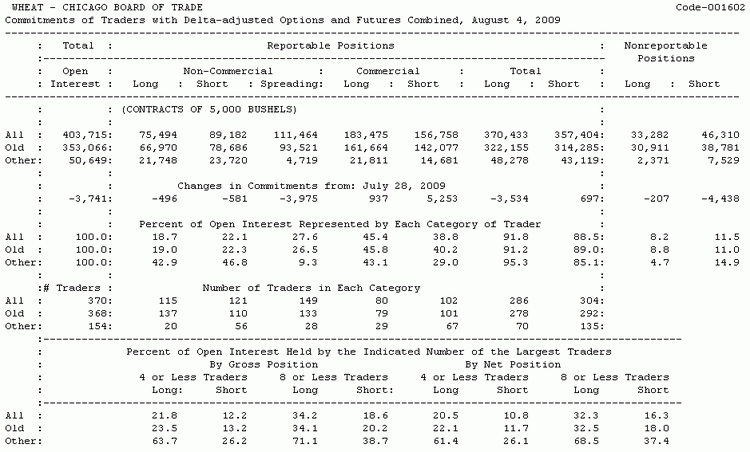

Each report is published on the official website: www.cftc.gov. The report is generated for every Tuesday state and is published on Friday late night, Moscow time. The report itself is presented in several forms: Excel table, CSV text file format, as well as a simple tabular text. Also you can download the history records for a long time period in the Excel and CSV formats. Reports are prepared for both futures deals and futures and option deals. The reports have a brief and extended form. The extended form differs from the brief by existence of the additional statistics and data on crop yields for some crops. In practice, the Excel or CSV files used for the CFTC report analysis. Now let's look at a brief report on wheat for August 4, 2009:

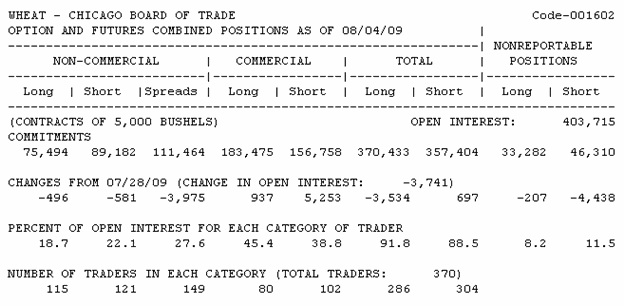

Table 2-1. The wheat report of 04.08.2009 (futures only)

At the top of the report there is a product name, in this case, it is the wheat traded on the Chicago Board of Trade, the type of report - futures only positions, and the date - August 4, 2009. The matrix consists of four main columns. Each of them represents the combined short and long positions of each of the three groups of traders. The first group of traders includes major speculators. The reports are called non-commercial traders (NON-COMMERCIAL). We can see that on 4 August 2009 the big speculators had 75 933 contracts, while on the short side there were 97 574 contracts. This indicates that their total or net position was short and it was -21 641 contracts. Usually, it is not a typical situation for speculators.

In the most, but not all markets they are pure buyers, that is, their long position is always higher than short. Using only one report for analysis it is impossible to determine whether this situation is typical in this market or not. In any case, you must remember that the most important parameter here is the Net position of the group, but not long or short position separately. This net position is used when calculating the majority of indicators of the traders reports analysis. So, once again: the total or net position is equal to the difference between long and short positions, it can be both positive and negative, that's its formula:

![]()

where NetPosition is a pure or total net position of the traders, i is the category of traders, such as major non-commercial traders or large commercial traders.

The next is the number of major contracts for non-commercial traders which are in the so-called spreads, or coverage.

The Larry Williams writes about it the following: "If a non-commercial trader holds futures contracts on the euro/dollar 2 000 long contracts and 1 500 short contracts, 500 contracts will be included in the "Long" category and 1 500 contracts are "Coverage" [1]. Simply, the coverage shows the number of both long and short contracts.

It is important to note that we do not mean the locking. For example traders can keep one and the same commodity opposed positions in futures contracts for different months of delivery, or have opposed positions on the same commodity in futures and options. In the report, which includes positions on options, such cases are taken into account.

The second group reflects the hedger's positions. They are also called the operators or commercial traders (COMMERCIAL). Typically, but not always, the operators are pure sellers, because most of them are producers of commodities like wheat, gold, or pigs. Commercial traders are also other manufactures who use goods as a base for their products, for example, candy floss or a bread. Typically, but not always, they are sellers, i.e., their contracts are on the short side.

Generally, when prices are dropped to a low level, operators are reducing their sales to minimum, because it is not profitable to sell their goods cheaply. At the same time, operators who are producing their own products, on the contrary, increase their long position. Thus, the net position of operators can be long, and indicators based on the net position of operators will be located in the upper zone.

Let's consider the specific case using the example of our report on wheat. The long side of the operators has 166 518 contracts, while the short side has 130 979 contracts. Their net position is 35 539 contracts, i.e. it is long. Often, this means that the price of goods is at the low level, because operators are selling less than buying. In any case, to determine the exact situation it is necessary to use a chart of their net position for a long time period.

The «Total» column contains a set of long and short positions for the combined commercial and non-commercial traders. It is of no practical interest.

The «Nonreportable Positions» column contains a number of long and short positions of unaccountable traders. In fact, this column reflects the small speculators' position, whose positions are too small to get into the speculators' group. These positions are calculated by synthetic calculation - from the value of open interest (OI) the total long and total short positions of reported traders are subtracted. In our case, the OI is 322 431 contracts, while the long is 279 239 contracts, this means that 29 194 contracts are long side of unaccountable persons (322 431 - 279 239). The same calculation can be performed to the short side: 322 431 - 279 339 = 43 092 contracts.

Here are changes in the number of contracts for each group compared with the previous report. Following is the share of each category in the open interest, and at the bottom of the number of traders in each category. These data are not used in practice.

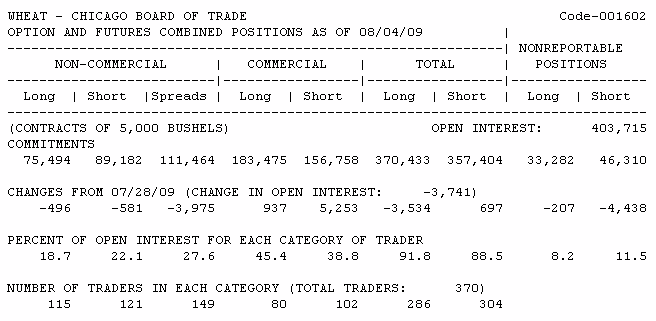

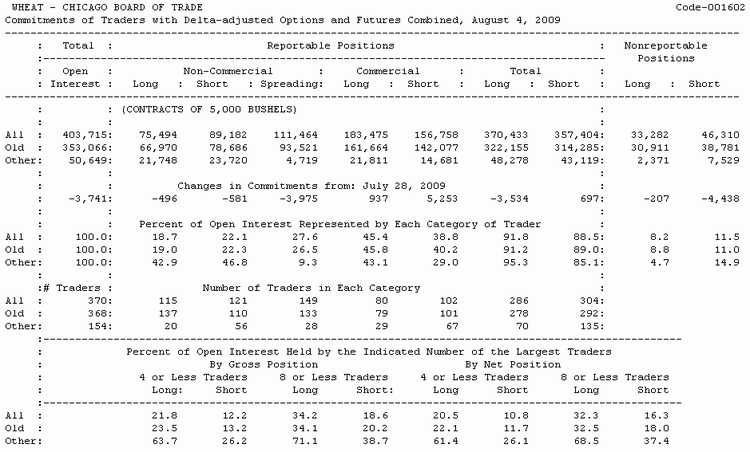

In addition to the report, as it was mentioned above, there are reports that include the Options position. All options positions are converted into futures equivalent and added directly to the futures positions. The same report on wheat, but option and futures combined positions looks as follows:

Table 2-2. The brief wheat report of 04.08.2009, futures and options

Despite of the different numbers, both types of reports will give similar charts of the position changes dynamics. Nevertheless, it's more preferable to use reports that include information on options positions, as they consider a more complete volume of the market. Take a look at the increased value of the "Spreads" column. Now values in this row are dominated by comparison with the long and short positions for non-commercial traders. This is due to the fact that commercial traders mostly use options to cover their futures positions.

