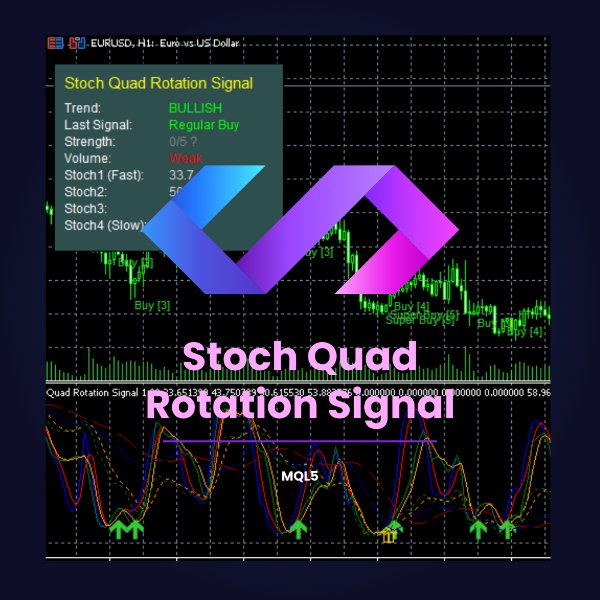

Stoch Quad Rotation Signal MQL5

- 指标

- German Pablo Gori

- 版本: 1.3

- 更新: 17 十一月 2025

- 激活: 12

Stoch Quad Rotation Signal v1.3 - Professional Trading System

Professional Multi-Stochastic Trading System

Stoch Quad Rotation Signal is a professional trading indicator based on the renowned strategy developed by Mark Kurisko. This advanced system combines four synchronized stochastic oscillators with exponential moving averages, creating a robust framework for identifying high-probability trading opportunities across all timeframes and markets.

Key Principle: The indicator analyzes the alignment and rotation of multiple stochastic oscillators across different periods to identify optimal entry and exit points. When all four stochastics align in the same direction while respecting trend filters, the system generates high-confidence trading signals.

Core Features

Quad Stochastic System

Four independent stochastic oscillators (9/3, 14/3, 40/4, 60/10) working in harmony to identify multiple timeframe convergence and signal strength. Triple EMA Filter

Three exponential moving averages (20, 50, 200) provide comprehensive trend analysis and filtering to avoid counter-trend signals.

Signal Scoring System

Advanced 1-5 basic scoring or optional 1-10 advanced scoring system evaluates signal quality based on multiple confirmation factors.

VWAP Analysis

Volume Weighted Average Price calculation with standard deviation bands for institutional-level price analysis.

Multi-Timeframe Filter

Optional higher timeframe stochastic filter ensures alignment with larger market trends before signal generation.

Volume Confirmation

Volume filter compares current volume against moving average to confirm genuine market participation.

Pattern Recognition

Detects divergences, flag patterns, ABCD harmonic patterns, and candlestick formations for additional signal types.

Fractal Analysis

Identifies key support and resistance levels using fractal mathematics with optional level visualization.

Market Regime Detection

Automatically identifies market conditions: strong trend, weak trend, range-bound, high volatility, or low volatility.

Multi-Symbol Scanner

Scan multiple currency pairs or instruments simultaneously with customizable update frequency and signal alerts.

Interactive Dashboard

Real-time information panel displaying stochastic values, trend state, signal strength, and volume analysis. Fully draggable interface.

Multi-Channel Alerts

Comprehensive alert system: on-screen notifications, mobile push, email, and Telegram bot integration.

Signal Types

Regular Buy/Sell Signals

Generated when Stoch1 and Stoch2 cross in oversold/overbought zones with trend confirmation.

Super Buy/Sell Signals

Premium signals requiring all four stochastics to align, indicating extremely high probability setups.

Divergence Signals

Identifies price-oscillator divergences suggesting potential trend reversals or continuations.

Pattern Signals

Detects flag patterns, ABCD harmonic setups, and candlestick formations for technical analysis confirmation.

