RSI v SMA MTF

- Indicatori

- Ebrah Ssali

- Versione: 3.10

- Attivazioni: 5

RSI v SMA MTF Indicator: Professional Trading Edge in One Tool

Summary

The RSI v SMA MTF Indicator is a sophisticated, multi-timeframe momentum analysis tool that transforms the traditional RSI into a powerful, actionable trading system. By combining RSI slope analysis with SMA crossover signals, divergence detection, and real-time multi-timeframe confluence, this indicator provides traders with a more comprehensive view of market momentum across all relevant timeframes.

Core Utility and Actionable Trading Decisions

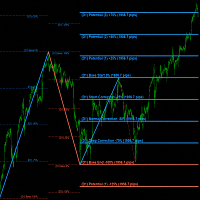

1. Smart RSI Momentum Visualization

- Colour-Coded RSI Slope: Instantly identifies momentum strength through 5 distinct slope colours:

- Steep Up/Down: Strong momentum (Blue/Orange)

- Slight Up/Down: Moderate momentum (Powder Blue/Yellow)

- Flat: Consolidation periods (Grey)

- SMA Dynamic Filter: Smoothes RSI noise while providing its own colour-coded trend direction (Lime/Red/Grey)

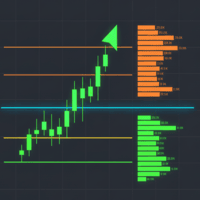

2. Multi-Timeframe Confluence System

- Trend Timeframes: W1, D1, H4, H1 for directional bias

- Entry Timeframes: M30, M15, M5, M1 for precise timing

- Real-Time Panel: Displays RSI values, direction, and status across all 8 timeframes simultaneously

3. Clear Trading Signals

- RSI/SMA Crossovers: Bullish/Bearish arrows with visual confirmation

- Divergence Detection: Automatic detection with trend lines and alerts

- MTF Confluence: Identifies when multiple timeframes align for high-probability setups

- Confidence Meter: Quantifies signal strength from 0-100%

Ease of Use and User Experience

1. Intuitive Visual Interface

- Clean Display: All elements in separate window with clear colour coding

- Smart Panel: MTF panel with CPU-saving toggle (on/off) functionality

- Automatic Updates: Panel refreshes every 3 seconds (configurable)

2. Zero Configuration Required

- Plug-and-Play: Default settings optimized for most markets (configurable to suit instrument)

- Customizable: Adjustable RSI/SMA periods, colours, and alert preferences

- Strategy Tester Optimized: Auto-optimizes performance during back testing to save CPU resources

3. Seamless Integration

- No External Dependencies: Runs entirely within MetaTrader5

- Minimal Resource Usage: Optimized calculations and memory management

- Cross-Platform: Works on all symbols and timeframes

Competitive Edge and Unique Advantages

1. Multi-Timeframe Context (What Others Miss)

Most indicators show only the current timeframe. This tool provides:

- Hierarchical Analysis: Understand trend direction (higher TFs) vs entry timing (lower TFs)

- Confluence Detection: Automatic identification when 4+ timeframes align

- Strength Assessment: Confidence meter quantifies setup quality

2. Dynamic Slope Intelligence

Unlike static RSI displays, this indicator:

- Quantifies Momentum: Not just direction, but strength of momentum

- Context-Aware Thresholds: Different slope thresholds for different timeframes

- Visual Progression: Watch momentum build or fade in real-time

3. Professional-Grade Features

- Rolling SMA Calculation: Optimized performance even on large datasets

- Selective Divergence Detection: Calculates only on recent bars to save CPU

- Smart Alert System: Configurable alerts for crosses, divergences, and MTF confluence

4. Risk Management Integration

- Overbought/Oversold Zones: Clear visual demarcation (configurable)

- Mid-Level Line: Key 50-level for trend determination

- Signal Strength Filter: Avoid low-confidence trades

Trading Applications and Use Cases

For Swing Traders (H4-D1-W1 Focus)

- Use trend timeframes for directional bias

- Enter on confluence with entry timeframes

- Hold positions through RSI/SMA alignment

For Day Traders (M5-M30-H1 Focus)

- Quick visual assessment of momentum shifts

- Precise entry timing with multi-TF confirmation

- Scalp divergence setups with high confidence

For Position Traders

- Monitor long-term trend alignment

- Identify major divergence patterns

- Time entries during multi-timeframe convergences

Performance and Reliability

Optimized Engine

- Efficient Calculations: Rolling SMA, selective divergence detection

- Stable Performance: Handles data gaps and invalid handles gracefully

- Memory Efficient: Cleans up objects and buffers properly

Professional Features

- EA Ready: Bullish/Bearish RSI v SMA Cross signals stored in buffers for easy access by EA

- Strategy Tester Ready: Disables visual elements during optimization

- Customizable UI: Adjust colours, sizes, and positions to preference

Why This Indicator Delivers Real Value

1. Comprehensive Analysis in One View: Eliminates/Reduces need for multiple charts/indicators

2. Quantifiable Edge: Confidence scoring removes subjectivity

3. Time-Saving: Instant multi-timeframe assessment

4. Adaptable: Works for all trading styles and timeframes

5. Professional-Grade: Features typically found in expensive commercial indicators

Ideal User Profile

This indicator is perfect for:

- Transitioning Traders: Moving from discretionary to systematic trading

- Multi-Timeframe Analysts: Who want confluence visualized

- RSI/SMA Strategy Users: Looking to enhance traditional approaches

- Busy Professionals: Need quick, comprehensive market assessment

- System Developers: Wanting a robust foundation for automated strategies

The RSI v SMA MTF Indicator transforms complex multi-timeframe analysis into clear, actionable trading decisions. By providing context, confluence, and confidence metrics, it gives traders a significant edge in identifying high-probability setups while avoiding noise and false signals.