Now let's examine an extended form of the report which includes positions of futures and options on the same wheat:

Figure 2-3. The full wheat futures and options report of 04.08.2009

As you can see, the report includes additional statistics on old positions for each of the three groups of traders. Since all of these reports are analyzed in the dynamics over a long time period, this information is of no interest.

2.3 Observing large hedgers' positions

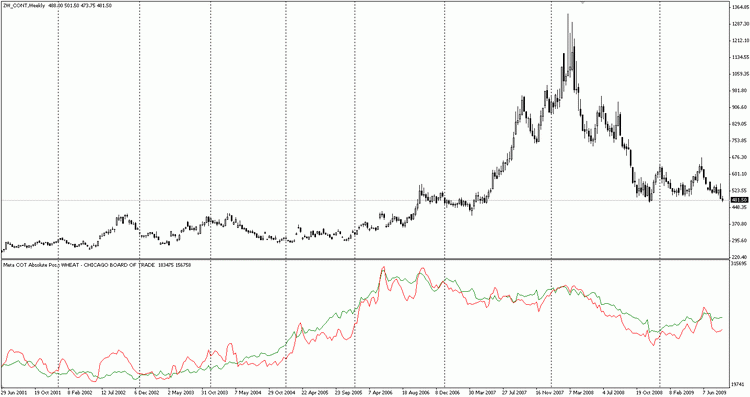

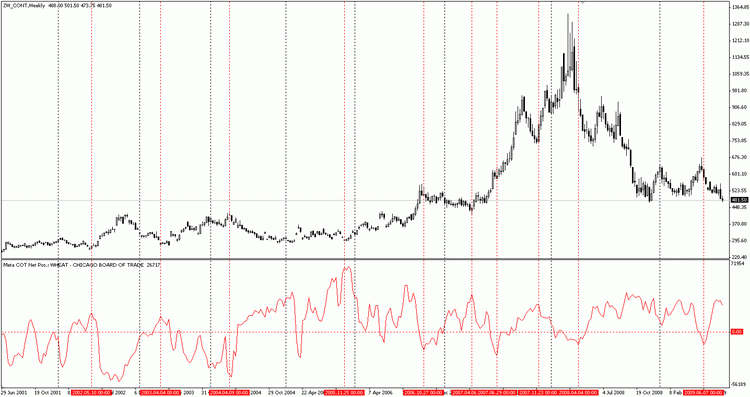

So, it is time to compile statistics on buys and sales of hedgers and monitor their actions for a long time period. For example, we will use the wheat price chart already presented, with the indicator showing the long and short positions of operators. The chart consists of weekly bars and covers the period from the middle of 2001 to the middle of 2009:

Figure 2-4. Wheat, long an short positions of operators, weekly bars

The green line here shows a long position of operators, the red corresponds to the short positions of operators. All positions are specified in absolute terms, they don't have a sign. It is necessary to assume that the red line represents the absolute amount of short positions, and green - the absolute amount of long positions. In general, short positions of operators dominated until the spring of 2004 (red line above the green), after which the operators had more buys than sells (the green line above the red). Such a chart does not show key break points. Now let's take a look at this same chart, but with an indicator of operators' total net position:

Figure 2-5. Total net positions for the operators, weekly bars

Here you can see more interesting moments. Note that when the net position of operators was relatively high, after some time the market went upward. At the same time, when the net position of operators was relatively low, after some time the market went downward. Of course, not all of the indicator predictions come true, but even if it happened to enter at least one correct point, it would be a huge profit.

Let's pay attention to the extremely high net position of operators in the end of 2005! Never before or after, the operators had such high values of the net position. And now take a look at what happened to the market thereafter. It began the inexorable upward movement, which continued more than 2 years. As a result, the price increased by more than 700 (!) USD. There were some other moments, showing us a good opportunity for speculation.

For example, after a strong price fall at the end of 2007, many might think that the bull trend would finish. Apparently,

the operators didn't think so. While others tried to reduce their long positions (we know it from the traders reports), the operators bought up the market! The rise was soon. A maximal price has been updated, and then the panic has began. During these four months, prices increased by another $400! The sale signals

given by the operators were not so convincing. Nevertheless, in many cases, the trader was able to escape the market safe if he used a simple trailing stop techniques. In any

case, all of the losses could be compensated by one good deal.

The key words here are "shortly thereafter". Do not forget that this

indicator is not calculated by using the price. It is completely independent from

it. We could remove the price chart, but the indicator of net positions

of operators will still be showing the same values. Price is the recent

market changes. The first to change is the balance of supply and

demand forces, and even before that the minds of major market

participants change. Observing that the operators are doing, we are witnessing

the evolution of the market at its early stage, when the price changes

hasn't appeared yet. It gives us a unique advantage to take place in

another half-empty trailer of the future locomotive trend. When the movement begins, many will come too late there, but not the traders using

the commission reports!

Let's observe gold and silver through the prism of operators:

Figure 2-6. The gold and the net position of the operators. Weekly bars

The chart of gold prices is full of favorable opportunities for speculation. Not all of them lead to excess profits, but many of them could bring a substantial income. If a trader correlated his entry points with the main bullish trend that continued for many years, he could be a very big winner. Let me remind you, we are considering the moments when the net position of operators is high enough, these points are potential points for buying. The same applies to sales: we're looking for relatively low levels of net position and trying to short, looking for an opportune moment to sale.

Note the madness that went to gold at the end of 2008. After the strong fall ended in early September, it began an unexpected rise. In fact, during one day the gold price has increased by 90 dollars! Then it was at a high price till the end of September, but it was not very long. Shortly after this there was a new fall, and in the end of October, the gold updated its year's minimum.

Could we predict that shaking at least partially? Yes we could predict it by using the reports on traders positions. Pay attention that not long before the bull Friday (it was the day when the gold's price "suddenly" has increased by $90), operators have stopped to sell the gold.

They are the producers in this market, and all these

years there was not a single week, when the purchase would exceed

the sale. In fact, their refusal of sales brought the panic among

the gold bulls. There was a shortage of metal that moved the prices up.

Although the prices didn't stay on such Olympus for a long time, operators sold some of their metal to gold bulls, who where the last to respond to the price peak. Further the gold price fall has began, after which operators reduced their gold

sales to the four-year minimum (their net position increased (see

chart)). Further we saw the effect of the sellers' competition. The shortage commodity began to rise in price, and this could be a good idea to make money.

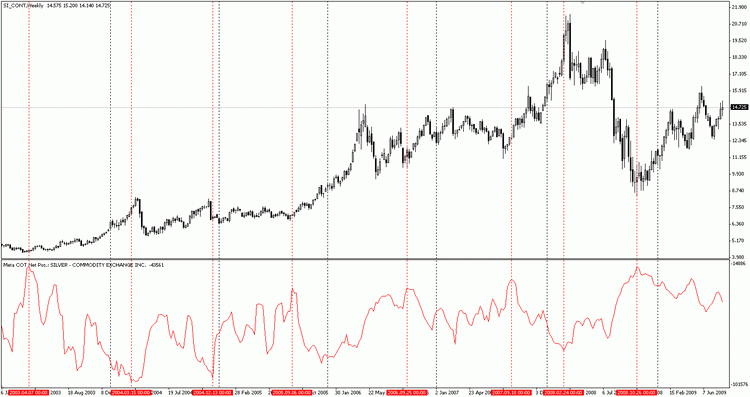

Now let's turn to the chart of silver:

Figure 2-7. The silver and the net position of the operators. Weekly bars

And again we see here the same as for the gold. Whenever the net position reached a relative maximum, the silver price made a new leap to the sun. The relatively low levels were indicating the recession in the uptrend of silver.

The conclusion is the following. The markets of precious metals are largely controlled by a small group of professionals. And any trader who wishes to trade profitably on these markets should take into account the influence of these forces.

2.4 Index of a net position

But how do we know what is the "relatively" high net position, and what is low? As noted by Larry Williams, the floor for one is the ceiling for another. Therefore it is necessary to use the normalized indicator, which would clearly state about the phases of our position. Such an indicator exists, it is called the COT Index. The index is a usual Stochastics calculated for the values of our positions.

Lets recall it's formula [1]:

The current price is compared to the maximal price for three years. The index can be calculated for any time period, not just for three years. It's better to use a period of not less than 26 weeks, i.e. half-year index. In the longer-term deals a 156-week(three-year) index is used. The index shows the relative current strength in percentages, compared with the selected period.

