Anti timeframe based moving average

- 지표

- Conor Mcnamara

- 버전: 1.1

- 업데이트됨: 19 8월 2025

- 활성화: 5

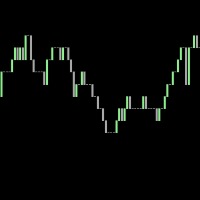

This is a unique moving average that does not use timeframes. The indicator calculates a simple moving average (SMA) based on latest tick prices rather than timeframe bars, offering a direct way to track market trends. It processes a large number of tick prices up to the latest tick, using only live data for its calculations. Once active, the indicator updates and recalculates without relying on any historical timeframe bars.

Real-Time Market Response

The indicator updates as tick prices move, reflecting live market activity. This makes it responsive to price changes, providing traders with timely trend signals.

Trend-Based, Not Period-Based

Unlike traditional moving averages, this indicator does not use fixed periods as no timeframe bars are used in the calculation. Instead, it displays either a macro trend for swing trading or a micro trend for scalping depending on your trading style.

Noise-Free Trading Areas

A gray line indicates a no-trading zone, marking areas of weak momentum where price movements are too small for reliable trends. This helps traders focus on higher-probability opportunities. Effective trend confirmation is applied to reduce minor color changes in the plot, though significant market events (news impact) may still influence signals.

Trend Structures

- Macro Trend: Tracks broader market movements, ideal for swing trading on H1 or higher timeframes.

- Micro Trend: Captures faster price shifts, suited for scalping or High Frequency Trading (HFT) on M2 or other lower timeframes.

Two Slope Modes

- Repainting Slope: Updates with each tick, showing immediate trend direction for manual traders monitoring price action in seconds.

- Non-Repainting Slope: Provides stable signals using tick data up to the tick preceding the current tick. This mode is ideal for automated trading when requiring consistent trend information.

Visible Across Timeframes

The macro trend is clear on H1 or higher timeframes, while the micro trend shines on M2 or other lower timeframes, offering flexibility for various trading approaches.

Timeframe Independence

Indicators that are built for timeframes on OHLC data are by no means useless, and can be very good depending on the indicator, however the purpose of this indicator was to eliminate timeframes so that no timeframes need to be negotiated when examining the moving average trend.

By removing time-based calculations, the indicator reacts purely to raw prices from the order book which gives traders confidence in trend signals without the influence of fixed time boundaries.