Support and Resistance Pro V1

- Göstergeler

- Jason Smith

- Sürüm: 1.8

- Etkinleştirmeler: 5

Support and Resistance Pro - Professional Trading Tool

Professional Daily Price Structure Analysis with Intelligent Notifications

A comprehensive trading tool that transforms your chart into an organized workspace by visually mapping the market's daily price structure while keeping you informed of critical price interactions through a sophisticated alert system.

Trading key levels that form clusters of confluence is about identifying price areas where multiple independent factors line up, rather than relying on a single signal.

When several forms of analysis point to the same price zone, that level becomes more significant because many different market participants are watching and reacting to it.

A confluence cluster can include things like prior highs or lows, daily or weekly open, high, or low levels, trendlines, moving averages, Fibonacci levels, VWAP, or higher-timeframe structure.

On their own, each factor has limited weight. When they overlap in the same area, the probability of a reaction increases because different strategies converge at that price.

Traders don’t treat these areas as precise lines but as zones. Price often reacts with hesitation, rejection, or acceleration when it reaches a confluence zone because orders tend to concentrate there.

Some traders look for reversals at these levels, while others wait for a clear break and then trade continuation, depending on the broader market context.

The key is patience and confirmation. Instead of predicting, traders wait for price behavior at the confluence cluster, such as strong rejection, consolidation, or a decisive breakout.

What This Indicator Does

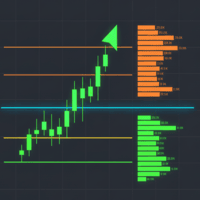

This indicator automatically identifies and displays the most significant price levels from each trading day—the daily high, low, and opening price.

These horizontal lines represent actual price boundaries where market participants previously established control, creating natural support and resistance zones.

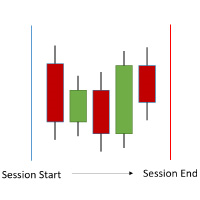

Simultaneously, vertical lines mark the opening time of each trading day, providing temporal context to the price structure.

The integrated alert system monitors price action in real-time, notifying you immediately when price approaches or touches these critical levels.

The indicator draws horizontal lines at daily highs, lows, and opens for your specified lookback period while adding vertical lines at each daily opening time to visualize the market's daily rhythm.

It monitors price continuously and notifies via audio, push notifications, and visual indicators.Practical Trading Applications

For day traders, this indicator provides immediate visibility of intraday support and resistance levels derived from recent daily ranges.

The alerts ensure you're notified when price tests these zones during fast-moving sessions.

Swing traders benefit from seeing how price interacts with multi-day levels, helping identify optimal entry points at proven support or resistance.

Price action traders get clear visual reference points where the market has previously shown significant reactions, aiding in pattern recognition and trade setup identification..

How to Use This Indicator Effectively

Step 1 – Initial Setup

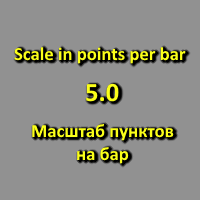

Apply to your chart and adjust the "DaysToShow" parameter based on your trading horizon—5-10 days for day trading, 10-20 for swing trading.

Step 2 – Visual Configuration

Customize line colors and styles to match your chart theme and personal preferences.

Set high lines to one color, lows to another, and opens to a distinct style for immediate visual differentiation.

Step 3 – Alert Configuration

Enable the alert types relevant to your trading style.

Day traders might enable all alerts, while position traders may only want alerts on major daily levels.

Step 4 – Trading Integration

Use the displayed levels as dynamic support/resistance zones.

Look for price reactions at these levels—bounces, breaks, or consolidations—as potential trade signals.

Step 5 – Alert Response

When alerted to a level touch, analyze the current price action context.

Is this a retest after a breakout? A rejection at a key level?

The alert brings your attention to potentially significant price behavior.

Step 6 – Market Structure Analysis

Observe how price interacts with multiple levels over time.

Clusters of levels form stronger support/resistance zones.

The vertical lines help you correlate price action with the start of trading sessions or news events.

Professional Trading Benefits

This indicator provides institutional-level market structure visualization in an accessible format.

By clearly showing where the market has established value areas through daily ranges and when trading sessions begin with vertical lines, it helps you trade with market structure rather than against it.

The alert system ensures you're proactively notified of important price developments, reducing screen time while increasing opportunity capture.

Given the complexity of this indicator. Some bugs may not have been discovered yet.

If you think you've found a bug in the .

Do not rush the process.

- Write a precise description of the context.

- Write a description of the error as precise as possible.

- Attach the logs of the expert tab for the corresponding date.

- Attach the logs from the log tab for the corresponding date.

Note: At the start of a new trading day or after the high and low are breached the chart may appear blank. If this happens, right-click on the chart and select refresh to update and display the levels correctly.