Here is an example of the index calculation for the operators listed below, the digits on the right side indicate the number of contracts [1]:

Current week value | 350 |

Minimal value of last 3 years | -150 |

Difference | 200 |

The maximal value of 3 last years | 750 |

The minimal value of 3 last years | -150 |

Difference | 600 |

Index = (200/600)x100=0,33x100=33%;

In this case the operators are bearish rather than bullish. If the index reaches extremely low levels, i.e. located in the bottom 20% range, the market tends to fall. If the index reaches extremely high levels, i.e. located in the upper 80% range, the market tends to the upward reversal.

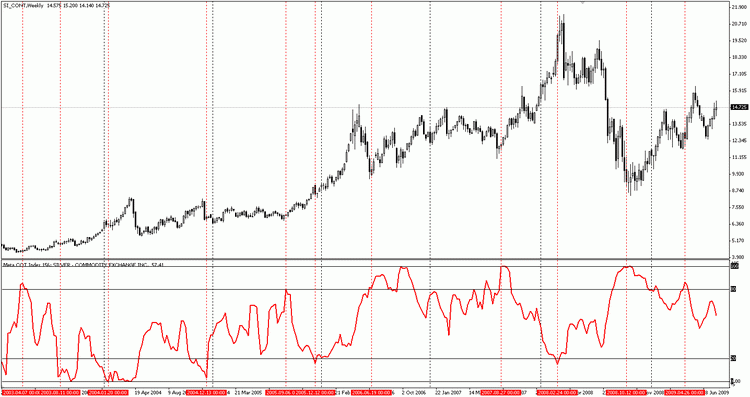

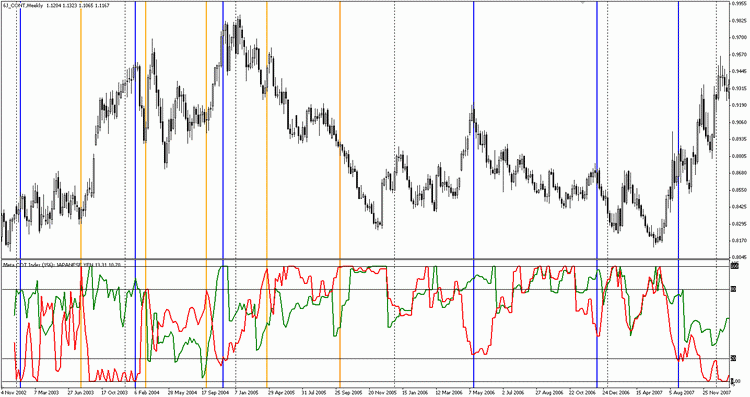

To verify this, let's look at the same silver chart, but with 156-week Operators Index:

Figure 2-8. Silver and 156-week Operator's Index, weekly bars

You can use other levels, for example 75% and 25%. The meaning will be unchanged, the Indicator will show potential overbought and oversold zones.

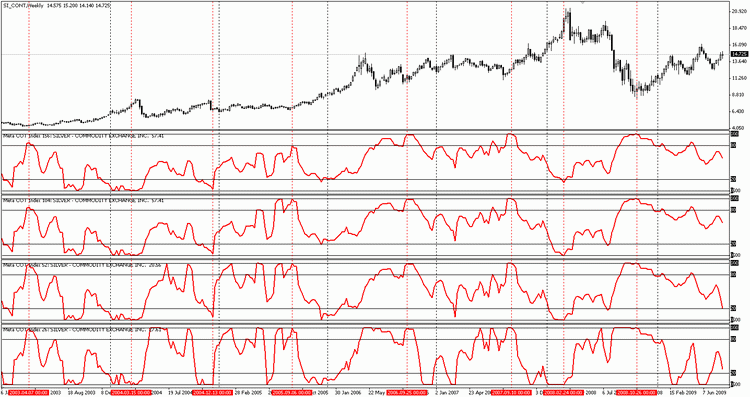

Strangely enough, but the period of the index does not change the dynamics of monitored positions. Here is an example of several indexes with different averaging periods for silver:

Figure 2-9. Silver chart with different periods for the index of the silver operators, weekly bars

Here we have used (from top to bottom) 156-week, 104-week, 52-week and 26-week averaging for the indexes of the operators. Only 26-week index shows a more frequent movement amplitude. The other periods of averaging look almost similar and don't change the indicator's shape. The averaging period used depends on the personal preferences. For example you can use the 156-week averaging period, it shows the dynamics in positions change rather widely, and at the same time it gives a clear interest result for bullish positions.

The COT index is used to monitor not only the bullish operators, but also for non-commercial traders, as well as small speculators.

2.5 The Open Interest Structure

In

the first part we have analyzed examples of the commodity volume influence on

its price. To measure the volume of goods on the

market, the use of the Open Interest (OI) is a very effective. Economic theory

predicts that the market which characterized by relatively high levels of

the Open Interest is most tends to the downward reversal. The same rule is true for the market with the relatively small values of the Open Interest. In this case, the

price most likely to move upwards.

Now

it's time to investigate its structure. From the traders deal reports we know that the main players on the futures markets are

hedgers, also known as operators, and "non-commercial traders" -

representing mostly large commodity funds. Also there is a third, minor

group of traders - scalper or so-called "crowd". Because of the small

deal volumes performed by them, they are not able to

influence the market prices. The operations volume of

that category is calculated indirectly, and represents the difference

between the Open Interest and the total amount of operator's and non-commercial traders' open positions.

The weekly Open Interest values are presented in the CFTC reports. Since the OI is the cumulative number of opened long and

short positions, as it always is, its level can be calculated in two

ways, by counting the total long position, or by counting the total

short position.

Here are the formulas:

OI = Noncommercial Traders Long + Noncommercial Traders Spreading + Operators Long + Nonreportable Long;

OI = Noncommercial Traders Short + Noncommercial Traders Spreading + Operators Short + Nonreportable Short;

Now

let us turn to the report on the euro futures of the August 4, 2009,

and calculate the open interest for this market by using these two

formulas:

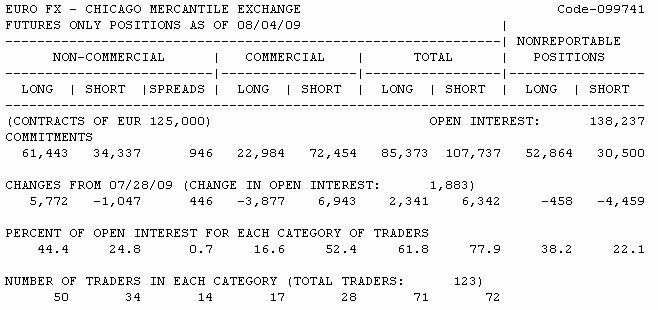

Table 2-10. Euro futures report of 4 August 2009

OI = 61 443 + 946 + 22 984 + 52 864 = 138 237;

OI = 34 337 + 946 + 72 454 + 30 500 = 138 237;

Regardless of the Open Interest calculating formula, the result is the same. However, as you can see, long positions are held mostly by large non-commercial traders (61 337 contracts), while the operators prefer short positions (52 864 contract). Calculation of share of each of these three groups in Open Interest would be a logical continuation of the analysis of the Open Interest structure. For example, the proportion of short position statements in favor of the period amounted to 52,4% of open interest (78 454 / 138,237 x 100%). For example, the share of the operator's short positions for the presented period has made 52,4 % of the Open Interest (78 454 / 138237 x 100 %). Its value is presented in section «Percent of Open Interest for each category of traders».

However it is interesting to consider the share change dynamics of each of three groups of traders. If we collect this information for the long period of time we can construct the corresponding chart. The indicator «Meta Cot: Percent Position in OI». It calculates this data for each of three groups of traders.

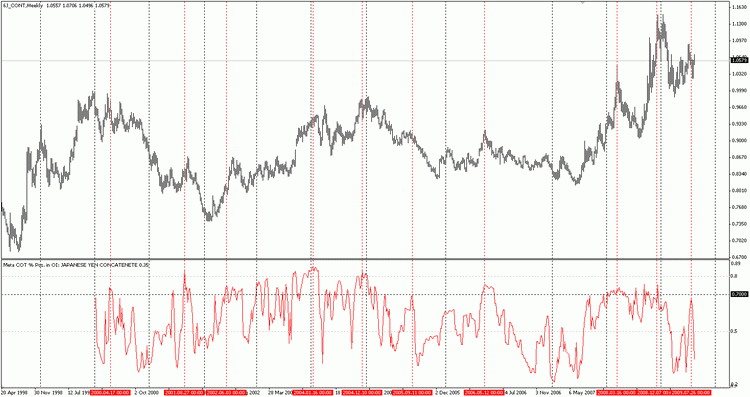

The figure

2-14 shows the long-term chart for the Japanese Yen futures. Every time when the share of operators' short position has made 70 % and more of the Open Interest the Ten was close to the downwards reverse. Almost

every time the share of short positions operators was below 30% of open

interest, the market was close to its bottom, and frequently thereafter

began its long-term bullish trends in the movement. Such cases are represented by red dashed line. The same is true for the upwards reversal. Every time when the share of the short position was below 30 % of the Open Interest the Yen was close to the downwards

reversal. Every time when the share of operators' short positions was below 30 % of the Open Interest, the market was close to its bottom, and frequently after that it began the long-term bull trends.

