Apex Arrows MQL5

- 指标

- German Pablo Gori

- 版本: 3.1

- 更新: 25 七月 2025

- 激活: 12

PEX ARROWS - PROFESSIONAL TRADING SIGNALS INDICATOR

GENERAL DESCRIPTION

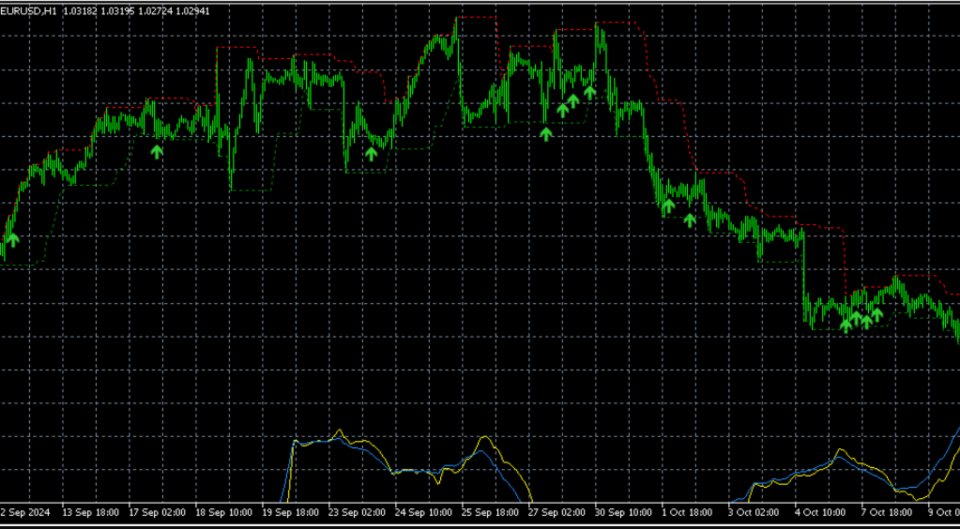

Apex Arrows is a powerful technical indicator specifically designed for MetaTrader 5 that provides clear and reliable trading signals through visual arrow markers on your chart. The indicator combines multiple technical analysis components including trend analysis, momentum assessment, and volatility measurement to generate high-probability trading opportunities.

CORE FEATURES

Signal Generation

- Buy signals displayed with upward-pointing arrows below price bars

- Sell signals displayed with downward-pointing arrows above price bars

- Color-coded arrows for easy visual identification

- Non-repainting signals that remain stable after bar closes

- Customizable arrow size and positioning

Technical Analysis Components

- Moving average trend filter for directional bias

- RSI momentum analysis for overbought/oversold conditions

- ATR-based volatility measurement for signal validation

- Multiple timeframe compatibility for various trading styles

- Support for all major currency pairs and instruments

Visual Customization

- Adjustable arrow colors for buy and sell signals

- Configurable arrow size (small, medium, large)

- Optional on-chart labels with signal information

- Customizable alert sounds for new signals

- Flexible panel display options

SIGNAL LOGIC

Trend Identification

The indicator uses a combination of fast and slow moving averages to determine the primary market trend. Buy signals are prioritized when price is above the moving average, and sell signals are prioritized when price is below the moving average.

Momentum Confirmation

RSI analysis is incorporated to confirm signal strength. Signals are validated based on momentum alignment with the trend direction, reducing false signals during ranging market conditions.

Volatility Filter

ATR measurements help filter out low-quality signals during low volatility periods. This ensures signals are generated only when market conditions support sufficient profit potential.

Signal Timing

Signals are generated at bar close to prevent repainting. The indicator waits for complete candle formation before displaying arrows, ensuring reliability and consistency.

