Buying the dips

- Göstergeler

- Steffen Reinhold Noll

- Sürüm: 4.5

- Güncellendi: 4 Şubat 2026

Buying the Dips – Marketing Description

Buying the Dips is a professional high-precision oscillator designed to identify market extremes and trend-based pullbacks.

Two adaptive quotient lines, visual trend clouds, and optional swing and scalping signals provide clear, non-repainting trading impulses.

Ideal for traders who want to buy oversold dips and sell overbought zones across all markets and timeframes.

Technical Description

Buying the Dips is built on an advanced quotient engine using high-pass filtering and adaptive normalization.

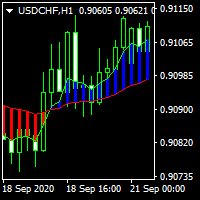

The indicator calculates two independent quotient oscillators (Fast & Slow) that evaluate price movement relative to local volatility.

Calculation Logic

-

High-pass filter to remove market noise

-

Smoothing using recursive filter coefficients

-

Dynamic peak normalization (adaptive extreme value scaling)

-

Quotient transformation to constrain values within a stable range

Signal Generation

-

Swing Buy

Fast line crosses above the Slow line from below in an oversold zone-

additional threshold and lookback confirmation

-

-

Swing Sell

Slow line exits an overbought extreme zone-

prior minimum overbought condition required

-

-

Scalping Signals (optional)

Extreme zone breakouts confirmed by the Fast line

(higher frequency, higher risk)

Visual Elements

-

Two color-coded quotient lines (Fast / Slow)

-

Dynamic bullish and bearish cloud showing trend dominance

-

Separate arrows for swing and scalping signals

-

Multiple fixed reference levels (0, ±ExtremeLevel, ±1)

Features

-

No repainting

-

Fully indicator-based (no future data)

-

Supports alerts and push notifications

-

Suitable for Forex, indices, crypto, and CFDs

-

Works on all timeframes

Recommended Settings for Signal Generation

Signal Level (ExtremeLevel)

Recommended range: 0.8 to 0.99

Higher values produce fewer but higher-quality signals.

Lower values generate earlier and more aggressive entries.Scalping on / off

Enables additional high-frequency signals, especially on lower timeframes.

Intended for experienced traders with active risk management.Minimum for Sell (SellThreshold)

The default value is already optimally configured.

Can be adjusted between 0.7 and 0.99 to control signal frequency.Maximum for Buy (BuyThreshold)

The default value is also optimized.

Can be adjusted between -0.7 and -0.99 depending on market volatility and trading style.

Nice work and very good support 5*