Figure 2-11. Share of the operator's short positions of the Open Interest. Japanese Yen, weekly bars

Larry Williams in his book "Trade Stocks & Commodities with the Insiders: Secrets of the COT Report" [1]

proposes to combine the Open Interest values with the net position of

operators in one indicator. In fact, if the relative net position of

operators is low enough and at the same time, they hold a significant

market share it can be assumed that the market is close to its peak and

soon will turn down.

This indicator is calculated by the formula:

Stochastic Oscillator (Net Operators / OI);

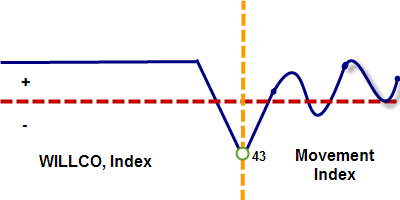

In other words, the net position of operators divides by the Open Interest, these data are collected over a long period of time, the Stochastics indicator calculates using these data. This indicator is called Williams Commercial Index, or simply WILLCO. Larry Williams recommends to use a 26-week or a six-month average, but you can use the other types of averaging, such as the annual (52-week) or three-year (156-week) averages.

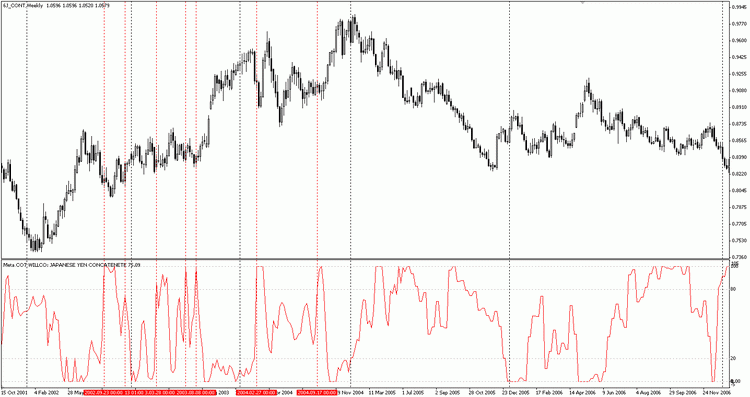

Its using is the same as the COT index, whenever its value exceeds 80% - expect the market turns down, whenever its value is below 20% - expect the market reversal up. At figure 2-15 is presented the WILLCO indicator for the Japanese Yen. The red dotted lines show the same levels that were outlines by Larry Williams on that same chart [1]:

Figure 2-12. The averaged WILLCO (26 weeks) and the Japaneese Yen, weekly bars

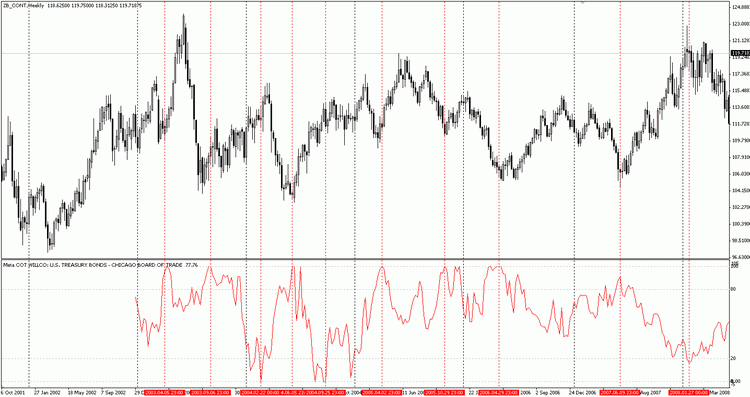

As we see, the further recommendations of this indicator were not so accurate. However, the time period increase removes this problem. Take a look at the chart of the U.S. Treasury Bonds and the same indicator, but with a period averaging of 156 weeks:

Figure 2-13. Averaged WILLCO (156 week) and U.S. Treasury Bonds, weekly bars

Now we have marked extremal low levels as well as extremal high levels. The indicator accuracy is amazing, because of the fact that its data are not based on the price data! Undoubtedly, the U.S. Treasury notes are very sensitive to the actions of operators.

2.6 Momentum indicator

This indicator was proposed by Stefan Brice, in his book «The Commitments of Traders Bible». Its idea is simple, it represents the difference between the current COT-index and the same index 6 periods ago, so its formula is:

COT-Index (p) – COT-Index(p-n);

Where p is the current value of the index, n is a period equal to 6.

The index delta can be any, and not only

6-period. In addition, the index can be calculated for all participants of the futures market, and even for the Open Interest itself. This indicator

is called the Movement Index. It is mainly

used to confirm for correction completion to the long-term

trends. Its interpretation is simple. If the Movement index rises above 40% -

the current downward movement is coming to finish. The prices rise is expected. If the index falls below 40% - the current upward movement is

coming to finish. The prices decrease is expected.

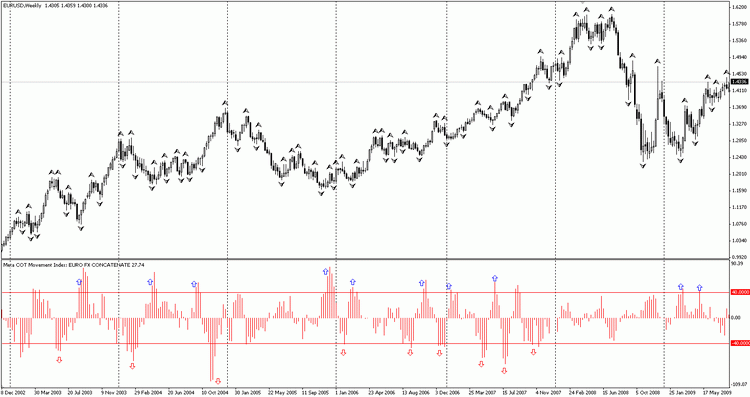

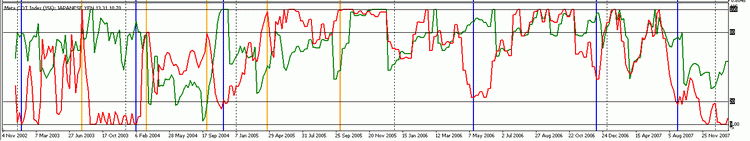

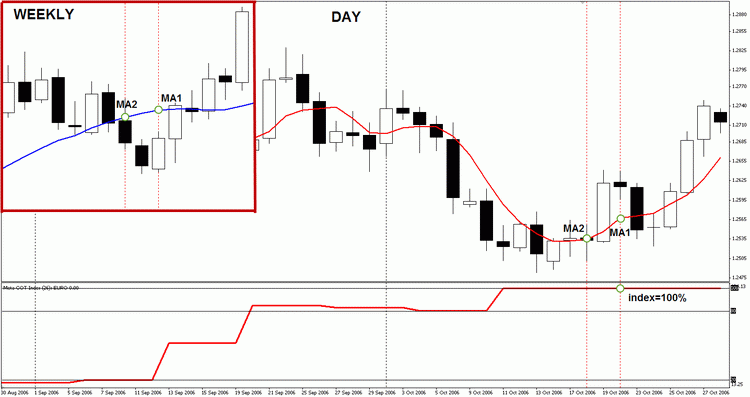

Let's try to apply this indicator to the futures of euro:

Figure 2-14. Movement Index for EURO futures

Over the past years Euro has a steady upward trend. The blue arrows

showing the times, where it has crossed the 40% barrier. Look to the incredible accuracy of the indicator, each time

after it has crossed the 40% level, the price correction has completed, and the euro has continued its rise. The sale signals of the indicator were not so accurate. However, often the correction has began after the movement

index crossed the lower boundary of -40%. Such indicator reactivity should be taken into account. It's a kind of

COT momentum barometer. It clearly shows the market turbulence. Its use is particularly useful for the aggressive and less

long-term trade.

