Reverse Grid

- 专家

- Paranchai Tensit

- 版本: 22.0

- 激活: 20

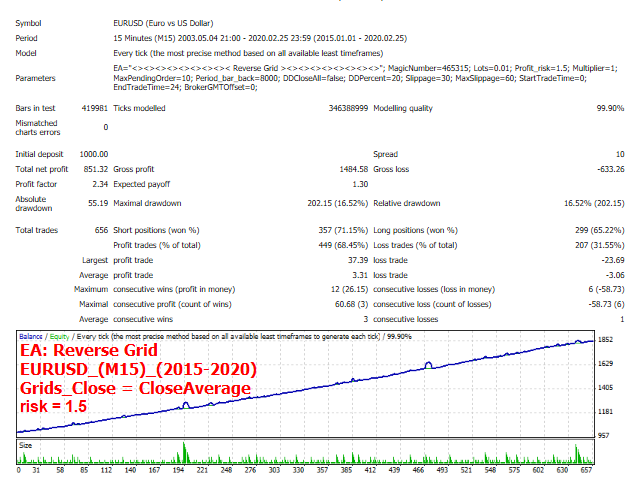

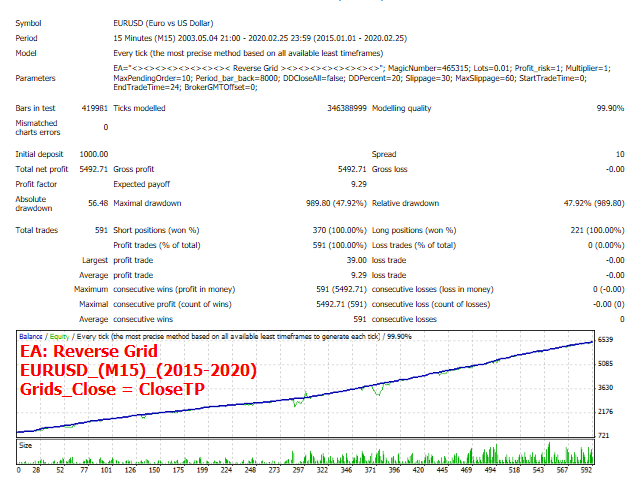

Reverse Grid is adopted from the dynamic grid trading system. The system has a mechanism for positioning, buying and selling according to trends. The system does not use a specific percentage to stop losses, but instead uses zone management methods to reduce the increase of drawdown. Passed 5 years back test of real tick data (2015-2020)

Key Features

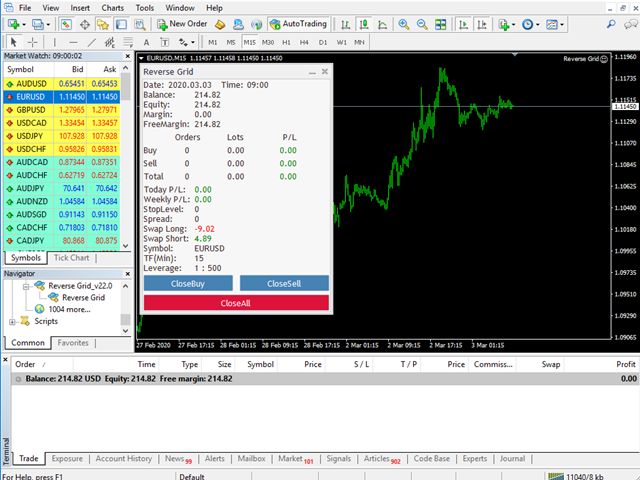

- Timeframe: M15

- Currency pairs: EURUSD

- Use only five-digit accounts

- Initial deposit: $ 1000

- It is recommended to use a low spread ECN Broker, 1:500 leverage

- Using real tick data in backtest with 99.9% modeling quality

Parameters

- MagicNumber - magic number to set the ID for each EA

- Lots - initial lot size

- Grids_Close - CloseAverage/CloseTP

- Profit_risk- risk percentage

- Multiplier - previous lot size will multiplied

- MaxPendingOrder - maximum pending orders on both the buy and sell side

- Period_bar_back - the number of bars count in the history for create zones

- DialogBox - Show / Hide / Quick test

- DDCloseAll - enable drawdown percent close, set true or false

- DDPercent - set the percentage to cut loss, % drawdown

- Slippage - slippage value in points

- MaxSlippage - maximum allowable slippage value in points

- StartTradeTime - set time to start trading

- EndTradeTime - set time to end trading

- BrokerGMTOffset - Your Broker GMT Offset

Links/Contacts

- Profile: https://www.mql5.com/en/users/paran1615

- Products: https://www.mql5.com/en/users/paran1615/seller#products

- Signals: https://www.mql5.com/en/signals/author/paran1615

- Myfxbook: myfxbook.com/members/EA_SPD

- YouTube channel: https://www.youtube.com/channel/UCu8lsRARFht9uhI5Uca4j-Q