POC Delta Order Blocks MT4

- Indicatori

- Suvashish Halder

- Versione: 1.0

- Attivazioni: 10

POC Delta Order Blocks is a rule-based order block and volume-delta indicator designed to help traders clearly understand where real trading activity happened and how price reacts around those zones.

Instead of drawing generic candle-based blocks, this indicator uses a Point of Control (POC) approach to identify the most actively traded price level between a swing high/low and a confirmed Break of Structure (BOS). The order block is then anchored to the earliest valid candle that interacted with that POC, giving you a structurally meaningful and volume-backed zone.

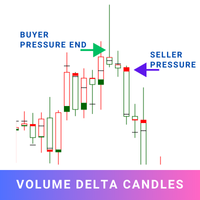

From there, the indicator continuously tracks how price interacts with the zone — whether it respects, retests, mitigates, or invalidates it — while visualizing buyer vs seller pressure directly inside the block.

MT5 Version - https://www.mql5.com/en/market/product/163925/

Join To Learn Market Depth - https://www.mql5.com/en/channels/suvashishfx

Why This Indicator Is Different

Most order block tools rely only on candle bodies or wicks. POC Delta Order Blocks goes further by being volume-aware.

You can optionally pull volume data from a lower timeframe (for example, using 1-minute volume on a 5-minute chart) to get a more accurate view of how buyers and sellers actually traded inside the zone.

This turns every order block into a story of participation, not just a price box:

-

Who dominated?

-

Where did activity concentrate?

-

How did that balance shift over time?

All signals are based strictly on closed candles only, keeping the indicator clean, stable, and non-repainting.

Core Logic Explained

-

A swing high or swing low is identified

-

A confirmed Break of Structure (BOS) occurs

-

Price levels between the swing and BOS are scanned

-

The most-traded price level (POC) is detected

-

The earliest unmitigated candle that interacted with the POC becomes the anchor

-

The order block extends forward, tracking future interaction

Order Block Boundaries

-

Bearish Order Block

-

Top = anchor candle high or wick high

-

Bottom = anchor candle low

-

-

Bullish Order Block

-

Bottom = anchor candle low or wick low

-

Top = anchor candle high

-

Only confirmed and valid order blocks are displayed.

Key Features

POC-Based Order Blocks

-

Built using the most actively traded price level

-

Anchored to the earliest valid POC-touching candle

-

Filters out already-mitigated zones

Volume Delta Visualization

-

Bullish vs bearish volume inside each block

-

Optional lower-timeframe volume aggregation

-

Clear view of buying and selling pressure

Retest Detection

-

Highlights valid retests after formation

-

Helps identify reaction vs rejection

-

Useful for continuation and mitigation setups

Fresh vs Mitigated Zones

-

Clearly labels fresh order blocks

-

Updates zones once mitigation occurs

-

Helps avoid trading exhausted areas

Multi-Timeframe (MTF) Support

-

Display higher-timeframe order blocks on lower charts

-

Keeps context without switching timeframes

-

Ideal for top-down analysis

Alerts

-

New order block formation

-

Retest events

-

Mitigation or invalidation

-

Stay informed without staring at the chart

Who This Indicator Is For

-

Scalpers, intraday, and swing traders

-

Traders using structure-based or smart-money concepts

-

Anyone who wants objective, rule-based order blocks

-

Traders who value confirmation over prediction

Notes

-

Signals are confirmed on closed candles only

-

No repainting or flickering behavior

-

Designed to be used as a decision-support tool, not a signal generator

-

Best results come from combining with proper risk management