The next indicator is an experimental and it hasn't described before anywhere. In the ninth chapter of his book Larry Williams explores the Open Interest changes via the action of the operators. It is not clear exactly how to use this relationship. For some examples, Larry Williams shows the divergence/convergence. For the other examples he concludes that the sales increase or operator's buys also increases the level of Open Interest. The investigation of the index movement has led to the idea that it is possible to monitor the changes in the operators positions via the changes of the Open Interest level.

The most interesting interaction models are the following:

1. Open Interest level is falling - the operators net position level is growing.

2. Open Interest level isincreasing - the operators net position level is falling.

In other words, there is a some discrepancy between the actions of all market participants (Open Interest) and the operators actions. Such changes would be best to observe based on the movement index calculated as for Open Interest as for the operators index. Comparing their difference, we can determine the divergence of the hedgers actions and the rest market participants actions.

This indicator was named Spread Movement Index, is its formula:

Movement Index (Operators) – Movement Index (Open Interest);

In

general it looks like simple Movement

Index, as well as WILLCO looks like COT

Index. The approximate critical level values are 60% and -60%

respectively. Its analysis is carried out by the same rules as for the ordinary

movement index.

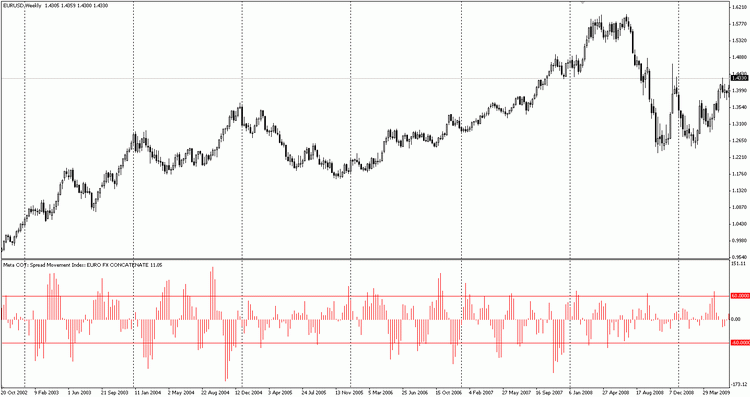

Lets consider the index behavior on the euro futures example:

Figure 2-15. Spread Movement Index EURO

One can see that its values also indicates the significant turning points and correction complete moments. However, this indicator should be used with caution - its efficiency hasn't been proved.

2.7. Observing the large hedge fund's positions

The main goal for the large commodity funds is a speculative profits on the commodity markets. The trading methods they used are based on the general trend following. Once the price exceeds a certain n-week high, some of the funds opens long position. It gives an additional upward prices movement. Perhaps one of the main reasons of the market trends in the medium term are the large commodity funds actions.

By some estimates the funds choses 26-week High/Low a most frequently [1]. Funds are in the market gradually, using the technique of building products, besides many of the funds use more long-term strategy for entry. The funds enters on the market gradually, using addition technique for their positions, besides many funds use more long-term strategy for entry. For example, if the price reached its 26-week high, some of the funds are open long positions. Then the price moves further upward and reaches its 52-week high. More cautious funds are join to the game and open long position, together with them the funds already have entered into long are adding to their position. Finally, the price reaches its 156-week high. At this point, who wanted to buy are already have bought. Thats's all. There is no buyers now.

The trend strategies of all of the funds are involved to the maximum. The market became extremely strained. Because of the fact that there are no more buyers, we know it from the traders reports, the price should soon go down ... and soon it does. The price begins its downward movement. At this point the market has an extremely high number of participants (we know it from the Open Interest level), in they are starts to panic.

The first, the buyers who have entered the market later than others starts to close their long positions. They have not yet managed to get a sufficient level of profit that is necessary for long-term position retention. It gives an additional price acceleration and it begins to fall faster. Soon the panic increases and more and more participants are trying to close their long positions. Everyone is trying to squeeze into a doorway. The panic is growing so much that price falls down, during a very short time period.

After the crowd has left the market and the price was at the bottom, just after that the operators start their game and come on the market again, by adding their long positions. Their idea is simple - the operators that use the commodities for production of its goods are interested to buy the goods at cheap prices. Operators, by contrast, reduce their sales to a minimum, is it not profitable to sell goods at low prices. As a result, the net position of operators will be extremely high. Indicators will show this fact accordingly. The demand competition will start, and the price will rise again. The circle closes and history will repeat again.

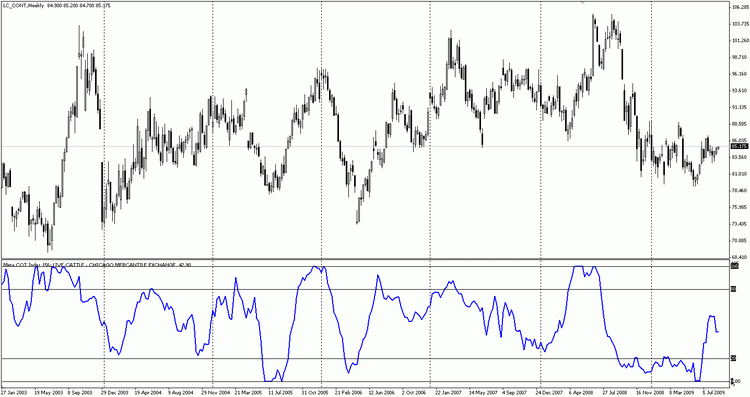

Let's examine the actions of large non-commercial traders on the basis of the above concepts using the three-year index applied to a non-commercial traders' net positions:

Figure 2-16. Cattle futures price and total net postion of non-commercial traders

As we see on the cattle futures exaple, the actions of the non-commercial traders looks like the current price trend. If the price goes up, the funds are buying, if it goes down, they are sold, it's simple. Let's note that every time when the funds have increased their positions up to maximal values, the cattle price has began it's downward movement. When the

funds position was close to its minimal values, the price has began to rise.

I think that the financial success of the investors, who have decided to invest their money to such funds are under the question. The similar actions of the non-commercial traders are the same on the other markets:

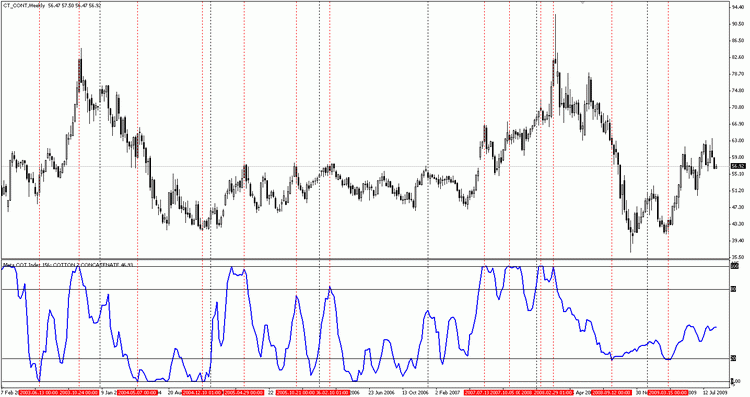

Figure 2-17. Cotton chart and 156-week averaged net position of non-commercial traders

While the index tops clearly shows for the coming market reversal, its low values, as a rule, were premature. In any case, this chart shows that it is better to short when the "big guys" are buying.

2.8 Observing of the small speculator's positions

According to the CFTC specification, the small speculators - all those who have too small positions to reach any of the above two groups. Their exact values are unknown, although it can be assumed that the total number rather impressive. For example, you can apply to a brief report CFTC on wheat on the Chicago Mercantile Exchange:

Table 2-18. The share of the small speculators in the brief report on wheat

As we see from the report the total number of major market participants is small. On the short side - 286, on a long - 304. 286 of the market participants holds 91.8% of all long positions and 304 traders has 88.5% of all short positions. Can we call these major market participants as crowd? I think that we can't. But many traders that haven't been counted in the commission report are the very small speculators, creating a market crowd.