Technical Specifications

| Parameter | Default Value | Description |

|---|---|---|

| Stoch1 K-period | 9 | Fast stochastic for scalping and quick signals |

| Stoch2 K-period | 14 | Fast stochastic for confirmation |

| Stoch3 K-period | 40 | Medium-term stochastic for trend alignment |

| Stoch4 K-period | 60 | Full stochastic for major trend analysis |

| EMA Fast | 20 | Short-term trend filter (Kurisko specification) |

| EMA Medium | 50 | Medium-term trend identification |

| EMA Slow | 200 | Long-term trend and major support/resistance |

| Oversold Level | 20.0 | Threshold for oversold condition |

| Overbought Level | 80.0 | Threshold for overbought condition |

| Volume MA Period | 20 | Period for volume moving average filter |

Signal Scoring System

The indicator features an intelligent scoring system that evaluates signal quality based on multiple factors:

Basic Scoring (1-5 Scale)

- Score 1: Minimal confirmation - Single stochastic in target zone

- Score 2: Basic signal - Two stochastics aligned

- Score 3: Good signal - Two stochastics + trend filter

- Score 4: Strong signal - Three stochastics aligned with trend

- Score 5: Excellent signal - All four stochastics + full confirmation

Advanced Scoring (1-10 Scale) - Optional

When enabled, the advanced scoring system adds additional factors:

- Volume confirmation (adds 1-2 points)

- VWAP alignment (adds 1 point)

- Multi-timeframe confirmation (adds 1-2 points)

- Pattern recognition bonus (adds 1 point)

- Fractal support/resistance alignment (adds 1 point)

Multi-Symbol Scanner

The integrated scanner monitors multiple instruments simultaneously, providing a comprehensive market overview:

- Automatic Symbol Suffix Handling: Works with any broker suffix (.pro, .i, .raw, etc.)

- Customizable Symbol List: Monitor any combination of forex pairs, indices, commodities, or cryptocurrencies

- Real-Time Updates: Configurable refresh rate from 1 to 60 seconds

- Signal Strength Display: Visual indication of signal quality for each instrument

- Trend State Visualization: Color-coded backgrounds showing bullish, bearish, or neutral conditions

- Optional Alerts: Get notified when new signals appear on scanned instruments

- Minimizable Interface: Collapse scanner to save screen space when not needed

Dashboard Features

The interactive dashboard provides at-a-glance market analysis:

- Real-time values for all four stochastic oscillators

- Current trend state (Bullish/Bearish/Sideways)

- Signal strength indicator (1-5 or 1-10 scale)

- Volume intensity analysis

- Market regime identification

- VWAP position and deviation

- Daily signal counter (optional)

- Current timeframe display

- Fully draggable positioning

- Color-coded visual states

Alert System

Multiple Notification Channels

- Screen Alerts: Standard MT5 popup notifications with sound

- Mobile Push Notifications: Send alerts directly to MetaTrader mobile app

- Email Notifications: Receive detailed signal information via email

- Telegram Bot Integration: Real-time alerts through Telegram messenger

Configurable Alert Types

- Regular buy/sell signals

- Super signals (all stochastics aligned)

- Divergence detection alerts

- Pattern recognition notifications

- Scanner multi-symbol alerts

Advanced Features

VWAP Analysis

Volume Weighted Average Price calculation provides institutional-level price analysis. The indicator calculates VWAP with standard deviation bands, helping identify fair value zones and potential reversal areas. Optional on-chart visualization available.

Fractal Support/Resistance

Automatic detection of fractal highs and lows creates dynamic support and resistance levels. The system identifies both regular fractals and "super fractals" (higher timeframe confirmations) for enhanced reliability.

Market Regime Detection

The indicator automatically classifies current market conditions:

- Strong Trend: Clear directional movement with aligned EMAs

- Weak Trend: Directional bias but with lower momentum

- Range Bound: Sideways price action between support/resistance

- High Volatility: Large price swings and increased ATR

- Low Volatility: Compressed ranges and reduced movement

Pattern Recognition

Optional detection modules for various technical patterns:

- Divergences: Regular and hidden divergences between price and stochastic

- Flag Patterns: Continuation patterns signaling trend resumption

- ABCD Patterns: Harmonic price structures based on Fibonacci relationships

- Candlestick Patterns: Classic formations like engulfing, hammer, shooting star (optional)