INPUT PARAMETERS

Moving Average Settings

- MA Period: Period for trend calculation (default 50)

- MA Method: SMA, EMA, SMMA, or LWMA

- MA Applied Price: Close, Open, High, Low, Median, Typical, or Weighted

RSI Settings

- RSI Period: Calculation period (default 14)

- RSI Overbought Level: Upper threshold (default 70)

- RSI Oversold Level: Lower threshold (default 30)

ATR Settings

- ATR Period: Volatility measurement period (default 14)

- ATR Multiplier: Sensitivity adjustment (default 1.5)

Signal Display

- Show Buy Signals: Enable/disable buy arrows (default true)

- Show Sell Signals: Enable/disable sell arrows (default true)

- Arrow Size: Small, Medium, or Large (default Medium)

- Buy Arrow Color: Customizable (default Lime)

- Sell Arrow Color: Customizable (default Red)

Alert Configuration

- Enable Popup Alerts: Visual notification (default true)

- Enable Sound Alerts: Audio notification (default true)

- Enable Email Alerts: Email notification (default false)

- Enable Push Notifications: Mobile notification (default false)

- Alert Sound File: Custom sound file (default alert.wav)

RECOMMENDED USAGE

Trading Styles

- Day trading on M15, M30, and H1 timeframes

- Swing trading on H4 and D1 timeframes

- Scalping on M5 timeframe (with additional filters)

- Position trading on W1 timeframe

Market Application

- Forex major pairs (EURUSD, GBPUSD, USDJPY, etc.)

- Forex minor and exotic pairs

- Stock indices (US30, NAS100, SPX500)

- Commodities (Gold, Silver, Oil)

- Cryptocurrencies (BTCUSD, ETHUSD)

Entry Strategies

- Enter on arrow signal confirmation at candle close

- Use pending orders at signal candle high/low

- Combine with support/resistance levels for confluence

- Apply risk management with appropriate stop loss placement

Risk Management

- Place stop loss beyond signal candle high/low

- Use ATR-based stop loss calculation

- Maintain risk-reward ratio of minimum 1:2

- Consider market volatility when sizing positions

PERFORMANCE OPTIMIZATION

Filter Settings

Adjust RSI levels to reduce signals in ranging markets. Tighter RSI thresholds (65/35) provide fewer but higher quality signals, while wider thresholds (75/25) generate more signals with slightly lower accuracy.

Timeframe Selection

Higher timeframes generally provide more reliable signals with larger profit targets. Lower timeframes offer more trading opportunities but require stricter money management.

Symbol Compatibility

The indicator works on all symbols but performs optimally on liquid instruments with clear trending characteristics. Avoid using on extremely low-volume or highly erratic instruments.

TECHNICAL SPECIFICATIONS

Platform Compatibility

- MetaTrader 5 build 2600 or higher

- Windows, Mac, and Linux operating systems

- Compatible with all brokers offering MT5 platform

- Works in both strategy tester and live trading

System Requirements

- Minimal CPU usage (optimized code)

- Low memory footprint

- Real-time chart updates

- Multi-symbol capability

Installation

1. Download indicator file to MT5 Indicators folder

2. Restart MetaTrader 5 platform

3. Locate indicator in Navigator window

4. Drag and drop onto desired chart

5. Configure parameters as needed

6. Click OK to apply

IMPORTANT NOTES

Signal Reliability

Arrows are generated at candle close and do not repaint. Once a signal appears, it remains permanently on the chart. Historical signals reflect actual trading conditions at the time of generation.

Alert System

Alerts trigger only once per signal to avoid notification spam. Ensure MT5 platform remains open to receive alerts. Email and push notifications require proper configuration in MT5 settings.

Backtesting

The indicator is fully compatible with MT5 strategy tester. Visual mode allows reviewing historical signals and assessing performance across different market conditions and timeframes.

USAGE TIPS

Best Practices

- Combine signals with price action analysis

- Verify signals against key support/resistance levels

- Use multiple timeframe confirmation for higher accuracy

- Apply proper risk management on every trade

- Keep trading journal to track signal performance

Common Mistakes to Avoid

- Trading against strong trends based on counter-trend signals

- Ignoring money management principles

- Taking every signal without additional confirmation

- Using inappropriate timeframe for trading style

- Overriding signals with emotional decisions

SUPPORT

For questions, suggestions, or technical support, please contact through MQL5 messaging system or product comments section.

Thank you for choosing Apex Arrows, a professional and versatile tool for confident trading in financial markets. Start making better decisions today.