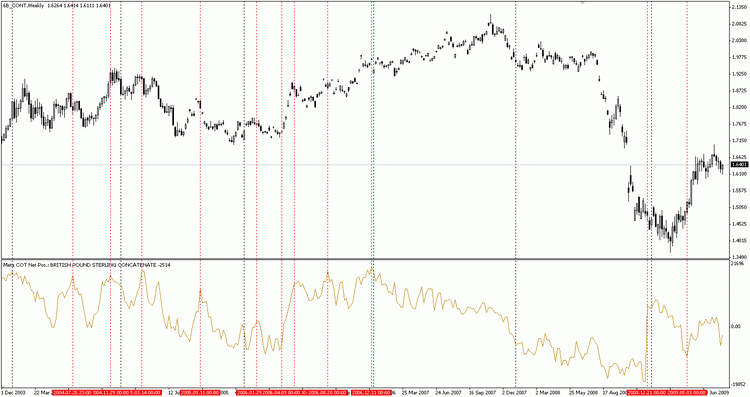

In this case, the crowd controls only 8.2% of long positions and 11.5% of short positions. It would be quite remarkable to observe the history of buys and sales of this category of traders. Let us turn to the GBP chart over a long time period, but this time we consider the total net positions of the small speculators:

Figure 2-19. Total net position of small speculators on GBP futures

Note that every time when the total net positions of the crowd are reached their relatively high values, the market price hardly began it's downward movement. Conversely, when the crowd were disappointed in GBP and began to sell it, the GBP price began a rally. Particularly noteworthy were the two final points which marked by red lines. After the grand fall of the pound, the small speculators have decided that the bottom has been reached and the upward movement is inevitable. Within one week, they escaped from net sellers to net buyers. However, the bottom hasn't yet been reached. Pound continued to fall about two months. During this time the crowd mood has changed, and it was again mainly sell. And crowd was wrong again. Pound showed a decent rally.

The general rule for the analysis of the trading activities of this group is simple. Try to act contrary to how the crowd. If unaccountable traders sharply increased their sales - try to buy if they are contrary started to buy - try short.

3. Technical solution

3.1 The aim and the structure of MetaCOT project

So, we have considered all of the project indicators, it's time to examine their structure. A clear understanding of their work principles will help you to avoid many problems with the data update and their setting.

The first of all lets consider the principles of the software, here they are:

1. Transperancy. All of the project source code is open and available to everyone. Anybody can download and compile these tools. Moreover, its work principle is described in this article, so it will be transparent and understandable to anyone.

2. Universatility. The software includes all of the CFTC data analysis tools described in the book by Larry Williams, including his

WILLCO indicator, which is absent in any other projects. Moreover, the software includes a special scripts, which groups the information in

a special way. As a result, you can automatically join the different

tools and even create a new ones! In addition, the project architecture is designed for an easy creating of the new indicators based on the COT project. The basic COT data can be obtained (for the date desired) with a single function. And these data can be easily

used to calculate in another indicator.

3. Automation. The CFTC data are extremely large. They contain an information on hundreds of markets, and the each market information is scattered across the different files and years. Using the Meta COT scripts now it will not be a problem. All you need to do now is to download (once a week) the updated file from CFTC and run the script. All of the data will be automatically extracted, grouped and ready to use .

4. Simplicity. All of the indicators and scripts were created using the MQL programming language, without any third-party DLLs. We have used the most simple algorithms for the data organization and calculations. We have used the separation of problems. So the scripts-based programs were developed for the program for group, for unite, for output and for the creation of new data. And these data were used for the indicators construction.

5.

Independence. One of the most important factors in the information obtaining

is the number of its transmitting "nodes". If the

information is transmitted directly from source to destination, the

possibility of its distortion is much less than if there are some additional mediators between the source

and destination. All the project is implemented in a way that the necessary information is taken directly from the source, without a third-party vendors.

The project includes a set of several program files that are not compiled. An each file must be placed in a specific directory and compiled. The following table includes a list of files, their brief description and the installation location:

|

Filename |

Type |

Destination |

Description |

|---|---|---|---|

Meta COT Script Build.mq4 | Script | ..\Meta Trader\experts\scripts\ | The main independent script for data preparation. Creates a set of files from standard CSV-files available on the CFTC.gov server. Each of new file includes an information about instrument. The name fo the created file corresponds to the instrument name. |

Meta COT Script Concatenate.mq4 | Script | ..\Meta Trader\experts\scripts\ | An independent script. It joins a multiple files into one file based on history. For example, the file "COT - SUGAR NO. 11 - NEW YORK BOARD OF TRADE. CSV" (with data for the period 2005.01.04-2007.08.28) and file "COT - SUGAR NO. 11 - ICE FUTURES U.S. .CSV" (with data for the period 2007.09.04-2009.09.01) will be converted into a file "SUGAR CONCATENATE", which includes data from 2005.01.04 to 2009.09.01. |

Meta COT Script Agregation.mq4 | Script | ..\Meta Trader\experts\scripts\ | An independent script. It joins a multiple files into one, based on the summation of their values. For example file "COT - WHEAT - CHICAGO BOARD OF TRADE. CSV", "COT - WHEAT - KANSAS CITY BOARD OF TRADE. CSV", "COT - WHEAT - MINNEAPOLIS GRAIN EXCHANGE. CSV" will be converted into one file "WHEAT AGREGATION" containing the sum of the values of all three files. |

Meta COT Script Report.mq4 | Script | ..\Meta Trader\experts\scripts\ | The script needs a library "cotlib.mq4". It creates a report file CSV, including a calculations for all of the indicators. The averaging periods and instrument name are defined in the script settings. It may be useful for data analysis in other programs. |

Meta COT Absolute Position.mq4 | Indicator | ..\Meta Trader\experts\indicators\ | The script needs a library "cotlib.mq4". It shows the absolute positions of traders in all categories, including an Open Interest. |

Meta COT Net Position.mq4 | Indicator | ..\Meta Trader\experts\indicators\ | The script needs a library "cotlib.mq4". It shows the net positions of traders in all categories, including an Open Interest. |

Meta COT Index.mq4 | Indicator | ..\Meta Trader\experts\indicators\ | The script needs a library "cotlib.mq4". It shows COT index of all categories of traders, including the Open Interest Index. The period for calculation is defined in the script settings. |

Meta COT Percent Position in OI.mq4 | Indicator | ..\Meta Trader\experts\indicators\ | The script needs a library "cotlib.mq4". It shows result of division of net position by Open Interest for each category of traders. |

Meta COT WILLCO.mq4 | Indicator | ..\Meta Trader\experts\indicators\ | The script needs a library "cotlib.mq4". It shows WILLCO index for all categories of traders. The period for calculation is defined in the script settings. |

Meta COT Movement Index.mq4 | Indicator | ..\Meta Trader\experts\indicators\ | The script needs a library "cotlib.mq4". It show the Movement Index and Open Interest for each traders category. The averaging and momentum periods are defined in the script settings. |

Meta COT Spread Movement Index.mq4 | Indicator | ..\Meta Trader\experts\indicators\ | The indicator needs a library "cotlib.mq4" It shows a division of the Movement index by Open Interest for each category of traders. |

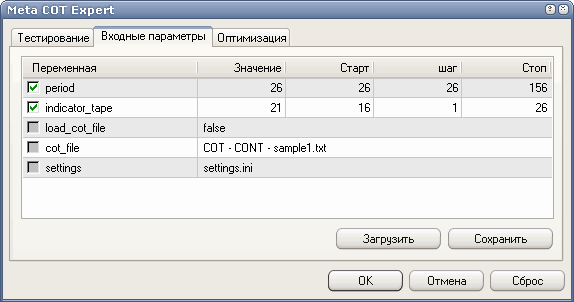

Meta COT Expert.mq4 | Expert advisor | ..\Meta Trader\experts\ | An expert advisor needs a library "cotlib.mq4". It is testing COT indicators on historical data. |

cotlib.mq4 | Library | ..\Meta Trader\experts\libraries\ | It's a kernel of system. It includes a COT data and methods for its processing. It has a large set of arrays, definitions and functions for the calculation for all of the indicators used. |

ONCATENATE.ini | File with list | ..\Meta Trader\experts\files\ | It's a file list, with lists to combine by time. |

COT - * CONCATENATE.ini | File lists | ..\Meta Trader\experts\files\ | It's a files with a file lists to combine by time. |

AGREGATION.ini | File with list | ..\Meta Trader\experts\files\ | It's a file list, with lists to combine by summation. |

COT - * AGREGATION.ini | File lists | ..\Meta Trader\experts\files\ | It's a files with a file lists to combine by summation. |

Table 3-1. Meta COT project files with installation paths

You need to install these files in the appropriate directories, and then compile. After these steps, the terminal must receive the appropriate MetaTrader custom indicators, scripts and advisor.