Usage Guidelines

Recommended Settings by Trading Style

| Trading Style | Timeframe | Min Score | Filters |

|---|---|---|---|

| Scalping | M1, M5 | 2-3 | Volume filter ON, MTF filter optional |

| Day Trading | M15, M30, H1 | 3-4 | All filters ON, MTF recommended |

| Swing Trading | H4, D1 | 4-5 | Trend filter ON, MTF filter ON |

| Position Trading | D1, W1 | 5 (Super signals only) | All filters enabled, advanced scoring |

Best Practices

- Use Complete Trend Filter: Enable "Filter ALL signal types" for safer trading and reduced false signals

- Start Conservative: Begin with higher minimum scores (3-4) and gradually adjust based on results

- Combine with Price Action: Confirm signals with support/resistance levels and chart patterns

- Consider Market Regime: Trade more aggressively in trending markets, cautiously in range-bound conditions

- Use Multi-Timeframe Confirmation: Check higher timeframe alignment before entering trades

- Monitor Volume: Strong volume confirmation indicates higher probability signals

- Respect Risk Management: No indicator is perfect - always use proper stop losses and position sizing

Compatibility and Requirements

Broker Compatibility

The indicator is designed to work with all major brokers and account types:

Asset Classes

Technical Requirements

- Platform: MetaTrader 5 (Build 3000 or higher recommended)

- Operating System: Windows, macOS (via Wine), Linux (via Wine)

- Memory: Minimum 4GB RAM recommended for multi-symbol scanning

- Internet: Stable connection required for real-time alerts and scanner

Mark Kurisko's Strategy Foundation

This indicator is based on the trading methodology developed by Mark Kurisko, a professional trader known for his multi-stochastic approach to market analysis. The core concept revolves around the "rotation" of multiple stochastic oscillators:

- Stochastic Alignment: When faster stochastics cross in oversold/overbought zones while slower stochastics confirm the direction, high-probability setups emerge

- EMA Filter: The 20 EMA acts as a dynamic support/resistance level, filtering trades to align with prevailing trends

- Multiple Timeframe Harmony: By using stochastics with different periods (9, 14, 40, 60), the system captures both short-term momentum and longer-term trend direction

- Risk Management Focus: The strategy emphasizes quality over quantity, waiting for optimal setups rather than forcing trades

Performance Considerations

Optimization Tips

- Scanner Symbols: Limit scanner to 5-10 symbols for optimal performance

- Update Frequency: Set scanner update to 5-10 seconds to reduce CPU load

- Pattern Detection: Disable unused pattern types to improve calculation speed

- Chart Objects: Enable "Aggressive Cleanup" to automatically remove old visual objects

- Historical Data: Ensure sufficient historical data is loaded (at least 500 bars recommended)

Memory Management

The indicator efficiently manages resources through:

- Optimized buffer calculations (only recalculates new bars)

- Automatic cleanup of outdated visual objects

- Smart scanner that updates only changed values

- Proper handle management and release on deinitialization

Input Parameter Categories

Kurisko Stochastic Settings

Configure the four core stochastic oscillators according to your trading preferences. Default values are based on Mark Kurisko's original specifications and work well for most traders.

EMAs and Trend Settings

Adjust the three exponential moving averages to match your market and timeframe. The default 20/50/200 combination is widely used and effective across multiple asset classes.

Levels and Signals

Customize oversold/overbought levels and enable/disable different signal types. The trend filter is highly recommended for reducing false signals.

Scoring System

Control signal quality requirements. Higher minimum scores generate fewer but higher-quality signals. Advanced scoring provides more granular control.

VWAP Analysis

Enable VWAP calculations for institutional-level price analysis. Particularly useful for intraday trading and identifying fair value.

Market Regime and Volume

Enable automatic market condition detection and volume filtering to adapt to changing market dynamics.

Multi-Timeframe Analysis

Add higher timeframe confirmation to ensure alignment with larger trends. Select the appropriate higher timeframe for your trading style.

Fractals and Support/Resistance

Enable fractal detection to identify key price levels. Optional visualization draws horizontal lines at fractal levels.

Advanced Features

Enable additional pattern recognition modules including divergences, flag patterns, ABCD harmonics, and candlestick patterns.

An absolutely incredible tool when used in conjunction with other indicators Im the same as many of you we are still trying to find our way to profitability and find something that actually works and trust me I've spent thousands on different indicators and ea's this is an amazing tool and if you use this in conjunction with other indicators and experiment I believe you can find a working formula.