3.2 Loading data and creating reports

As you know, all of the indicators data are provided by a non-commercial organization CFTC. These data are published weekly on the CTFC official website. There are several kinds of reports. The first type is called «Futures Only Reports», it includes only futures positions data. The second type of report is called «Futures-and-Options Combined Reports», it includes the data on futures and options.

It provided much more complete information about the market. It is preferable to use it. Also there is a special kind of report, called

«Commodity Index Trader Supplement». Its main difference is that it is

prepared for the limited range of agricultural markets, and, most

importantly, it includes the fourth traders category, the so-called

Commodity Index Traders (CIT).

These traders are occupies an intermediate position. From the one side their positions belong to the hedgers, they are included in «Futures Only Reports» and «Futures-and-Options Combined Reports», from the other side- their behavior is similar to the behavior of large hedge funds. Generally, they are net buyers, in contrast to classical hedgers, which are net sellers. There is an opinion that this category of traders is making a panic on the market. The sharp falls and rises - are mostly their actions. They have a sufficient power to move the market in any direction, at the same time, their main goal - to get a speculative profit. Data for this category of traders are available from 2007 in Exel and CSV formats. Because of the small history of their actions, the study of their behavior in a task for the future. At present time this kind of report is not supported by the project.

The reports are published in several formats. First, it is the trade tables itself. In this format, there is no report «Commodity Index Trader Supplement», which is available only in the Excel and CSV files.

The form of these tables is familiar to you:

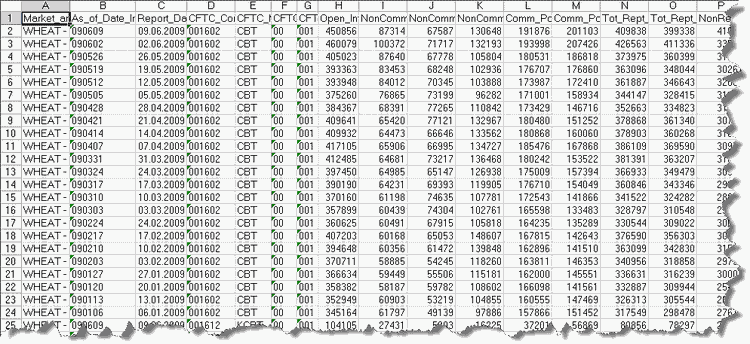

Figure 3-1. The part of COT report in Exсel-format

Also, there are an ordinary Excel tables. They contain the same data as in conventional report, with the only difference being that the data collected over a long period of time. A fragment of this table is shown at Figure 3-2:

Figure 3-2. A part of the COT report in Exсel-format

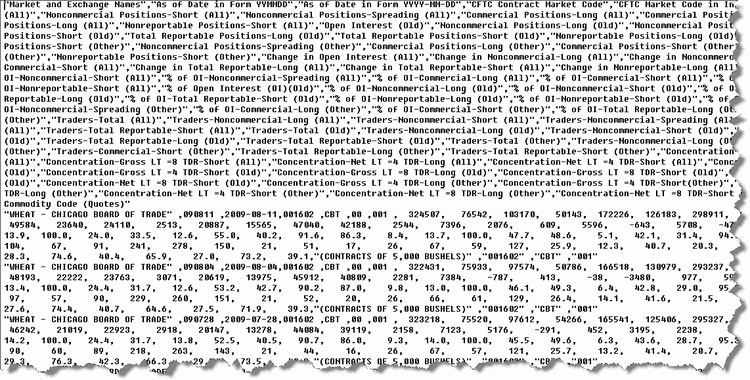

The Commission publishes its reports in CSV. This format represents a text file with the «txt» extension, the data are separated by comma. This is the only format, which Meta COT uses, so this format should be described in more detail. At figure 3.4 there is a part from this file:

Figure 3-4. COT report example in CSV format

Its structure may seems chaotic, but its not. The file consists of rows and columns. Number of columns is 128, the number of rows depends on the number of instruments and the report period. Typically, a the report file contains data for one year. For example, the report downloaded in this format in September 2009, will contain data from January 2009 to September 2009 (the date of this writing). The first line consists of 128 columns, its a column names. The CSV files are basis for constructing of the project data.

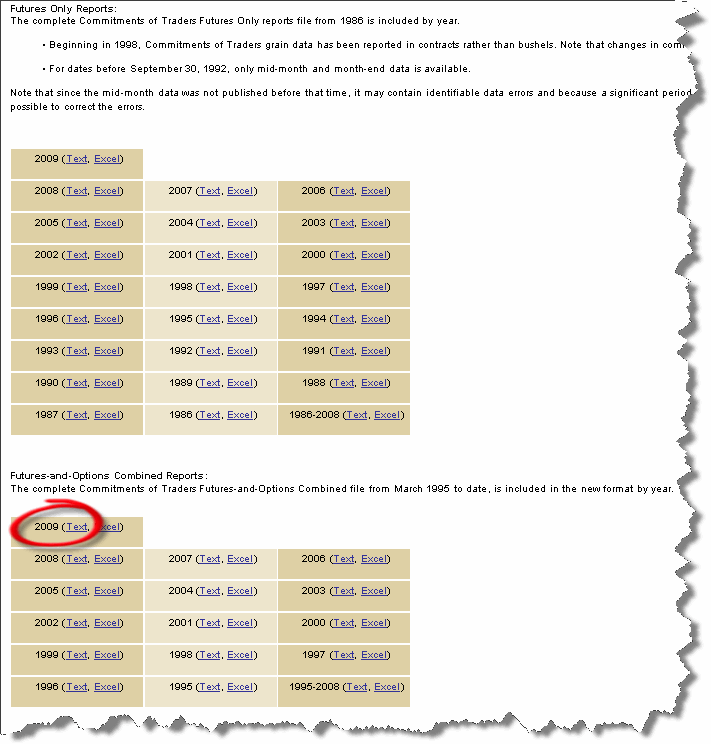

Now lets create a charts. Is convenient to consider the COT data for a long time period. Lets prepare the data from 2000 to the present. So, lets go to the address http://cftc.gov/marketreports/commitmentsoftraders/CFTC009781.html or to the sections Home> Market Reports > Commitments of Traders, at http://cftc.gov.

We will see the picture like the following:

Figure 3-5. Data archive

There are two types of reports: futures only reports and futures and options combined reports. We want to use the data from 2000, it is reasonable to use a second type of report on futures and options (by the way, the data prior to 1995 are available only for futures reports). However, they have the same report formats, and you can use either of these two report types. Download all of the nine text files from 2009 and ending with the year 2000. Later, you can also download a single file which includes all of the data from 1995 to 2008 and one file in 2009, but in such case, there will be a large number of instruments. At Fig. 3.5 one of the references is circled by red circle. Downloaded files should be unpacked in directory ..\ Meta Trader folder \ experts \ files \.

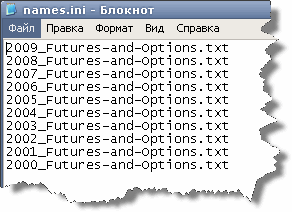

All of the files in the archives have the same name annualof.txt, so they must

be renamed. The file name can anything, but these file names must be

listed in names.ini, its a special configuration file of the project. It is very simple and represents a simple listing of the files to be

processed.

For example, if we have file named "2009_Futures-and-Options.txt" for 2009, "2008_Futures-and-Options.txt" for 2008 and so on, the list of processed files will be as follows:

Figure 3-6. An example of processed files list for COT project

If

you rename the downloaded files the same way as in the

example, then you do not have to edit the names.ini file, by default the script will work with this set of files. If, for whatever

reasons, you will need to use other names, then specify the new file names in names.ini, instead of those that are specified by default.

So, in the directory \files you must have 10 files, as shown in Figure 3-6:

Figure 3-7. The contents of the folder MetaTrader\experts\files

The names.ini contents should be same as in Figure 3-6. Note, that file names order in file names.ini is important. The file names should be listed in descending order. For example, the first shoul be a file for 2009, and the last for 2000.

Now, when the data are prepared, it's time to run the Meta COT

Script Build script. It works in automatic mode, and it has an only option - the name of the file list. In this case, the file

name is " names.ini" but it can be changed. It is necessary for flexible solutions to some problems.

Suppose, for example, that for some of the instruments you want to analyse the futures data only, without options data. At the same time for other instruments you want to use a more complete reports on futures and options. You can download two types of reports to your computer and create the two lists of files, for example names_option.ini and names_futures.ini.

First, you can get data on futures by running a script with a parameter "names_list" equal to "names_futures.ini". After that, these data should be saved in another folder. Then, when the necessary data will be obtained by running the script again, but this time with a parameter "names_list" equal "names_option.ini". A data for futures and options will be generated.

Shortly after the script run many files with reports in CSV format in the "\files" folder will be generated. An each such file will have a form like "COT - Market Name - Name of the exchange. CSV".

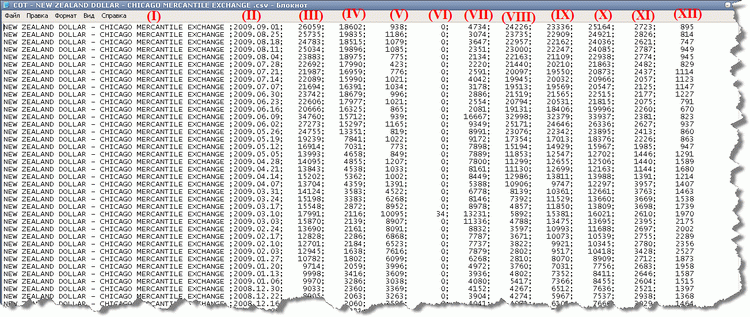

Many of the files will be incomplete. COT reports on some markets have a feature to appear briefly, then to disappear forever. Nevertheless, there is a sufficient number of instruments, that have a regular reports. Later we will consider, the report instruments included in more detail, but now turn our attention to the files generated. Consider the format using the one of them: "COT - NEW ZEALAND DOLLAR - CHICAGO MERCANTILE EXCHANGE. CSV". It's an easy to guess that it contain an information we need for the New Zealand dollar futures.

Let's open it in notepad and see what inside:

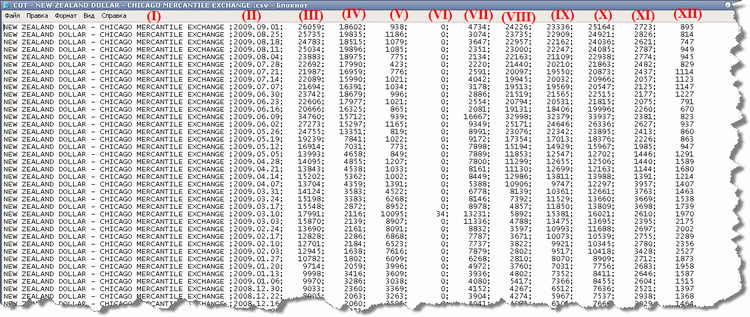

Figure 3-8. New Zealand dollar

One can see, this file contains statistics for a long time period on one instrument, in this case of the New Zealnd dollar. column with names are absent, this file is used for indicators that does not need the column names. Nevertheless, in order to understand what does these numbers means, lets look at each column:

II - Report Date;

III - Open Interest;

IV - Long Positions of non-commercial traders;

V - Short Positions of non-commercial traders;

VI - Spread (Coverage) of non-commercial traders;

VII - Long Position of Operators;

VIII - Short Positions of operators;

IX - The Cumulative number of long positions of the traders reporting;

X - The Cumulative amount of short positions of the traders reporting;

XI - Long Positions of unaccountable traders;

XII - Short Positions of unaccountable traders.

That's all you need to construct the COT indicators.

At this stage the the same markets information are in different files. This is due to the fact that firstly, the names of stock exchanges are changing over time, and secondly, the name itself, the Commission may change the instrument name itself, or even more possible just a mistake in their title. The instrument name change, even one character leads to a significant difference for the program that extracts data.

For example, the instruments "COT - SUGAR NO. 11 - COFFEE SUGAR AND COCOA EXCHANGE" and "COT - SUGAR NO. 11 - COFFEESUGAR AND COCOA EXCHANGE" are completely different to the program, and it will create two different titles for the instruments file. Let's take a look the example of sugar. After running the script Meta COT Script Build a \files directory among many files will have:

COT - SUGAR NO. 11 - COFFEE SUGAR AND COCOA EXCHANGE .csv

COT - SUGAR NO. 11 - COFFEESUGAR AND COCOA EXCHANGE .csv

COT - SUGAR NO. 11 - ICE FUTURES U.S. .csv

COT - SUGAR NO. 11 - NEW YORK BOARD OF TRADE .csv

COT - SUGAR NO. 14 - COFFEE SUGAR AND COCOA EXCHANGE .csv

The

last file belongs to another class of sugar, and contains too little

data, so they can be used, so this file can be immediately removed. As one can see from the name, the first and second files - are corresponds to the same instrument, the Commission some time created a reports on this instrument with

grammatical errors, that influenced for the second file creation. The third and fourth positions contain the files of the same sugar, but

on other exchanges: "ICE FUTURES" and "NEW YORK BOARD OF TRADE".

If you open these files it is possible to identify the chronology of sugar trades:

|

Sugar file name |

Trade begin date |

Trade finish date |

|---|---|---|

COT - SUGAR NO. 11 - ICE FUTURES U.S. .csv | 2007.09.04 | 2009.09.01 |

COT - SUGAR NO. 11 - NEW YORK BOARD OF TRADE .csv

| 2005.01.04 | 2007.08.28 |

COT - SUGAR NO. 11 - COFFEE SUGAR AND COCOA EXCHANGE .csv

| 2003.02.25 | 2004.12.28 |

COT - SUGAR NO. 11 - COFFEESUGAR AND COCOA EXCHANGE .csv

| 2003.01.07 | 2003.02.14 |

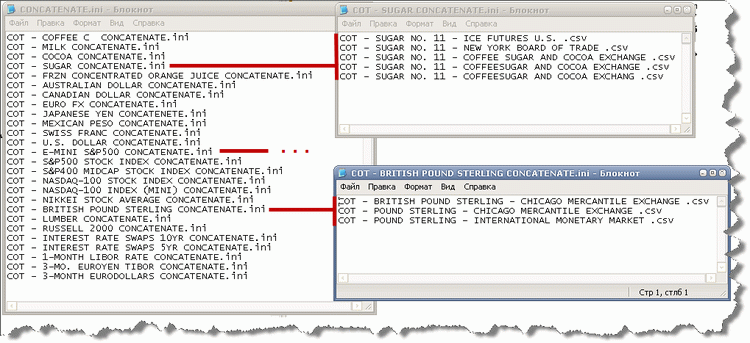

Table 3-9. Files with reports on sugar

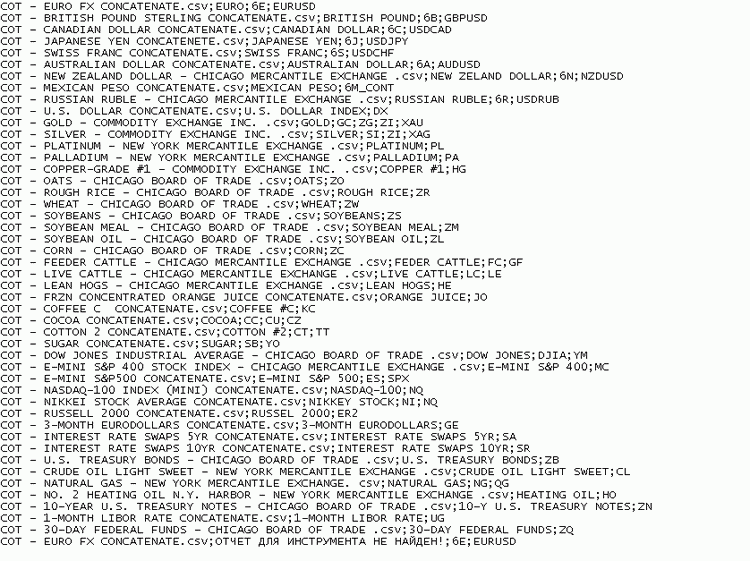

As it seen from the trades chronology, all data files describes the same product, therefore it is logical to combine all these files into one continuous report file. For that purpose there is a script Meta COT Script Concatenate. The script needs a special file with the enumerations, for example SUGAR CONCATENATE.ini. All of the sugar files that is necessary to join in a single chronology, should be listed there. For his work with the files of sugar to create a special file transfers, such as SUGAR CONCATENATE.ini. It should list all the files of sugar to be combined into a single chronological sequence.